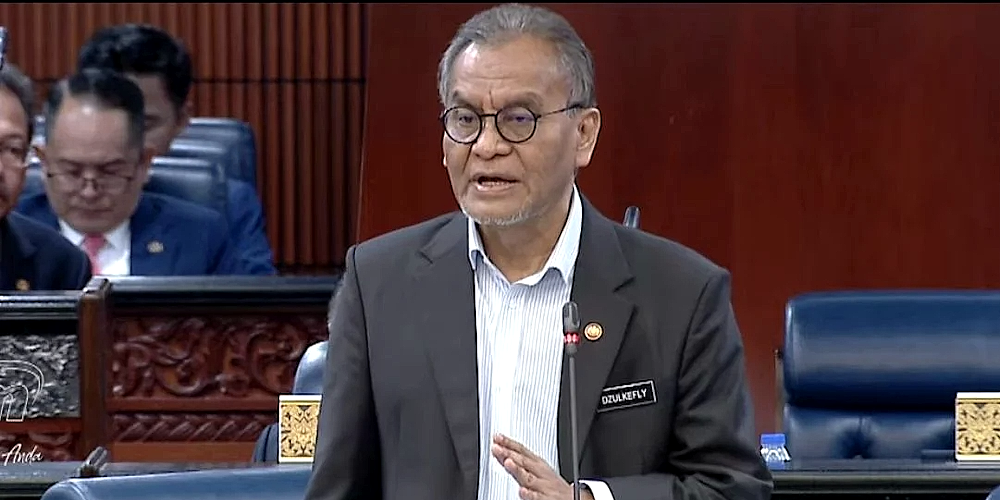

KUALA LUMPUR: There is no quick fix formula for medical inflation, says Health Minister Datuk Seri Dr Dzulkefly Ahmad.

“We can only request for a more transparent method called DRG (diagnostic related group) to list the prices,” he said.

DRG is a system payment used to regulate private hospital bills and curb healthcare costs.

Dr Dzulkefly said this at Dewan Rakyat on Tuesday, in reply to points raised on the Ministry of Health when members of parliament debated on motion of thanks for the royal address.

Dr Dzulkefly also said that the government could only request medical consultation fees to be fixed under Schedule 15 of Private Healthcare Facilities and Services Act.

“We are aware that if medical charges at private hospitals keep rising, and private hospitals continue to rake in handsome profits without any form of control, more patients who can’t afford the medical fees will turn to government hospitals. The government hospitals will face a hard time too,” he said.

Dr Dzulkefly said there are two types of medical inflation. One involves usage of top-notched medical equipment which leads to expensive fees, while the other is unreasonable charges.

“We are going after the second one,” he said.

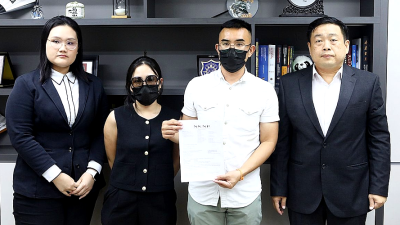

Ng Kian Nam, a lawyer who is also the head of the Campaign to Protect the Right of Insurance Consumers of Malaysia, submitted a memorandum of understanding to the Public Accounts Committee (PAC) on Tuesday.

He urged then PAC to look into the excessive increase of medical insurance premiums and the failure of Bank Negara in its regulatory role to protect the interest of insurance consumers under Financial Services Act.

While claiming that the medical inflation rate in Malaysia is as high as 12 per cent in recent years compared to the global average of 8 per cent, Bank Negara should investigate as to why certain insurance companies in Malaysia have increased premiums to unreasonable levels of 100 per cent within three years – higher than the medical inflation rate.

Bank Negara should investigate and explain to the public as to why despite gaining substantial reported profits of RM3.2 billion in the first half of 2023 and RM8.4 billion in the first half of 2024 from overall life insurance funds, they still allow insurance companies to increase medical insurance premiums, Ng said.

ADVERTISEMENT

ADVERTISEMENT