Shanghai-based developer’s Genshin Impact leads buzz chart

According to a report recently released by social media platform X — formerly known as Twitter — Genshin Impact, a role-playing video game produced by Shanghai-based developer miHoYo, topped the global gaming buzz charts in 2022 and the number of tweets and users involved in discussing the game took first place on buzz charts in many countries.

X analyzed a large number of tweets posted from May 2022 to this April to summarize the most mentioned games on its platform across the world.

Genshin Impact is one of the successful examples of how Chinese gaming companies are making big gains on the global stage, leading to broad optimism from industry experts and insiders on their future growth in overseas markets.

Wang Wei, general manager of AppsFlyer Greater China, said its most recent survey shows that gaming is a highly representative industry for China’s overseas businesses. AppsFlyer is an Israeli mobile marketing analytics company.

“Over the past four years, mobile games steadily took up 64.9 percent of all the Chinese apps going overseas,” Wang said on the sidelines of the 20th China Digital Entertainment Expo and Conference, or ChinaJoy, which concluded on July 31 in Shanghai.

AppsFlyer said the fast-growing global gaming market is expected to reach $268 billion by 2025 and China is certain to take a huge share.

“Considering the uncertainties in the approval of licenses for new game titles at home, and the larger overseas markets with predictable growth, we believe that global expansion will be increasingly essential for Chinese gaming companies,” Wang said.

In recent years, leading Chinese gaming corporates, including Tencent, Perfect World and Netease, have already been expanding in the vast overseas market.

Tower of Fantasy, Perfect World’s mobile game unveiled overseas last August, has topped the list of the most downloaded free games in the iOS App Store in nearly 40 countries and regions. The game is also set to hit the Play Station platform next month.

“China has become a bellwether in the global gaming industry,” said Lu Xiaoyin, co-CEO and president of Perfect World.

Gaming revenue climbs

Citing a report released by CNG, a research institute on the gaming industry, Lu said the actual sales revenue of Chinese games exceeded 265.84 billion yuan ($36.9 billion) in 2022, with gamers surpassing 664 million.

“To make our games go overseas is our key focus, and will be for a long time in the future,” Lu added.

Tencent, another leader in China’s gaming industry, also attaches great significance to its global expansion.

Vigo Zhang, vice-president of Tencent Interactive Entertainment, said they are sparing no effort in not only maximizing profits, but also using games as a bridge to promote international cultural exchanges.

“Online games are extremely inclusive, and have become one of the main entertainment and social norms for Generation Z worldwide,” said Zhang.

“A report shows that from 2012 to 2022, over 40 percent of Chinese games had contributed to spreading our nation’s traditional culture.”

He said Tencent’s games, such as Moonlight Blade and Call of Duty, have integrated intangible cultural elements like Suzhou embroidery and paper-cutting, which allow overseas players to know more about Chinese culture.

Furthermore, China’s gaming leaders are also looking to tap into overseas markets with investment in esports.

“Esports have already been one of the most promising and dynamic sectors in the global digital economy,” said Ding Lei, CEO of NetEase Inc.

“And the original esports games and events have proved their capability of capturing global audiences.”

He pointed out that esports events based on Netease’s original hits, Naraka: Bladepoint and Identify V, have attracted contestants from over 30 countries, as well as hundreds of millions of viewers.

“In Southeast Asia, we are operating an esports brand named Top-Clans. Not limited to Netease’s events, it also provides services to global esports events.

“It has become one of the most influential esports brands in the SEA region, and we are looking to further expand in other regions such as the Middle East, Europe and South America,” Ding added.

Hou Miao, vice-president of Tencent Games and general manager of Tencent esports, shares the same view and in particular, highlighted the impact of the upcoming Asian Games to be held in Hangzhou, Zhejiang province, in September. For the first time, esports is listed as a medal discipline.

“The first official entry of esports into the Asian Games is undoubtedly the most positive signal within the global esports industry,” Hou said.

Hou added that taking the opportunity of the Asian Games, Indonesia’s national esports team came to Hangzhou this April to prepare. Thanks to their training with two local CFPL (CrossFire Pro League) teams in China, the Indonesians later won a silver medal in the Southeast Asian Games.

“In the future, we will continue to go global in terms of esports. We collaborate with more countries in East Asia, Southeast Asia and Central Asia on fields such as tournament setups, talent education and gaming infrastructure,” Hou added.

Challenging but promising

Although the worldwide gaming industry is flourishing overall, many challenges are weighing on Chinese gaming companies’ dreams of going global.

They include limited overseas marketing budgets, localization challenges caused by companies’ unfamiliarity with policies, cultural differences and privacy policies, among others, experts said.

In the first half, China’s self-developed games recorded total actual sales revenue of $8.2 billion, down 8.72 percent year-on-year, according to a report released during ChinaJoy on July 27.

Experts attributed the decrease to diminished consumer willingness to spend, as well as increasing marketing costs brought on by international conflicts, exchange rate instability and strong market competition.

Similarly, AppsFlyer conducted an analysis of over 17,000 Chinese gaming apps over an 18-month period, from the start of 2022 to this June. The results showed that the downtrend of Chinese games’ installation had aligned with the sluggish global economic performance in the first six months.

“The slowing economic growth led to falling marketing budgets among game developers, while overseas media buying costs have risen by as much as 30 percent,” said Peter Wei, senior vice-president of the Growth Business Center at Mobvista, a leading Chinese mobile marketing platform specialized in global growth for game developers.

Thus, how to target the most potential users with limited budgets in diverse overseas markets is a major and crucial challenge for Chinese game developers, Wei said.

Privacy policy updates also have a crucial impact on the gaming industry, especially on mobile games.

In recent years, Apple’s App Store has been tightening its user privacy policy, focusing on aspects such as data collection and requirements on anti-tracking measures.

Furthermore, Google is also rolling out its Privacy Sandbox, which will make it harder for game developers and marketers to target their users, said Wang from AppsFlyer.

Despite the challenges, the global gaming industry still offers eye-catching growth in different regions, as per AppsFlyer’s report.

In North America, games using the Android system saw a total growth of 56 percent from the start of 2022 to this June, led by children’s games and sports games.

In Japan and South Korea, in-app purchases on social apps from the iOS App Store surged 120 percent.

In Latin America, all game categories were seeing growth. The African gaming market also saw rapid growth and has a promising future, said the report.

“Nevertheless, big challenges could turn into vast opportunities. The most important thing for Chinese game developers is to adapt to the changing environment,” Wang said.

“The one who adapts to the new environment the best will get through the hard times and then perform better.”

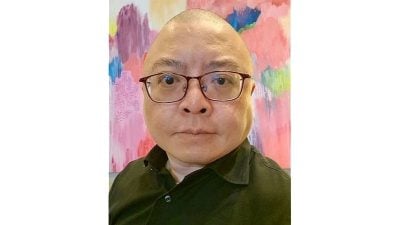

Alan Lan, managing director of Greater China at X Corp, also said he is fully confident about the overseas expansion of the Chinese gaming industry.

“We firmly believe that innovation and resilience will enable Chinese game makers to traverse the downtrend cycles faster, and achieve long-lasting success in the global gaming market competition,” Lan said.

ADVERTISEMENT

ADVERTISEMENT