We know that incompetent, haphazard and obscure top governance over the years has already exposed Malaysia to serious risks on many fronts from the raging COVID-19 pandemic to the complete loss of competitiveness in advancing the Fourth Industrial Revolution to the brain drain. Yet, another danger might be looming on the horizon.

Malaysia might be riper than ever for another round of speculative pressure on its currency.

Seminal research in economics and finance over the decades established that the strongest predictors of imminent speculative attack among many factors are the behavior of international reserves, the real exchange rate, domestic credit, credit of the public sector, and domestic inflation. The appearance of any of these indicators or, more so, their combination severely curtails the government ability to defend a speculative attempt to devalue national currency successfully.

For instance, stagnated or depleted international reserves void the government’s capacity to maintain its currency within predetermined bounds by dumping international reserves.

Sliding exchange rate, especially in combination with the belief that this trend will continue (based on fundamentals), informs speculators that the government of a targeted country would not opt for the strategy of aggressive borrowing in foreign currencies to stem speculative attack as long-term depreciation will only increase the costs of repayments – both principals and interest rates.

Expansion of the domestic credit, as well as credit to the public, make intervention through interest rate increase implausible option as doing so may push a large proportion of individuals and companies into default and send turmoil through the entire financial system.

This strategy of currency defeat is also not an option in case of rising domestic inflation as it will undoubtedly send domestic inflation to new highs.

When the above conditions are all met, the government of a targeted country is basically “trapped” or “ripe” for the successful speculative currency attack.

Depleting international reserves

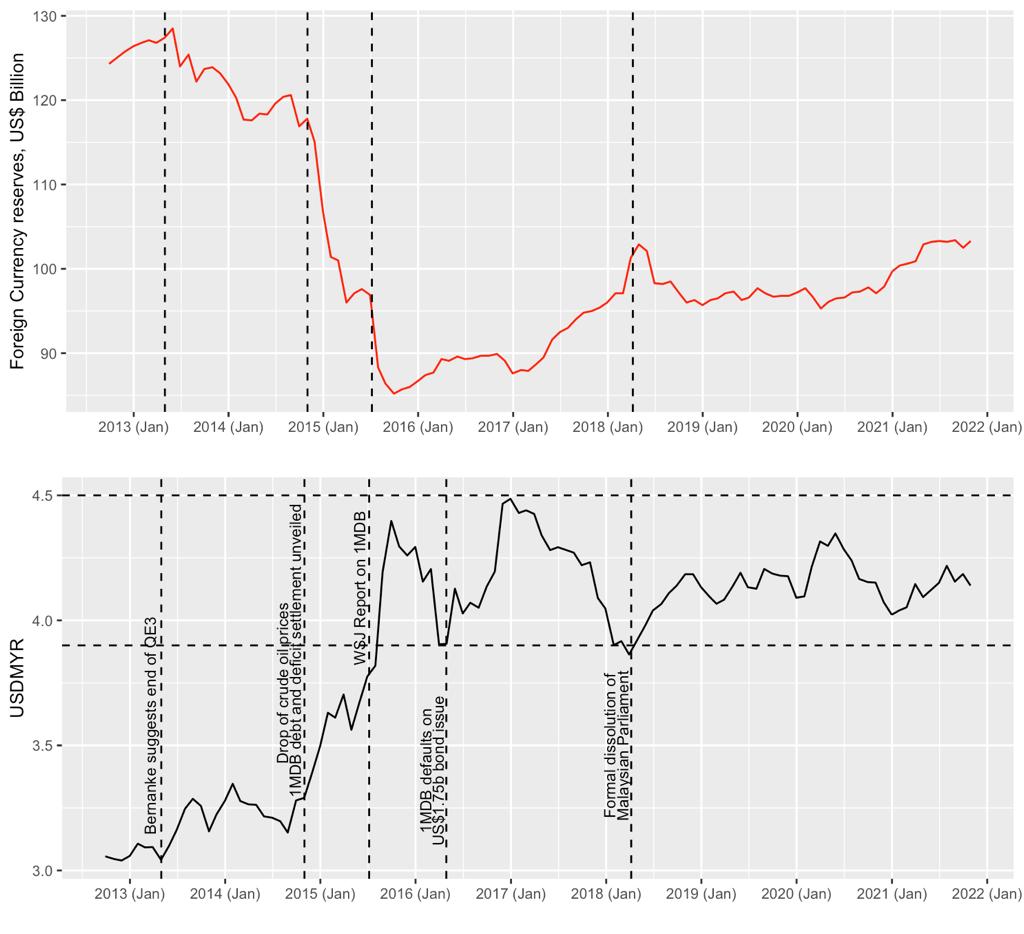

The following long historical data (see the graph) shows Bank Negara Malaysia’s (BNM) foreign currencies reserves levels together with the corresponding USD/MYR movements. Note how Malaysia could not rebuild even 50% of its foreign reserves since its fall from USD128.2 billion in mid-May 2013 to USD85.2 billion in mid-September 2015 on one of the greatest ringgit slides since the Asian Financial crisis.

Also, our foreign reserves are currently just above that psychological USD100 billion mark (at USD103.9 as of November 30, 2021, according to the BNM report).

Gloomy long-term outlook for ringgit

Looking at the long-term behavior of our currency (refer to the same graph), the ringgit has been ranging in the broad channel of RM3.900 to RM4.500 to USD since 2016, probably falling victim to profitable range trading.

Note the pair’s strong and sharp bounces every time it nears RM3.900-RM4.000 region, indicating a massive number of sell orders stacked at those levels. At the same time, the currency pair less and less reluctantly comes down. This, in turn, indicates investors’ firm belief that our currency is poised for long-term depreciation based on the country’s weak fundamentals.

This is very significant, as since 2016—the onset of the 4th industrial revolution (4IR)—many, even developing, countries (Indonesia, Vietnam, for example) set their sight on harnessing 4IR potential and gearing it towards building national self-sufficiency and resilience while combating all sorts of inefficiencies (including corruption).

Unfortunately, during the same period, Malaysian governance was distracted and derailed by unprecedented politicking, power, and money-grab at all levels. Notably, the literature suggests political instability, weak national governance, inconsistency and uncertainty of national policies as yet other strong predictors of national currency attack.

The graph above, too, clearly illustrates how politics and corruption have contributed to the ringgit’s wounds.

Where citizens of the country close their eyes, investors and speculators (not necessary foreign) may see profitable opportunities.

Debt-ridden nation for generations

We are a highly debt-ridden nation.

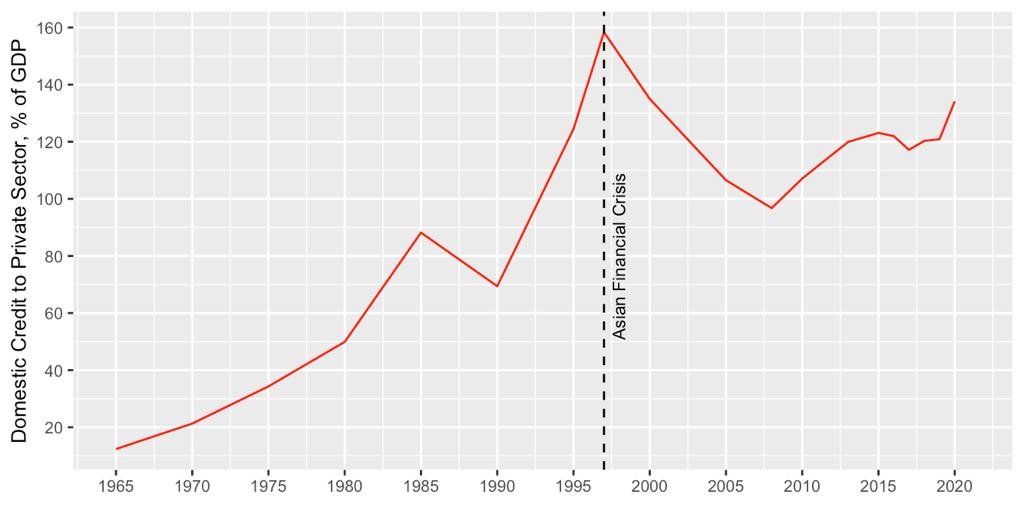

Malaysia’s private sector debt (businesses and households included) as a percentage of GDP has been on the steep rise since 2008 (graph below)—jumping from 96% of GDP to 134%. Note that Malaysia’s private sector debt was at its highest (158% of GDP) just before the 1997 Financial Crisis.

However, more importantly, we are a debt-ridden nation for generations as our government rolls over debt—new money is borrowed to pay off the old debt rather than using it to generate productive activity.

Furthermore, when it comes to development expenditures, due to rampant corruption at all levels, there is a high chance that a large chunk of scarce financial resources will end up being wasted through leakages and investment in marginal industrial projects rather than generating robust future economic growth.

According to estimates by Transparency International Malaysia (TI-M) and World Bank, since 2013, Malaysia has been losing close to 4% of its Gross Domestic Product (GDP) annually. Looking at the GDP data, this figure comes to RM40–RM60 billion on annual basis, and this could be still a downside estimate given the high number of unresolved corruption cases in Malaysia.

It is staggering from this data (sourced from BNM) how the Malaysian government’s fiscal discipline has been getting from bad to worse over the last couple of decades.

Notably, there were no signs of fiscal consolidation even during the periods of economic growth, which is a big sign of poor management and likely misappropriation of national resources.

COVID-19 devastation and rising inflation

The interest rate rise is one of the powerful tools to stave off currency depreciation. However, we cannot even name it amidst handling the unprecedented devastation brought by COVID-19 to local businesses and households.

Furthermore, Malaysia is already facing rising inflation due to various macro- and micro-economic factors, including even apparent price gouging (“Strategies to combat high food inflation” by EMIR Research from November 30, 2021).

Therefore, with all the above criteria met, we are trapped as never for speculative pressure on our currency.

And even though we can applaud BNM for its smart regulation measures to seriously curtail the possibilities for ringgit speculation, the rise of the crypto economy and lack of governance and enforcement in our own country still leaves many doors wide open.

There is a lot for us to ponder over the governance of this nation—where are we ALL collectively taking this country.

And start acting decisively before the ringgit is sent to a new low (below the historic low of 4.5 ringgit to USD)—the move that would be devastating for our economy given its high dependency on imports (food insecurity).

(Dr Rais Hussin and Dr Margarita Peredaryenko are part of the research team at EMIR Research, an independent think tank focused on strategic policy recommendations based on rigorous research)

ADVERTISEMENT

ADVERTISEMENT