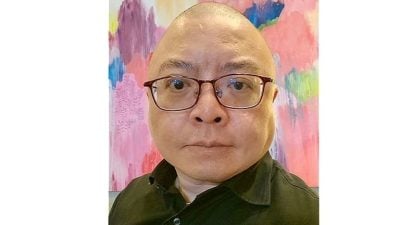

PETALING JAYA: Local economic analyst Koong Lin Loong said the twice OPR hikes by Bank Negara within two months will force borrowers to pay higher interests for their loans, remarkably adding to the already heavy financial burden of many.

For a RM500,000 housing loan of 30-year repayment period, for example, the twice interest rate hikes will mean additional RM146 a month or RM1,756 a year for borrowers to settle their loan instalments.

Over a period of 30 years, Koong said the additional interest will sum up to a whopping RM52,686!

He told Sin Chew Daily the additional RM146 a month is more than the RM100 assistance provided by the government.

“For a 30-year RM500,000 loan, the total interest at the end of the repayment period is supposed to be RM859,348.80, but will now become RM910,234.80.”

Housing mortgages aside, the interest rate hikes will also increase the cost of borrowing for local businesses.

“Unless a company is totally debt-free or is absorbing the additional interest cost, it will very likely transfer the additional cost to the consumers, aggravating the inflation.

“Interest rate aside, the ringgit exchange rate is also unstable. The cost of our imports and raw materials has risen significantly compared to 2019 just before the pandemic, putting a lot of pressure on local businesses.”

Koong is of the view that the government should have a macroscopic policy to stabilise the local currency and prevent the inflation from worsening.

He urged Malaysians to spend wisely and make prudent financial planning on what they are going to spend.

“The pandemic is not yet over and the number of new cases are on the rise. We can’t keep spending indiscriminately.”

He also reminded the public to improve their work efficiency.

“As people around us may get infected, thus affecting our work efficiency, we must learn to enhance our efficiency under such circumstances.”

ADVERTISEMENT

ADVERTISEMENT