PETALING JAYA: The rising cost of healthcare in Malaysia shows no sign of slowing down, with the country’s medical inflation forecast to accelerate even further next year, according to a new report.

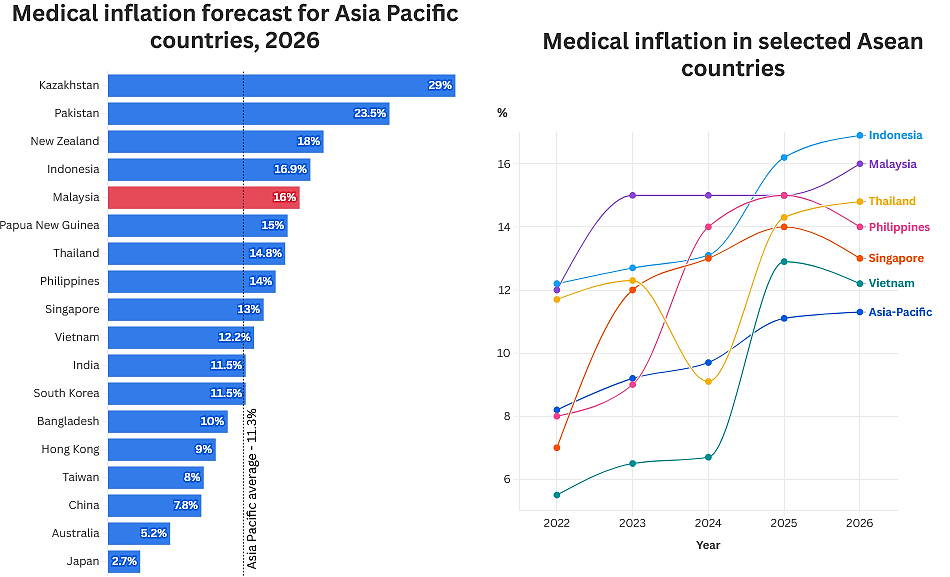

The 2026 Global Medical Trend Rates Report by professional services firm Aon shows Malaysia’s medical inflation rate is projected to climb from 15 percent this year to 16 percent in 2026.

These figures are well above the Asia-Pacific average of 11.1 percent this year and 11.3 percent next year.

Among the six Asean countries included in the report, Malaysia’s projected 16 percent gross medical trend rate for 2026 trails only Indonesia (16.9 percent), while surpassing Thailand (14.8 percent), the Philippines (14 percent), Singapore (13 percent) and Vietnam (12.2 percent).

The 16 percent projection for Malaysia marks the highest rate for the country since 2021 and breaks a three-year plateau where medical inflation held steady at 15 percent.

Aon, when contacted, said that key medical conditions driving costs for Malaysia in 2026 are respiratory, musculoskeletal, gastrointestinal, and cardiovascular conditions as well as accidents.

“Risk factors are lifestyle-related such as high blood pressure, high cholesterol, and high blood glucose. All of these continue to cause medical plan costs to increase,” it said.

Kathryn Davis, vice-president of global benefits at Aon, said higher medical utilisation rates, adoption of new advanced technologies and growing demand for private healthcare services are driving medical inflation globally.

“Additionally, aging populations in Europe, Asia-Pacific and Latin America are emerging as key drivers of rising medical costs,” Davis said.

According to Bank Negara Malaysia (BNM), the significant rise in healthcare costs in the country is driven by factors including advancements in medical technology and the increasing prevalence of non-communicable diseases.

These factors have led to greater demand for healthcare services, with claims paid out by insurers and takaful operators growing faster than the premiums collected.

On December 20, 2024, the central bank stepped to address complaints by Malaysians about steep hikes in medical insurance premiums.

It told insurance and takaful operators to spread out premium increases over a minimum of three years, limiting premium hikes to not more than 10 percent per annum.

BNM also announced that there will be no increase in premiums for 2025 for individuals aged above 60, and that any increase can only be imposed after their policy anniversary in 2026.

During the tabling of Budget 2026 on Oct 10, Datuk Seri Anwar Ibrahim outlined additional measures that the government is taking to address rising medical inflation.

They include RM60mil in joint funding from the Government and the private sector to introduce affordable basic insurance products for all Malaysians.

On Oct 11, BNM issued a statement saying that the design of the base medical and health insurance/takaful product is expected to be finalised by the end of this year, with a view to launch in 2027.

In his budget speech, the Prime Minister said a Diagnosis Related Group (DRG) payment model would also be implemented.

A DRG framework will standardize and make healthcare payments more transparent, so patients are not overcharged.

Billing will be based on defined categories such as diagnosis, procedure and complications.

In August, the Health Ministry had said that the DRG is expected to launch in 2027.

To encourage greater insurance participation, Anwar in his Budget 2026 speech said the personal tax relief of up to RM3,000 for life insurance or takaful premiums for individuals and their spouse would be extended to cover their children.

ADVERTISEMENT

ADVERTISEMENT