Impact of the ZEV Declaration at COP26

To deal with the global climate change issue, developed countries mainly are moving toward banning the sale of internal combustion engine (ICE) vehicles.

At the 26th Conference of Parties to the United Nations Framework Convention on Climate Change (COP26) in November 2021, 39 countries signed a declaration to make all new vehicle sales zero emission vehicles (ZEVs), in major markets by at least 2035 and globally by 2040.

At the recent COP27, two more countries decided to participate. Although this declaration is not legally binding and it excludes hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs), it came as a major shock to those working with automobiles in ASEAN, which is an export base for third countries that boasts the world’s fifth largest production (3.54 million units in 2021).

According to Boston Consulting Group, the turning point for the shift from ICE to ZEV, centered on battery electric vehicles (BEVs), is expected to happen around 2035, with BEVs accounting for 59% of global new vehicle sales in the same year.

Shift to EVs will lead to collapse of industrial structure and competition to become EV manufacturing bases

The shift to BEVs will affect ASEAN in two ways. The first is the impact on the industrial structure and employment, and the second is the intensification of competition among countries in the region to becoming EV manufacturing hubs.

ICE’s EV shift will damage the industrial pyramid with final automotive assemblers at the top through a drastic reduction in the number of parts. According to the Thai Auto-Parts Manufacturers Association (TAPMA) in Thailand, ASEAN’s largest automobile manufacturing country, 49 out of 160 auto parts will no longer be required.

This includes fuel injection devices and radiators among engine-related parts, starter motors and alternators among electrical parts, and axles and transmissions among drive system parts.

As a result, a total of 999 companies, meaning 816 out of 2,500 auto parts companies and 183 companies that support them, are expected to be directly affected, so immediate measures are required.

Meanwhile, new parts have also been introduced due to the shift to EVs, initiating competition to attract the manufacture of these parts.

Indonesia and Thailand are trying to attract and encourage investment in order to domestically produce batteries and other key EV parts.

The Board of Investment, Thailand (BOI) has already granted corporate tax exemption benefits for 17 key components related to EVs, and is encouraging investment. Moreover, as part of efforts to attract BEV manufacturing projects, domestic production of at least one of three critical parts (traction motor, drive control unit [DCU], and battery management system [BMS]) is required within the first three years of production.

The Thai government also aims to lower BEV prices and promote sales by providing financial subsidies and excise duty exemptions, but those who wish to enjoy them must engage in local BEV production and domestic production of EV parts.

At the same time, Indonesia, which boasts the world’s largest production and reserves of nickel that is the main raw material for batteries, has banned the export of nickel ore and aims to become a manufacturing hub for EV batteries.

The Indonesian government is also gradually increasing the local content rate of BEV raw materials and parts, requiring EV manufacturers to procure at least 80% after 2030.

Furthermore, local content ratio regulations have been established for several parts such as batteries and drivetrains.

Local content requirements would normally not only violate WTO regulations but also hinder the development of ASEAN’s EV industry itself, so this may adversely affect efforts to improve competitiveness.

Toward an environment that allows for mutually complementary EV systems within the region

The ASEAN automobile industry broke away from import substitution in the latter half of the 1990s, realizing economies of scale through the division of production by companies with multiple bases in the ASEAN region and refining their international competitiveness.

This was supported by regional cooperative measures such as the ASEAN Industrial Cooperation Scheme (AICO) and the ASEAN Free Trade Area (AFTA), which allowed ASEAN products to be included in local content rates.

As a result, Thailand has grown into a focused manufacturing and export hub for pickup trucks and eco cars, while Indonesia has become the same for minivans. Moreover, the Philippines and Malaysia have become focused manufacturing hubs at the parts level, for example, with the former manufacturing transmissions and the latter steering-related parts.

In preparation for the upcoming EV era, it is necessary for each country to look beyond its own interests and take measures that consider regionwide interests. This requires maintaining a free trade system in the region, avoiding protectionist measures, and including ASEAN-origin products in local procurement regulations.

As the EV market itself is extremely small, the economies of scale cannot operate if each country insists on domestic production, which will force the country into high-cost production.

Meanwhile, if EV parts, which are price-competitive thanks to mass manufacturing and the ASEAN-China Free Trade Agreement (ACFTA), flow in from China and other countries, this may nip the growth of the EV-related industry that ASEAN is aiming to cultivate in the bud.

Now is the time when ASEAN’s regional cohesion is put to the test.

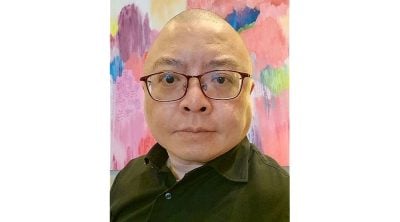

(Seiya Sukegawa is Visiting Professor, Thai-Nichi Institute of Technology, Thailand, and Professor, Kokushikan University, Japan.)

ADVERTISEMENT

ADVERTISEMENT