US President Trump’s economic strategy for his second term aims to get the rest of the world, especially its wealthy allies with greater means, to pay more to help strengthen the US economy.

Recent US initiatives have undoubtedly accelerated de-dollarization but these have largely been unavoidable consequences of its own actions rather than due to any conspiracy by others to that end.

De-dollarization distraction

Harvard economist Kenneth Rogoff recently observed, “We are absolutely at the biggest inflection point in the global currency system since the Nixon shock to end the last vestige of the gold standard.”

After the Bretton Woods Conference in 1944, the gold price was set at $35 per ounce.

In August 1971, US President Richard Nixon ended this gold-dollar parity.

De-dollarization has gradually continued since, with occasional brief spurts and reversals. For example, capital flows abroad rose following the 2008-09 global financial crisis.

Growing weaponization of economic relations has probably accelerated de-dollarization.

Rogoff observed, “this was happening for a decade before Trump. Trump is an accelerant.”

Governments, central banks and BRICS countries have been de-dollarizing. Even US dollar hegemony advocates no longer deny alternatives to the dollar’s role as global reserve currency.

Meanwhile, private foreign investors, including foreign asset managers, investment banks and pension funds, do not want to be left behind.

Investment fund managers are increasingly ‘de-risking’ by cutting exposure to dollar-denominated assets.

Mar-a-Lago plan

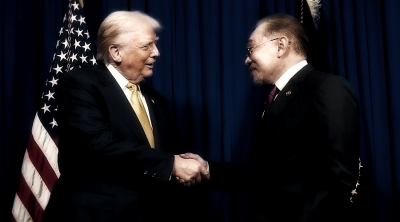

Economist Stephen Miran has proposed a new Trump initiative to require other governments to pay the US for services purportedly rendered.

First appointed chair of Trump’s Council of Economic Advisers, Miran has since been appointed to the US Federal Reserve Board.

A few days after Trump announced his Liberation Day tariffs on April 2, Miran articulated five expectations.

These expect other nations to pay the US for ‘public goods’ services it ostensibly provides the world.

Allies will be expected to pay the US more for the ‘security umbrella’ it provides to NATO and other allies.

The US also expects those buying Treasury bonds to pay more for the ‘privilege’

In November 2024, Miran’s A User’s Guide to Restructuring the Global Trading System proposed the Mar-A-Lago accord, named for Trump’s exclusive Florida island resort and residence.

He also referred to the Plaza Accord, which the Reagan administration imposed on its G5 allies in September 1985. Then, the US forced Japan and Germany to appreciate their currencies against the dollar.

The yen’s appreciation fueled a massive Japanese asset price bubble that burst with devastating consequences in 1989, ending its post-war boom.

Trump now seeks the appreciation of other major currencies. Already, he has succeeded in getting his European allies to agree.

However, it seems unlikely that Trump will get China and other BRICS economies to do so, as they are aware of how the Plaza Accord affected Japan.

Century bonds

Other national monetary authorities buying US Treasury bonds to stabilize their own currencies have long caused dollar appreciation.

They are now expected to help depreciate the dollar. Miran has proposed that the US issue century, i.e., 100-year bonds, at very low interest rates, well below the current rates for US Treasury securities.

Miran wants foreign central bank reserve currency managers to sell off their dollar-denominated assets.

They should “term out” their “remaining reserve holdings” and refinance short-term debt with long-term borrowings.

Miran is explicit: “The US Treasury can effectively buy duration back from the market and replace that borrowing with century bonds sold to the foreign official sector.”

His plan thus intends to force foreign holders of US government debt (‘Treasuries’) to extend the duration of their loans.

Very low interest rates for century bonds will ensure that foreign bondholders effectively pay the US more for the ‘privilege’ of borrowing dollars.

For Miran, the appreciation of other currencies against the dollar will also strengthen the American economy. US manufacturing will strengthen as its exports become more competitive.

Thus, his Mar-A-Lago accord plan expects other nations to pay more to strengthen the world’s largest and richest economy.

Miran’s Mar-A-Lago plan is not yet official US policy. However, this can change with Miran’s likely appointment as the next Fed chair, replacing Trump 1.0 appointee Jerome Powell.

BRICS de-dollarization?

However, Miran’s declared plan to strengthen the US economy by depreciating the dollar against other major currencies has also accelerated de-dollarization.

In recent years, the BRICS have been accused of conspiring to accelerate de-dollarization worldwide, but this is certainly not a shared ambition.

Lacking significant trade surpluses, Brazil and South Africa have long advocated de-dollarization. But Russia’s complaints have more to do with recent NATO weaponization of financial instruments against it.

There is no comparable enthusiasm among other BRICS member states, which have much healthier trade surpluses and more dollar assets.

Its recent membership expansion will make an official BRICS de-dollarization stance even more unlikely.

Nevertheless, Trump’s leadership relies on the American public believing the rest of the world is conspiring against them.

(Jomo Kwame Sundaram is currently senior adviser at Khazanah Research Institute (KRI). A former economics professor, he was United Nations assistant secretary-general for economic development. He is a recipient of the Wassily Leontief Prize for Advancing the Frontiers of Economic Thought.)

ADVERTISEMENT

ADVERTISEMENT