If the already severely bloated civil service keeps expanding, the government will be forced to trim development expenditure, which is not going to be healthy!

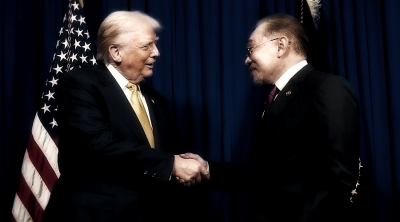

Prime minister Anwar Ibrahim will be tabling the 2023 Budget this afternoon.

The finance ministry has put up a Budget that will include the promises made in the election manifestos of various parties in the unity government, meaning this is going to be a Budget designed to fulfill the election pledges that will take care of all Malaysians irrespective of race, in particular the B40 communities.

Anwar says the special allocation to help the rakyat weather the pandemic crisis over the past two years have ended late last year. As s result, the 2023 budgetary deficit will be lower than that in 2022.

Deputy finance minister Ahmad Maslan said on Tuesday that the 2023 Budget would focus on capping the public debt to not more than 65% of GDP and debt service charge not more than 15% of annual budget.

Currently the government debt to GDP ratio stands at 60.4% or RM1.0796 trillion. Because of the coronavirus pandemic, the previous administration has on two separate occasions upped the statutory debt limit from 55% of GDP to 60% and later 65%.

The unity government’s “debt policy” will be unveiled today. If the statutory debt limit is 65%, government debt can be increased to RM1.1618 trillion, giving the government room for additional RM82.2 billion borrowings. Although this amount can be used for emergency needs, it will increase the government’s interest burden in the long run.

Cutting public debt is the focus of the unity government. As such, the 2023 Budget is expected to cut budgetary deficit and cap it at 5% of GDP (approximately RM90 billion), lower than the 5.5% deficit for the Budget announced last October by the previous administration.

The goal of the Budget is current account balance, while the government’s revenue comes from mostly taxes, including excise duty, individual and corporate income tax, value-added tax, stamp duty, sales tax, GST, land value-added tax, inheritance tax, etc.

Cutting taxes contravenes the goal of expanding government revenue, and that explains how we get the 5% budgetary deficit. But if we don’t increase the taxes, then we will need to look into shrinking government expenditure.

The Federation of Chinese Associations of Malaysia (Hua Zong) have offered a ten-pronged proposal that includes lowering individual and corporate income tax rates, but we doubt this will be adopted given the current health of the government’s finances.

The budgetary allocation can be broadly divided into operating expenditure (emoluments for civil servants and servicing of public debt interest) as well as development expenditure (for various government infrastructure projects).

Based on the Budget tabled last October for instance, operating expenditure makes up about 73.1% of total allocation while development expenditure only makes up a mere 25.5% or RM95 billion, which is quite restrictive for a country that is fast developing and in need of implementing major infrastructure development projects.

In view of this, Ahmad Maslan has proposed to increase new borrowings to boost development expenditure while the allocation for operating expenditure would need to depend on the government’s tax revenue.

Indeed, to have sufficient funds (development expenditure) to spearhead the country’s economic development, we may need new borrowings whenever necessary, but the bulk of the budgetary allocation for emoluments and benefits for civil servants must be suitably adjusted. If the already severely bloated civil service keeps expanding, the government will be forced to trim development expenditure, which is not going to be healthy!

The Budget tabled by then finance minister Tengku Zafrul Tengku Abdul Aziz on October 7 last year totaled RM372.3 billion or 20.5% of the country’s GDP, with a budgetary deficit at 5.5% of GDP. Of the total, RM272.3 billion was set aside for operating expenditure, with RM95 billion for development and RM2 billion as contingency reserve. This Budget was nevertheless rendered void following the dissolution of parliament on October 10.

Anwar tabled a RM107.72 billion mini budget on December 20 soon after he became prime minister. The mini budget went into effect from January 1 this year.

This mini budget would be used for government’s operating expenditure before the Supply Bill 2023 goes into effect, including for the disbursement of emoluments, public works, welfare, education, medical services as well as projects under development. Back then the PM promised to table a more comprehensive Budget in February this year.

The B40 and M40 communities in the country have been struggling to make ends meet over the past three years as a consequence of the coronavirus pandemic and globalized inflation. Many low- and middle-income families have to look to their future money for survival, as evidenced by the drastic drop in their EPF savings.

Anwar reassured on Tuesday that the government would continue to provide targeted direct cash assistance to the poor, in particular those in B40 category, to help them tackle the rising cost of living, including Sumbangan Tunai Rahmah (STR) program for 8.7 million B40 households, RM1,000 monthly children assistance scheme from the welfare department that will benefit families meeting the poverty line income (PGK) criteria, namely monthly income below RM1,169.

From the macroscopic point of view, the government’s efforts to boost tax revenue, implement national infrastructure projects, tighten operating expenditure, control spiraling inflation, promote economic development and preserve the stability of ringgit; to boost the people’s incomes, provide assistance to the low-income and underprivileged communities, provide living subsidies, stabilize day-to-day goods supply and prices, ensure that the country’s education and medical systems will benefit all Malaysians — these are what Malaysians in general are looking for in the 2023 Budget.

ADVERTISEMENT

ADVERTISEMENT