KUALA LUMPUR: Revenue generated from cryptocurrency-related activities in Malaysia, including trading, mining, and exchanging, is taxable income under Section 4 of the Income Tax Act 1967, says the Finance Ministry.

The ministry explained that digital currencies are classified as commodities and therefore fall under business income.

This rule is in line with international tax practices, and the Inland Revenue Board (IRB) has already issued guidelines clarifying the tax treatment of cryptocurrency transactions, including taxation on income derived from them.

In a written reply uploaded to Parliament’s website for August 28, the ministry further noted that digital services provided by local service providers have long been governed under the Service Tax Regulations 2018.

Since January 1, 2020, digital services offered by foreign providers to Malaysian consumers (business to consumer) have also been subject to service tax.

“This measure aims to broaden the tax base and ensure consistent tax treatment between local and foreign service providers.

“Accordingly, cryptocurrency trading platform services, whether provided by local or foreign suppliers, must pay service tax in accordance with the relevant service classifications and conditions.”

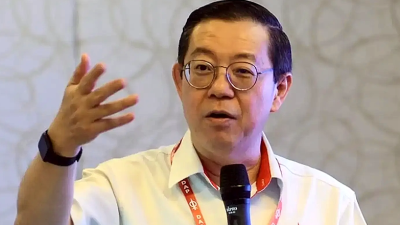

Bagan Member of Parliament Lim Guan Eng asked why international cryptocurrency platform Luno Malaysia reportedly generated RM254 million in revenue between 2019 and 2024, yet only paid RM3.8 million in taxes.

The Finance Ministry clarified that corporate tax is not calculated solely based on gross profits, but after deducting allowable expenses and specific tax incentives, before applying tax to the chargeable income.

“Any company’s or taxpayer’s actual tax payments are highly confidential information protected under Section 138 of the Income Tax Act 1967.

“This confidentiality provision aligns with international practice and is intended to maintain taxpayers’ confidence in the filing process.,” it said.

The reply to Lim also stated that Luno Malaysia was registered with the Companies Commission of Malaysia in 2015 and received approval from the Securities Commission in 2019 to offer cryptocurrency trading and storage services, including Bitcoin and Ethereum.

The company has also introduced “Islamic staking” products in compliance with Shariah law.

ADVERTISEMENT

ADVERTISEMENT