KUALA LUMPUR: Due to the war between Russia and Ukraine, coupled with the start of the Ramadan fasting month next month, local gold prices have soared more than 10% on overwhelming orders during the past one month.

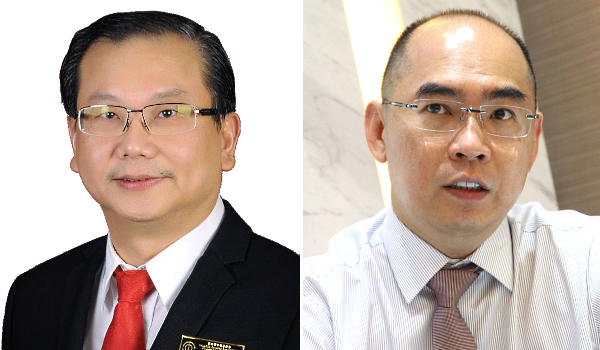

Federation of Goldsmiths & Jewellers Association of Malaysia (FGJAM) president Datuk Steven Siow Dek Kuen told Sin Chew Daily the war between Russia and Ukraine has sent international gold prices soaring, as investors, buyers and consumers are grabbing up gold, making it a very sought after commodity.

He said 999 gold was traded at around RM290 per gram in January but is now more than RM300 and rising. Meanwhile, 916 gold has surged to almost RM285 per gram from RM260 early this year.

Buoyed by festive buying

He said the coming Ramadan would send the business volumes up by 20-25% as this is the traditional peak season for the goldsmith and jewelleries industry.

He said many local goldsmiths had received overwhelming orders from the consumers, adding that his own shop had orders until April, meaning the buyers would have to wait for one month to get their purchases due to the strong demands.

Siow explained that gold is an excellent investment as it hedges against inflation, and investors, buyers and consumers have their own sets of buying timetables based on their individual needs.

Although gold prices are a bit steep now, some buyers still feel that it is a good time to buy in, as the current uptrend is expected to continue in view of various factors.

“As for the Raya festive season, the buying spree is set to be boosted, as the Malays have always had a passion for gold, especially during the festive season. This will significantly lift the local gold market.

“An interesting phenomenon is that some Malays will also sell the gold they have in hand and buy new one during the festive season, even though they do not join the buying rush.”

‘Gold rush’ to stay for some time

Meanwhile, Tomei Consolidated Group managing director Datuk Ng Yih Pyng said the local gold market, which was supposed to end last month after the year-end holidays, has remained robust as a consequence of the war in Europe and the upcoming Raya festivity.

He said if not for the pandemic which has somewhat dampened the market sentiment, the current gold rush would have been even more bullish.

Due to the marked increase in international gold prices on the back of global uncertainties and instability, Ng believed gold prices would remain high for some time.

Like the equity market, he said the gold market is also volatile, and the prevailing conditions will determine at what prices consumers will buy or sell.

ADVERTISEMENT

ADVERTISEMENT