Whether the dollar will cease to be a reserve currency within the following N number of years hinges on several factors, including the outcomes of military operation in Ukraine, the state of affairs in Taiwan, or even in Latin America — the United States’ own backyard.

However, the process of de-dollarisation has started.

Throughout history, the US has often attempted to resolve its economic issues through military interventions across the globe.

After all, it is through the means of two extremely bloodshed wars in Europe (WWI and WWII) that the hegemony of the US dollar was established in the first place.

Before the 1940s, gold served as the only reserve “currency” globally, and a country’s gold reserves backed the reliability of its national currency.

During WWI, the Great Depression, and WWII, inflation in many European countries went rampant—the national currencies lost value and the gold reserve was no longer a viable option.

The US “kindly” provided loans to the impoverished European countries, which those then used to buy American weapons and food products—carbon copy Ukrainian scenario!

Furthermore, many companies and wealthy gentlemen preferred to keep their money not in war-torn Europe but in reliable American banks.

As a result, by the early 1920s, the US had accumulated half of the world’s gold reserves, while by 1944, the US had already amassed three-quarters of the international gold reserves. Hence, the Bretton Woods decision, giving the US dollar its unique status for the first time, was natural.

However, in 1971, the US dollar technically defaulted for the first time!

The rest of the countries swallowed the refusal of the US to fulfill their gold convertibility obligations and continued to use the dollar. But why?

When Nixon was on TV, more than half of all international trade deals were settled in US dollars.

And a sudden abandonment of the US dollar could have caused far more damage than maintaining the status quo.

The global financial system would need to be built from scratch.

According to the data from United Nations, by the early 1970s, US’ annual GDP made up nearly one-third of the world economy. And, of course, neither the franc, German mark, or the weakened pound could bear the brunt of world trade.

However, the unlimited issuance of the US dollar and circulation worldwide required a new anchor.

In 1974, Saudi Arabia “volunteer-compulsory” committed to pricing its oil exclusively in US dollars in exchange for security guarantees from the US.

This petro-link is one of the pillars on which the US dollar rests as the world’s primary reserve currency:

1. Petro-dollar link: The oil-exporting countries would have piles of US dollars and thus would be compelled to invest in US treasuries and borrow in US dollars (assets-liabilities match principle).

Obviously, oil-importing countries would need to keep reserves in US dollars too.

2. US military power: There have been isolated projects by certain countries to move away from petro-dollars.

However, the US military intervention has brutally suppressed each such attempt.

3. International Monetary Fund (IMF): Asset-liabilities matching principle and borrowing in US dollars would demand paying back principle plus interest in US dollars, supporting the perpetual demand for the US dollars.

4. Confidence in US dollars: History shows that trust in US dollars remained strong even when it was wholly delinked from gold and became the same tissue paper as the other currencies.

5. World economic leadership: The US is still the world’s largest economy.

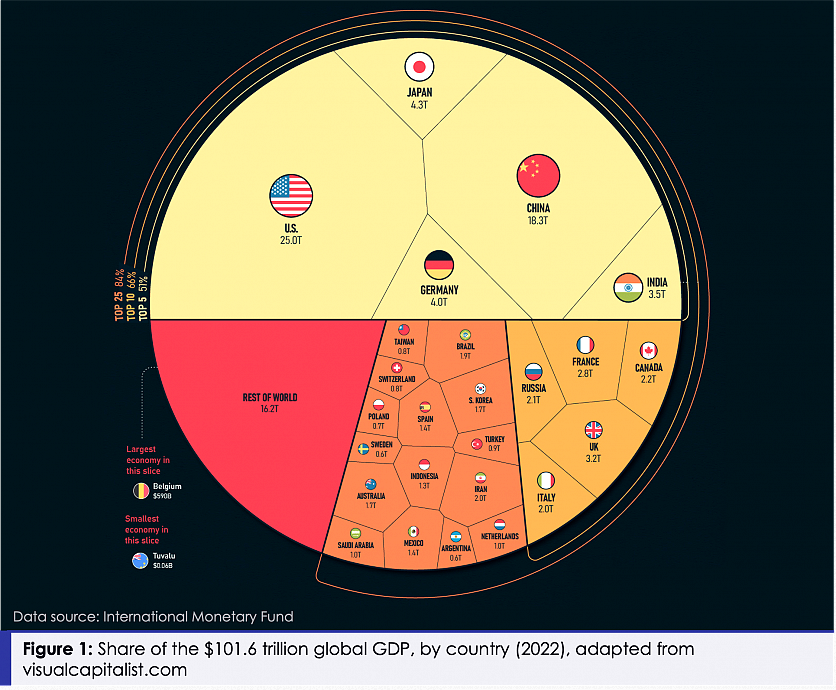

According to the 2022 global GDP data (Figure 1), the US makes up a quarter of the world economy.

In other words, no other single country has comparable assets and financial infrastructure to provide a currency that international trade participants would trust.

6. US Debt Structure: US debts are held mainly by US authorities and national companies, with foreign investors owning only a quarter of US loans.

To default on domestic debts is nearly impossible. This is why the US can continuously run its vast trade deficit.

However, significant global developments have shaken the pillars of the US dollar’s world dominance.

1. Weakening petro-dollar link: If Saudi Arabia starts accepting yuan for oil supplies from China alone, to which it exports more than a quarter of the produced “black gold,” this will be a powerful signal to the other OPEC and OPEC+ countries.

At the same time, Russia, put under sanctions, is forced to switch to payments for oil supply in currencies other than the dollar and the euro.

Russia switches to yuan-rubble settlements with China, Turkish lira-rubble settlements with Turkey, and settlements in rupees and roubles with India.

The entire Eurasian Union is also ready to abandon dollar settlements for trade completely.

Russia has also indicated that this forced measure of selling oil and natural gas in roubles is just a “start.”

Therefore, we should expect to see other highly demanded worldwide commodities produced mainly by Russia, such as wheat, fertilisers, metallurgical products, wood etc., to be traded in Russian roubles soon.

2. Diminishing US military power: The recent findings by a strategic research institute in the US, The Heritage Foundation, reveal interesting dynamics. According to their recent report, the “2023 Index of U.S. Military Strength”:

“In the aggregate, the United States’ military posture is rated “weak.” The 2023 Index concludes that the current U.S. military force is at significant risk of not being able to meet the demands of a single major regional conflict while also attending to various presence and engagement activities. It most likely would not be able to do more and is certainly ill-equipped to handle two nearly simultaneous major regional conflicts—a situation that is made more difficult by the generally weak condition of key military allies.”

3. Reduced reliance on the IMF: As of relatively recent development, South African countries now prefer taking loans from China rather than from the IMF.

The reinvigorated idea of the Asian Monetary Fund is another project that can significantly weaken IMF’s influence.

4. Blemished confidence in the US dollar: The trade war with China, which limited the purchase and sale of Asian assets on the American market, and the “freezing” (read simply “writing off”) of around 300 billion US$ worth of Russian foreign exchange reserves became the final wake-up call for the entire world.

No nation can know when and how its national interests might conflict with the world’s hegemony, and it is better to prepare in advance by diversifying its holdings away from toxic Western currencies and credit system.

According to the IMF data, the US dollar share of global reserve currencies has fallen from 79 per cent to 59 per cent from 1999 to 2021.

According to more recent statistics by IMF, the US dollar share still hovers around 59 per cent. However, according to alternative sources (according to Eurizon SLJ Asset Management), the buck’s status as a reserve currency eroded in 2022 at ten times the pace seen in the past two decades.

Strategists at the asset manager found that the greenback’s share of total global reserves fell to 47 per cent last year from 55 per cent in 2021.

5. Bubble world economic leadership: US may command a quarter of global GDP (Figure 1), but in essence, it represents the trade of air (financial derivatives upon financial derivatives upon financial derivatives).

According to the theory of money, a currency should be only issued by an entity that produces something of real value (commodity) in demand by many to ensure the currency reflux—in a global context this should be a country richest in natural resources and other globally demanded commodities and products like China, Russia, Iran, South Africa, Saudi Arabia.

This raises an interesting question of whether the oft-quoted Figure 1 is a fair reflection of real economic power.

According to recent statistics, BRICS’s (Brazil, Russia, India, China, and South Africa) total population is 3.3 billion, while their total nominal GDP is 26 trillion US dollars (as big as the US).

And these countries are talking about creating their own currency and financial token to bypass SWIFT.

Furthermore, we now also talk about BRICS Plus.

If all the interested countries are accepted, the newly proposed BRICS members will create an entity with a GDP 30 per cent larger than the US, over 50 per cent of the global population and controlling 60 per cent of global gas reserves.

With more and more bilateral currency settlement agreements being inked all over the world, we observe a monumental shift gaining significant momentum from the unipolar world with artificially imposed dominance of Western currencies and, by extension, rigidly centralised political and economic power (thus defending the interests of a handful of nations) to a more democratic, natural, balanced and fairer multipolar world with financial settlements in all sorts of national currencies, backed by the things of real value (natural resources or produce), based on mutually beneficial cooperation and respect for national sovereignties.

The de-dollarisation process is inevitable, and it has started.

US actions over the conflict in Ukraine have significantly intensified it.

The only question is how long it could take in the context of the global historical process.

We must understand that in the context of a historical scale, such tectonic shifts in the world order may take decades to unfold fully.

(Dr. Rais Hussin is the president and chief executive officer of EMIR Research, a think tank focused on strategic policy recommendations based on rigorous research.)

ADVERTISEMENT

ADVERTISEMENT