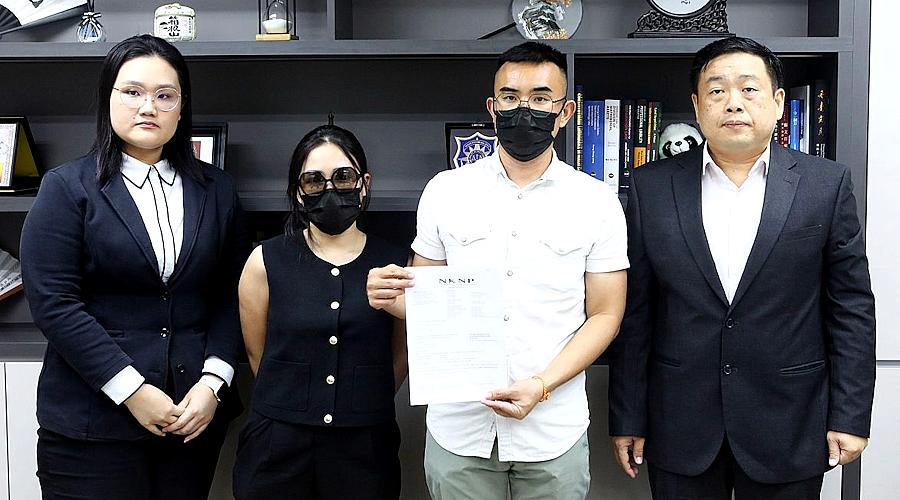

PETALING JAYA: An accountant receives RM208,331.04 in insurance claims to cover medical expenses of her child following her appeal in a prenatal insurance dispute.

The sum is approximately 90 percent of medical expenses of the original claim, said Ng Kian Nam, a lawyer acting for the accountant, Chin Pou Xiang.

“This additional payout covers crucial surgical costs for Chin’s child, specifically procedures related to a liver abscess. The medical condition in question is unrelated to congenital heart defects such as a ventricular septal defect (VSD),” said Ng in a statement issued on June 20.

Chin bought a prenatal insurance policy when she was pregnant with a monthly premium of RM250.

The insurance company accepted the non-invasive chromosome check, a prenatal screening test submitted by her and the policy took effect on December 1, 2023.

Chin delivered a pair of twins on Feb 19, 2024, two months earlier than the expected delivery date.

Few months later, one of the babies was found to be suffering from a liver abscess and VSD which cost RM290,000 for medical treatment but the insurance company was only willing to pay up to RM50,000 on the ground that the baby was suffering from a congenital condition.

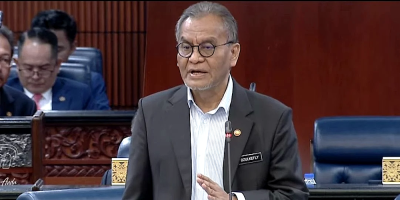

Chin sought Ng’s help as Ng is the activist for the Movement to Defend Malaysian Policyholders’ Rights and filed an appeal with the insurance company.

“We sincerely appreciate the insurance company’s timely decision, which spares the family the emotional strain of a prolonged court process and allows them to focus on their child’s recovery,’’ said Ng.

From a policy standpoint, Ng said Bank Negara Malaysia is urged to take a firm stance against the ongoing sale of vague and controversial prenatal insurance products in the local market.

“We also call on multinational insurers to explain why such policies are not marketed in other countries, including Singapore but are actively promoted in Malaysia,’’ he said.

“This case also underscores a troubling and recurring issue within the insurance industry: the tendency of insurers to disregard the medical opinions of attending specialists, favoring assessments made by their own internal consultants. Such practices present a clear conflict of interest and raise serious concerns about fairness and transparency,’’ he said.

Bank Negara Malaysia and the Ministry of Health are urged to take swift and decisive action to address this issue and to uphold the rights and interests of policyholders in Malaysia, he said.

ADVERTISEMENT

ADVERTISEMENT