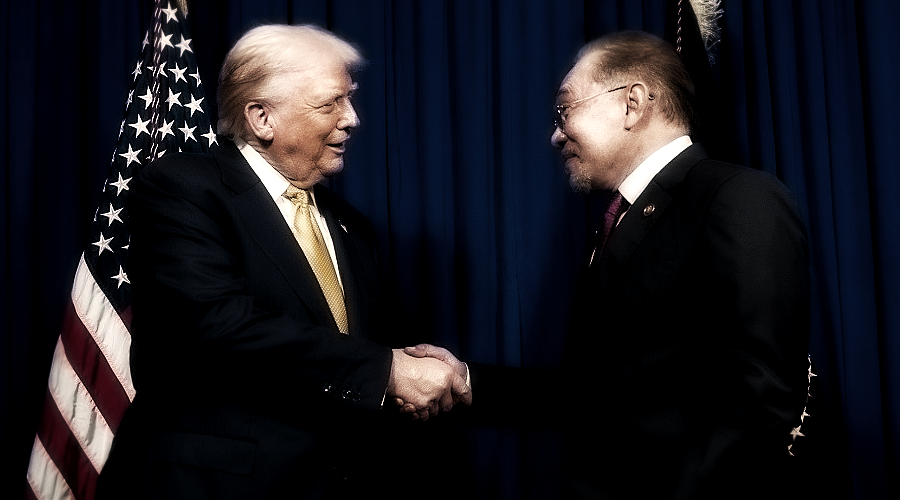

In October 2025, Malaysia and the United States signed a trade deal that looks amazing in headlines: billions in business, lower tariffs, and promises of closer economic ties.

However, if one were to read past the press releases, then the deal looks less like a masterstroke and more like a delicate balancing act where Malaysia is spending megabucks, political goodwill is the currency, and at the same time, she nervously glances towards China.

In the deal which both U.S. president Donald Trump and prime minister Anwar Ibrahim signed on Sunday, the main takeaways of what Malaysia has agreed to spend are the following:

■ Petronas will purchase 3 million tons of U.S. liquefied natural gas (LNG) annually, valued at roughly US$2.04 billion, with an option for another 2 million tons (US$1.36 billion).

■ The Malaysian Aviation Group, the parent company of Malaysia Airlines (MAS), will buy 30 Boeing 737 MAX aircraft, with an option for 30 more.

■ Tenaga Nasional Berhad (TNB) will commit to a two-year U.S. coal contract which is worth US$42.3 million.

■ Telekom Malaysia will spend US$119 million on American products and services.

■ Malaysian multinationals will purchase US$103 billion in semiconductors, US$3.5 billion in aerospace equipment, and US$43.5 billion in data-center machinery and equipment over the next five years.

In exchange, the U.S. would reduce reciprocal tariffs on Malaysian goods from 25 percent to 19 percent and at the same time, grant exemptions on some imports.

Some people may be convinced that it’s a win-win situation. Only after unraveling the “deal,” one then realizes that perhaps, Malaysia has been brought to its knees, the main beneficiary being the U.S. The devil is in the billions of details.

The first anomaly is with LNG. Eyebrows were raised, with Petronas buying U.S. LNG.

Malaysia was once a global LNG powerhouse exporting over 26 million tons worth US$13 billion annually. Although it has slipped from the highest position, it remains among the top five exporters of LNG.

Why would we now import the very commodity which we export? The answer is simple. This is part of the trade deal which favors American suppliers.

Financially, this is a bill of over US$2 billion annually, with an option to reach US$3.4 billion which is around 15-25 percent of Malaysia’s total LNG export revenue leaving the country.

Strategically, it undermines Malaysia’s LNG export position, making the nation a net importer for certain volumes of a product it once sold with pride and profit.

The optics are striking: we are simultaneously selling and buying the same commodity, paying billions to import what we export, all in the name of political alignment.

Short-term diplomatic convenience risks long-term economic tension.

The Boeing deal is more than meets the eye. The government insists the 30-plane Boeing order is strictly commercial, ostensibly aimed at modernizing Malaysia Airlines.

True, newer planes are fuel-efficient and support route expansion. But the optics are awkward because it looks like Malaysia is buying goodwill with steel, aluminum, and jet engines.

Beijing may view the move as Malaysia aligning too closely with U.S. strategic interests, especially regarding rare earth minerals and critical technologies.

Financially, this is a multibillion-dollar commitment, with maintenance and delivery schedules stretching years.

One wonders if the money could have better spent on serving domestic aviation infrastructure or low-carbon transport initiatives.

That is a huge possibility, but then politics often trumps prudence in headline-making deals.

The other oddities, as we make our way down the shopping list is to do with coal and technology.

TNB’s US$42.3 million coal purchase and Telekom Malaysia’s US$119 million in tech products are small individually, but they signal a larger trend: Malaysia is importing large amounts of fossil fuels and high-tech equipment in exchange for modest tariff relief.

So, when combined with multinationals’ tens of billions in semiconductors, aerospace, and data-center purchases, the pattern is clear: the deal prioritizes political alignment with the U.S. over strategic economic or environmental gains.

Ordinary Malaysians should show great concern instead of just thinking that this trade deal is brilliant.

The long-term consequences will soon impact the pockets of ordinary Malaysian.

Energy costs could rise: Imported LNG and coal can indirectly increase electricity or gas bills. Contracts divert resources or may lock in prices that could rise, thus squeezing household budgets.

Missed opportunities for local industry: Massive imports may dampen potential for manufacturing. Every dollar spent abroad is a dollar not invested in Malaysian jobs and innovation.

Environmental impact: Fossil fuel reliance contradicts Malaysia’s green technology goals. Higher emissions affect public health and slow the clean-energy transition.

Perception of buying friendship: Citizens may rightly wonder if short-term diplomacy has taken priority over economic independence.

The elephant in the room is China. While Malaysia courts Uncle Sam, it must hope that Beijing doesn’t notice.

Malaysia’s largest trading partner is China, which accounts for around 17 percent of total trade, and a major source of foreign investment, particularly in infrastructure and technology.

Meanwhile, the U.S., also a significant investor, now secures billions in Malaysian purchases through this deal.

There is a delicate balancing Malaysia must juggle. The trade pact strengthens U.S.-Malaysia ties, but granting tariff reductions, technology access, and political goodwill has potential to strain relations with China.

Beijing may view the move as Malaysia aligning too closely with U.S. strategic interests, especially regarding rare earth minerals and critical technologies.

If China reacts negatively, the consequences could result in higher tariffs, stricter regulations on imports, delays in ongoing Chinese investments, and disruptions in supply chains for electronics and semiconductors.

For local manufacturers, this could translate into increased costs, limited access to raw materials, and slower growth.

Every billion-dollar “gesture of friendship” with the U.S. risks unintended economic friction with China.

The doubters should do well to take heed because China does notice. While it rarely reacts with drama, it monitors shifts in trade, resources, and technology closely. It will use tariffs, regulatory hurdles, and investment slowdowns to protect its interests.

For Malaysia, this means every billion-dollar gesture to the U.S.—from LNG to Boeing jets—carries a quiet risk: economic friction with its largest trading partner that could ripple into costs, jobs, and opportunities for ordinary citizens.

To put it crudely, Malaysia is the monkey in the middle.

This trade deal is a classic example of modern diplomacy. Fantastic press releases, but costly in practice.

Malaysia gains short-term political and tariff advantages, but ordinary citizens may bear the hidden costs of higher bills, fewer local jobs, and slower progress toward clean energy.

This deal requires a deeper analysis. The Malaysian taxpayer, voters, and consumer should ask: Are we truly gaining national advantage, or are we simply buying friendship with Uncle Sam, one billion-dollar contract at a time, while nervously glancing at China?

(Mariam Mokhtar is a Freelance Writer.)

ADVERTISEMENT

ADVERTISEMENT