A health insurance policy eases one’s financial burden on medical bills, but insurers are likely to surrender their health insurance policies despite making successful claims due to the spike in premiums.

In a poll conducted by Sin Chew Daily on the spike of insurance premiums, more than half of those who were successful in making insurance claims were financially stressed.

Of the 425 people who were successful in receiving insurance claims for medical treatments, 245 (57.6 per cent) of them planned to surrender their policies.

Sin Chew Daily collected a total of 996 responses, of which 929 (93.3 per cent) were covered by health insurance while 67 (6.7 per cent) were uncovered.

The respondents were from different age groups – 47.1 per cent aged between 31 and 50; 42.7 per cent between 51 and 65; 7.8 per cent 65 years and above; while 2.3 per cent between 18 and 20.

The poll indicated that 93.7 per cent of respondents with health insurance said their premiums had increased in the past three years.

Of the 113 respondents whose insurance premiums increased by more than 70 per cent, 87 (77 per cent) said they were under immense pressure.

For those whose insurance premiums increased between 51 and 70 per cent, 62 (79.5 per cent) faced similar pressure.

Only 26 insurers felt that the increase in insurance premiums did not give them financial pressure.

Of the 67 respondents without health insurance, 14 said they had terminated their policies due to the spike in premium.

A retiree whose household income was below RM3,000 said he opted to terminate his policy last year due to sharp increase in premium.

Another retiree did the same in 2022 when the premium of his health insurance policy exceeded RM4,000 a year.

A self-employed man said he paid a monthly premium of RM340 since 2016, but it increased to RM650 last year.

If he did not agreement with the increase in premium, his policy would be terminated automatically eight years later.

“I decided to surrender the policy. My earning power is lower when I get older. I prefer to have cash,” he said.

He also lamented that he felt like a citizen not taken care of. Hence, he could only look after himself.

A freelancer in the age group between 51 and 65 said after paying insurance premium of 30 years, the premium increased three-fold in the last three years. He opted to terminate the policy.

More than 90 per cent of respondents hoped the government could enhance monitoring and control on charges fixed by private hospitals while 80.1 per cent of respondents supported the move to enhance monitoring and control on charges by insurance companies.

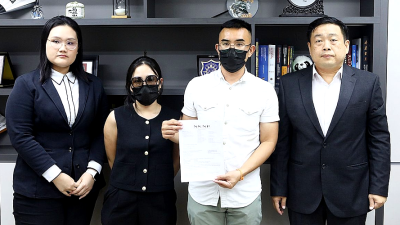

National Association of Malaysian Life Insurance and Family Takaful Advisors (NAMLIFA) president Krishnan Appanu said the association is planning to launch a nationwide signature campaign to present a memorandum of understanding to Prime Minister Datuk Seri Anwar Ibrahim on the matter.

Among others, NAMLIFA is urging the government to set up a special committee comprising the Finance Ministry, Health Ministry, Bank Negara, Life Insurance Association of Malaysia, insurance companies, and members of the public, to explore ways to resolve the spike in insurance premium.

NAMLIFA is also asking insurance companies to reveal the price mechanism, enhance transparency and accept monitoring.

It is also urging the government to enhance monitoring on fees charged by private hospitals while upgrading services at public hospitals.

It was reported that Bank Negara Malaysia (BNM) announced interim measures in December 2024 to spread out medical and health insurance premium increases over three years. The measures are intended to help policy-holders manage the impact of premium adjustments.

Logen Kanisan, founder of Bayes Actuarial Solutions, said the entire healthcare ecosystem needed reform.

The greatest challenge lies with various stakeholders – insurance companies and medical service suppliers who were pointing fingers at each other or targeting at the government and monitoring agency.

He suggested all stakeholders to push for changes of healthcare ecosystem within their own jurisdictions.

“This is a social issue as well as a business problem. Making a small progress will bring positive impact to society and business,” he said.

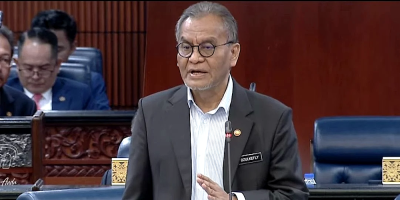

Lawyer Ng Kian Nam, who has represented insurance consumers and is the head of the Campaign to Protect the Right of Insurance Consumers of Malaysia (CPRICM), said there are loopholes in the enforcement of the existing system and misleading advertisements, leading to many issues cropping up.

Ng said insurance companies were not transparent in their cost budgets. Insurers’ claims could be rejected for many reasons or even slapped with cancellation of policy.

“Bank Negara should take people’s interest into consideration. While approving insurance companies’ proposal to revise the fees, it should also review the relevant data in a stringent manner to strike a balance between inflation in healthcare and the consumers’ affordability,” he said.

ADVERTISEMENT

ADVERTISEMENT