Let’s dissect Digital National Berhad (DNB) one more time on the level of ideas, plain logic and strategic policy planning as a more detailed analysis of the issue EMIR Research has published earlier (“Deconstructing 5G rollout in Malaysia” in two parts from January 14 and 24, 2022).

From the mainstream narrative, leaving aside the most far-fetched claims made by DNB-proponents for eloquence alone, the two realistic impacts could be improving internet connectivity in rural areas and improving the overall quality of internet connectivity in the country.

Now, if these are indeed the intended impacts, then the DNB proposal as it stands today could be best described as “Exhibit A — Misplaced Solution”. This is because the same impacts can be achieved in a more efficient, straightforward manner (without all the acrobatics surrounding the current DNB model) and would be agreeable to all the stakeholders provided, of course, the government does not flop on execution and conducts it with the high standard of governance and integrity.

Therefore, DNB insistence on its original proposal of the Single Wholesale Network (SWN) model gives all the reasons for proper investigation by various authorities.

Strategic 5G deployment

First of all, speaking of 5G, let us make it clear once again that DNB “supply-driven” or “cost recovery” model appears to ignore completely the very basic and fundamental principle — the value of any technology is unlocked only if there is a solid foundation in the form of other compatible technologies (not forgetting necessary tech skills and knowledge base), which we call ecosystem, to create the conducive enabling environment and demand for new technology and therefore maximize the value per dollar invested in it.

In Malaysia, given its still disjointed digital ecosystem, lack of plain digitalization and nascent digital transformation, 5G is to be enjoyed by selective enterprises and minority well-offs with cutting-edge 5G enabled phones for at least another few years down the road.

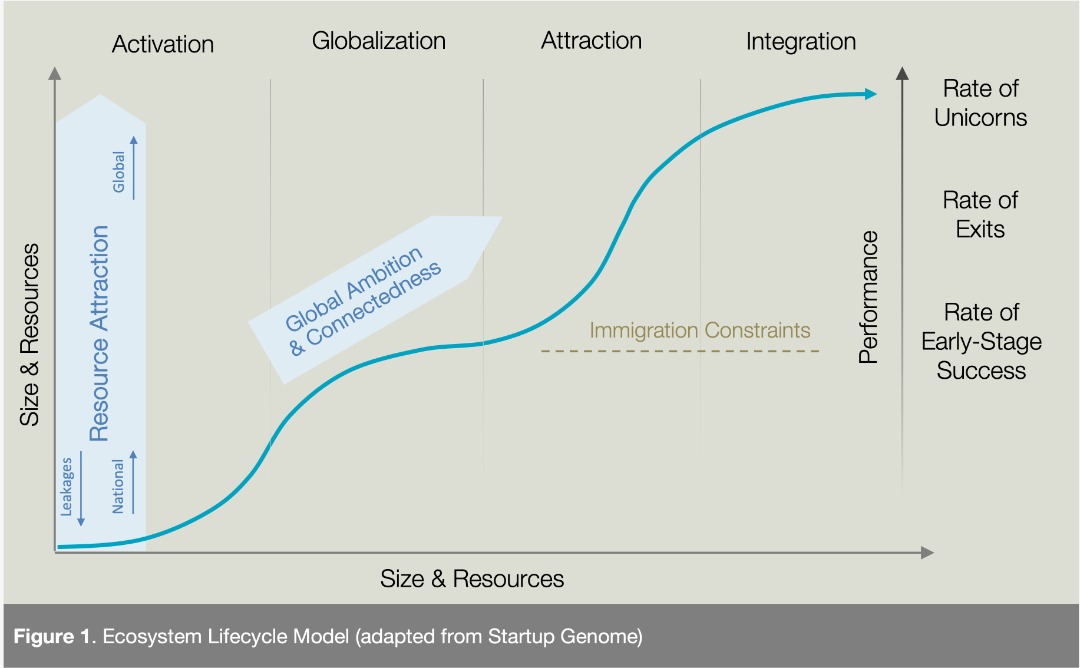

Note that Malaysia’s capital Kuala Lumpur has never appeared in the top 20 or top 30 global startup ecosystem report (presented by Startup Genome group since 2012). And only in the 2020 report we appeared as an “early-globalization phase ecosystem” (Figure 1) while even Jakarta was declared as being in the “late-globalization phase” already in 2019, positioning itself to transcend into “attraction” and “integration” spaces where other countries such as Singapore and South Korea have long-established their strong presence.

For near a decade, China, Singapore, South Korea and other nations, currently championing 5G, have been consistently leading various global digital skills and competitiveness rankings, which points to the fact we already know—the amount of digital integration, digital transformation, digital creative skills in these nations is simply astonishing, the internet of things devices omnipresent across the industries and social life. These are the antecedents or prerequisites or critical success factors for 5G wide adoption and not the way around as they determine the country’s capacity to monetize 5G.

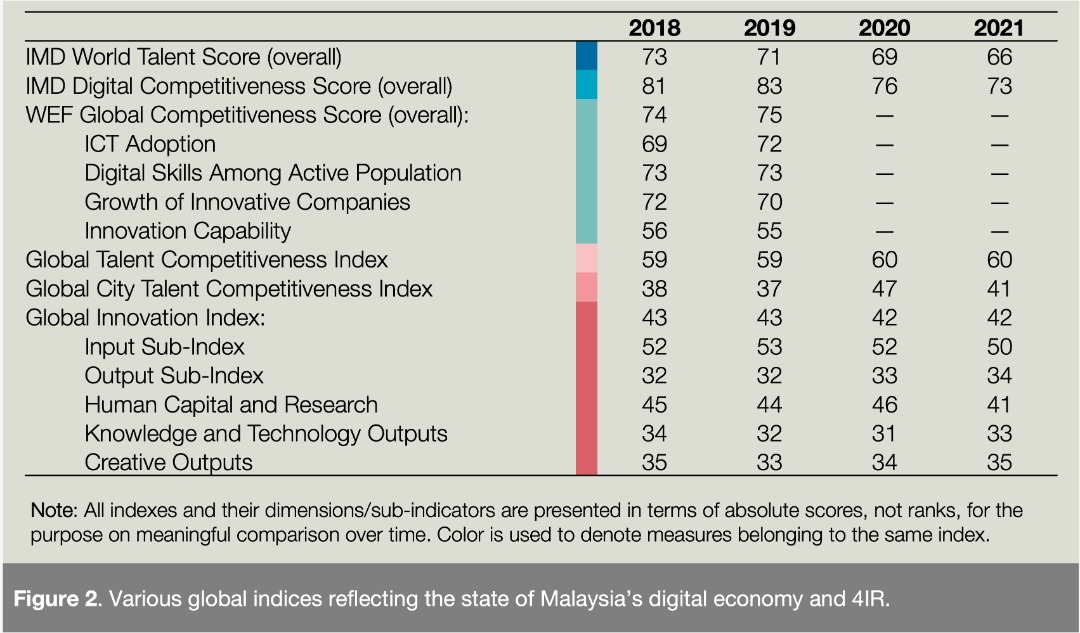

At the same time, Malaysia have been consistently losing its 4IR plot because important decisive solutions are never made on time and where they are direly needed. Our Global Innovation Index has been in permanent steep decline since 2013. From 2020 to 2021 alone Malaysia has lost 20 positions in Smart City Index ranking that even measures more mundane manifestations of digital transformation in society. Our technical skills and talents? You can see for yourself how it has been stagnant or even deteriorating over the last years (Figure 2).

With these weak fundamentals, a sluggish 5G demand inadequate to cover minimum coverage capacity will not only negatively impact telcos’ cashflows but also directly DNB’s bravados “securitized” cashflows and therefore become the taxpayer’s liability very quickly.

In other words, 5G has time to grow organically in our country. Otherwise, over-supply, inefficiencies and waste will always be ironed out by the loses to the industry whether it is led by public or private sector. Although, on this 5G rollout, the private sector appears to be more sense-driven and grounded in reality.

It would be absolutely instrumental for our policymakers to borrow wisdom from “The 5G Readiness Guide” by the Economist Intelligence Unit (based on study of 60 the world’s largest markets) which lists the following as key strategies for successful 5G deployment: high capacity to monetize 5G (as we already double underscored above), early access to 5G spectrum (early auctions took place in all those countries that DNB benchmarks) with equitable distribution to all operators, incentives to encourage infrastructure and spectrum sharing, government-industry collaboration for finding better application for 5G etc.

Meanwhile, while we are still trying to get out 4IR and 5G game together, we cannot also ignore the fact that coverage and quality of even the previous generation networks in our country have serious issues. However, those can be addressed in a more efficient and effective way with less unwanted externalities to the entire national ecosystem.

Improving internet connectivity in rural areas

If Malaysia needs a monopoly to solve its internet access problem on a nationwide scale, then it should be a neutral entity controlled by the government and tasked to build, operate and maintain passive Radio Access Network (RAN) infrastructure (this can also include spectrum) with open access to all licensees.

And even if DNB proponents still want to argue their supply-driven model but in the right context—in the context of previous generation networks as even reliable 4G would be sufficient to cover the needs of the rural dwellers—the provision of fiber, including fiber to the home (FTTH) for fixed broadband and mobile broadband, is sufficient to satisfy the purpose of a supply-driven model.

The sharing of passive RAN infrastructure which constitutes the largest cost for telcos, has no value added in itself (except for those enjoying its monopolistic ownership and raising industry entry barriers) and causes the greatest disruption in terms of duplication will elegantly solve a vector of problems in one go.

Telcos would now be more inclined to come to rural areas with their service offerings, at least for the previous generation networks as to one hugely untapped market suddenly open for them.

This move will also increase competition in the industry while preserving great potential for long-term competitive advantage driven by innovation, research and development in active RAN equipment and therefore keeping industry attractive. On the contrary, the SWN model will make industry competitive but on the features that can be quickly copied by competitors therefore making industry unattractive in the long-term.

Also when the greatest fixed cost is covered telcos will have more financial freedom to invest in such innovation, research and development. If individual telcos don’t—the intensified competition surely will compensate for it.

The neutral and government-controlled entity owning the passive RAN infrastructure can initially focus on extending passive infrastructure to new areas but, if need be, acquire the existing infrastructure on a willing buyer/willing seller basis. The government can also focus on policies encouraging the sharing of the existing infrastructure, which is recent trend in the telecom industry worldwide anyways.

Improving the overall quality of internet in the country

Malaysia’s telcos have been blamed by DNB proponents for “excessive profiteering” while providing substandard quality services (below the regional peers). They were even claimed to be “among the most profitable in the world” (see The Edge article from December 13, 2021, pp. 78-80).

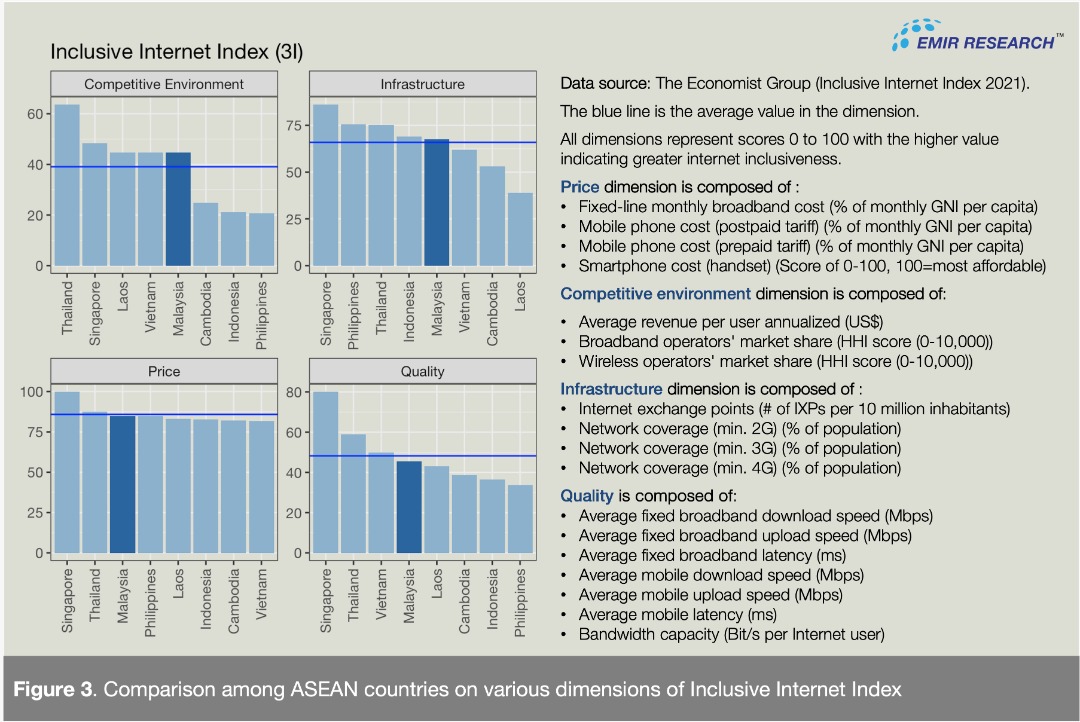

However, let’s check how much of those claims are grounded in the data. In doing so, global indexes provide more reliable measures by covering the minimal requirement of having at least three data source points to capture a variable of interest. In Figure 3 below, the Inclusive Internet Index (3I) by the Economist Group does precisely that.

As we can see the DNB proponents’ claims appears to be rather exaggerated (intentionally or not), although the snapshot is still not satisfactory. Malaysia appears to be quite at par with its regional peers even in terms of internet affordability (mobile included, see the price dimension which essentially reflects the affordability). Only Singapore significantly outperformed us, but Singapore is in its own league.

The only dimension where Malaysia notably below ASEAN group average is internet quality.

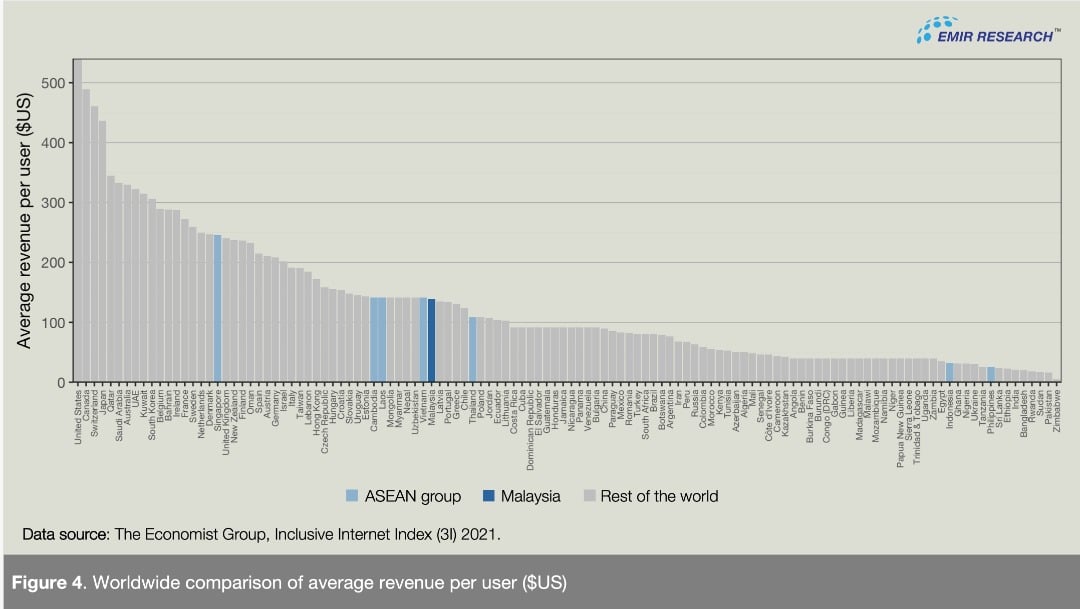

Another graph below shows us how much DNB proponents over-sensesationalize the profitability of our telcos. Even though we could explain Malaysia falling behind near monopolistic environments such as Cambodia and Laos, comparison with the most competitive telecommunication ecosystems in the world beats us.

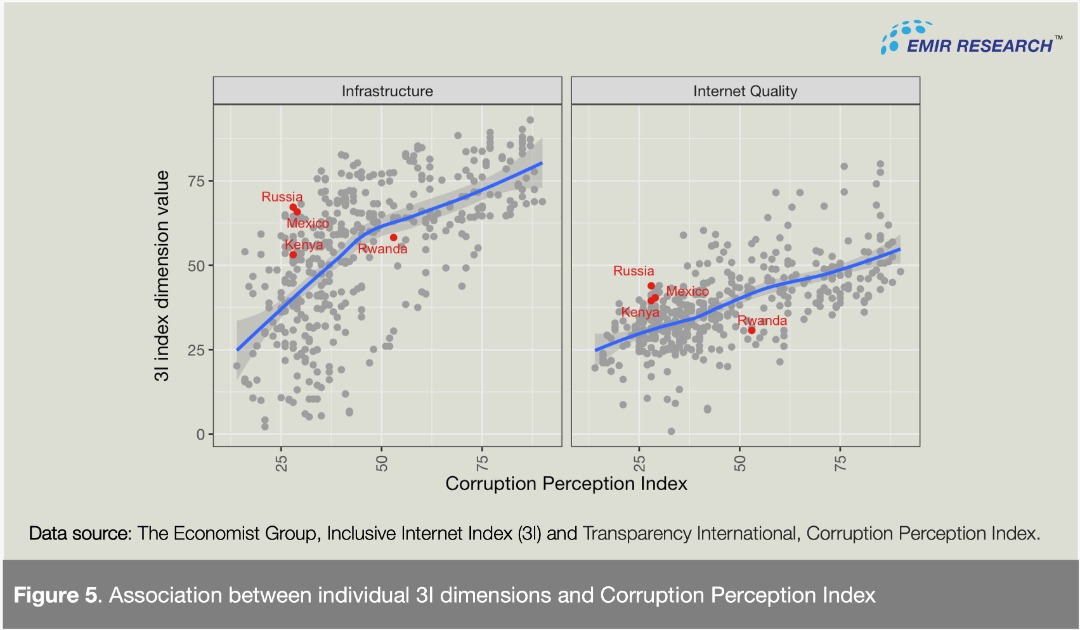

If we see what countries are ahead and behind of us in Figure 4 we might notice a regularity, but Figure 5 makes it apparent.

The telecoms business model of high operating leverage combined with stable (and even growing) demand is indeed a lucrative one. Nevertheless, like any other business it requires the accumulated cash to be spent wisely into the future growth via research and development.

However, this does not appear to be the case for more corrupted countries where corruption in the private sector already redirects money from investment into better internet infrastructure and quality while public sector, which is supposed to monitor and regulate the quality standards, does so with one eye closed just to get their share in form of bribes.

Given the wide spread of corruption in public sector in those countries (as precisely measured by Corruption Perception Index) it would be destructive to leave full and uncontested control over the network deployment in the government hands. In fact, the countries that ever voiced or championed SWN while never reaching their objectives or even filing for bankruptcy, such as Belarus, Mexico, Rwanda, Kenya, Russia, are among those in the left-hand side lower corner of the graphs in Figure 5.

In other words, global data indicates strong link between proper governance and regulation and adequate internet infrastructure/quality.

Therefore, issue of internet quality should be resolved by enforcing the appropriate standards in our telecommunication industry, for example, via revocation of spectrum licensing for substandard quality.

However, again it is governance and competency at the country level and the level of public administration that we should be also worried about as this very incompetent governance already led Malaysia to lose its 4IR plot in terms of very foundations of the digital economy.

The decisions at the level of public administration that do not stand the critic based even on the plain logic and have serious void between proposed inputs-outputs and the claimed outcomes-impacts, intentionally or not, both should be worrying because it speaks loudly about the quality of country’s governance in terms of competence and integrity.

DNB proposal, as it stands today, have raised serious questions from the local and global industry leaders, analysts, and the parliament members. However, DNB is yet to address those substantively rather than repeating in a catboat-like fashion their most unrealistic and far-fetched claims such as, for example, “catalyze digital transformation”, “stop the brain-drain”, “kickstart the economy” or “bridge income gap”. The rakyat already knows what is required to achieve those.

And as the first step, government needs to mellow down on its populistic and misplaced solution with big facade approach, start talking sense and real workable strategies to us and start benchmarking the leading nations when and where they should and not when it suits their personal needs.

(Rais Hussin and Margarita Peredaryenko are part of the research team of EMIR Research, an independent think tank focused on strategic policy recommendations based on rigorous research.)

ADVERTISEMENT

ADVERTISEMENT