What warrants more public attention is the indiscriminate spending by some Malaysians who put themselves closer to the edge of the cliff.

Having announced a 25 basis point increase in OPR in May, Bank Negara hiked the rate by another 25 basis points to 2.25% earlier this month.

The central bank’s move is well within market expectation, as it is seen as necessary to tame inflation.

Nevertheless, two consecutive rate hikes also makes it harder for borrowers to service their bank loans.

It is widely anticipated that more rate hikes will follow, making it even tougher for borrowers in coming months.

Some are already speculating that the rate hikes will be the last straw that broke the camel’s back, sending more into bankruptcy.

Our world is now in the midst of an inflation crisis, with many nations following the footsteps of the Fed to raise their interest rates. This makes it almost impossible for Malaysia to buck the trend.

Moreover, goods prices have been rising steadily of late, and higher interest rates are therefore expected and inevitable.

On the flip side, the move has further burdened the people, in particular the M40 and B40 communities with car and housing mortgages to pay. They are now facing a dual challenge of higher goods prices as well as monthly loan instalments, significantly squeezing their disposable incomes.

Malaysian Association of Borrowers and Consumers Solution (4PM) has claimed that if the government were to raise the OPR by at least another 25 basis points by the end of the year, the number of bankruptcies in this country will double.

Let the numbers tell how true this is.

Bank Negara governor Nor Shamsiah Mohd Yunus refuted in a recent open letter claims that higher OPR will increase bankruptcies in the country.

She said there wasn’t any link between these two because statistics from banks and non-bank lenders showed that the number of individual bankruptcies had been declining since 2016, including the period when the OPR was raised in 2018.

Statistics from seven financial institutions (making up 71% of all loans) showed a steady decline in bankruptcies, from 5,283 cases in 2018 to 3,948 in 2019 (down 25.27%), down another 27.96% in 2020, and further 33.76% drop last year to only 1,884.

The numbers have been sliding over the recent years, but that could be because the government has raised the bankruptcy threshold.

What the government needs to seriously look into is the reality that more and more young people have been declared bankrupt.

According to the Malaysian Department of Insolvency, the country recorded a daily average of 18 people going bankrupt during the first five months of the year, while 60% of bankrupts from 2018 until this May were aged between 25 and 44. Additionally, over 200 young Malaysians aged below 25 were declared bankrupt.

It is definitely not something encouraging to still have 18 people going bankrupt each day even after the government has raised the bankruptcy threshold, and this definitely warrants some serious attention from the authorities.

Half of the 46,132 individuals declared bankrupt between 2018 and this May were because they were unable to service their personal loans, showing the severity of indiscriminate borrowings among some Malaysians. Perhaps the government should evaluate the need for further credit controls.

Besides, many people lack fundamental financial planning knowledge and are prone to spend their future money.

As such, the government must strive to boost financial planning a awareness through public education and publicity especially at a time the entire nation is grappling with spiralling inflation,

The finance ministry has issued guidelines to various departments to cut public expenses. Meanwhile, members of the public, in particular young people, should also have this awareness and spend within their means to avoid falling into the bankruptcy trap.

At the same time, there have also been rumours claiming that the country is facing tremendous economic trouble and is on the verge of bankruptcy.

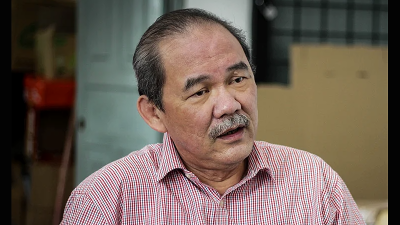

In view of this, finance minister Tengku Zafrul reiterated that the we would never become a second Sri Lanka. He said the country’s finances were still in good shape and public debts were at manageable levels with no signs whatsoever of an imminent bankruptcy.

By comparison, what warrants more public attention is the indiscriminate spending by some Malaysians who put themselves closer to the edge of the cliff.

ADVERTISEMENT

ADVERTISEMENT