The recent appreciation of the ringgit has brought a sigh of relief to many Malaysians.

While the weakening of the US dollar is significant, the ringgit’s remarkably strong performance in Q3 2024 suggests that factors beyond the dollar’s depreciation influence its rise.

Regarding the dollar, it has tanked since the Federal Reserve’s FOMC statement on July 31, 2024.

Although the interest rate was held steady at that time, Fed Chair Jerome Powell indicated that while no decisions had been finalised regarding future actions, a rate cut could be considered as early as the next meeting in September, contingent on continued signs of easing inflation.

This statement served as a clear signal to the markets that the Fed was contemplating a policy shift.

The USD weakened further after an unusually large 0.5% interest rate cut on September 18, 2024, along with indications that additional rate cuts are on the horizon.

Although the prospect of further interest rate cuts by the Fed is already largely factored into market movements, with Fed officials forecasting the US interest rate to drop to 3.4% by the end of 2025 (“The ‘dot plot’ signals rate cuts this year”, The New York Times), this rate remains still significantly higher than it was at the start of 2022 before the hikes began.

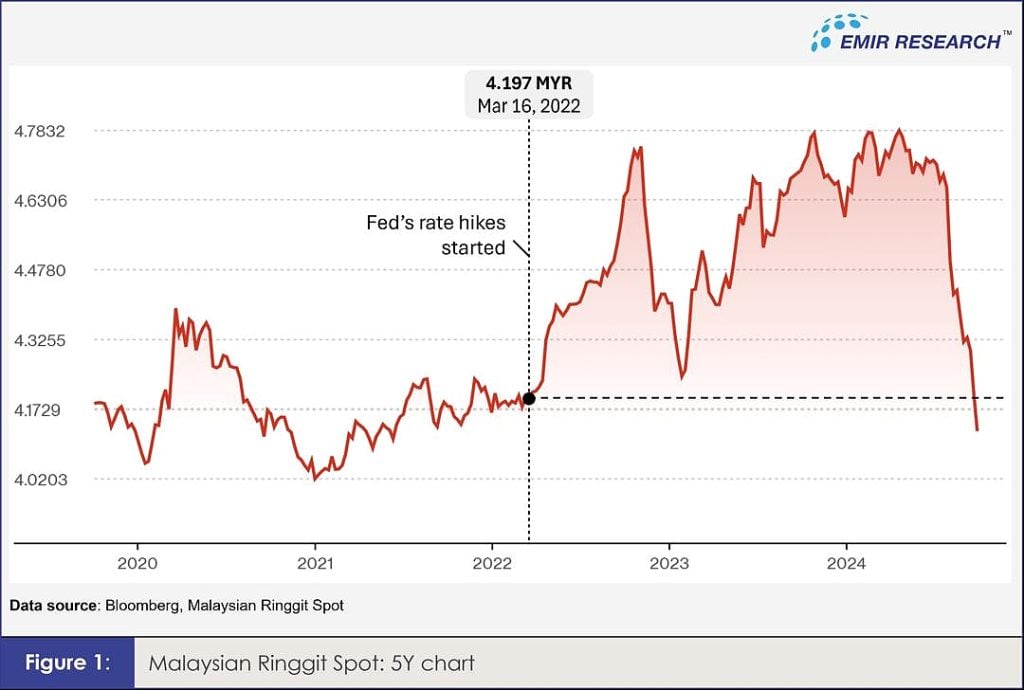

Despite this, the ringgit has not only retraced all its losses since the interest rate hikes commenced in 2022 but has also inched beyond those levels (Figure 1), indicating that there is certainly more to the story of ringgit strength.

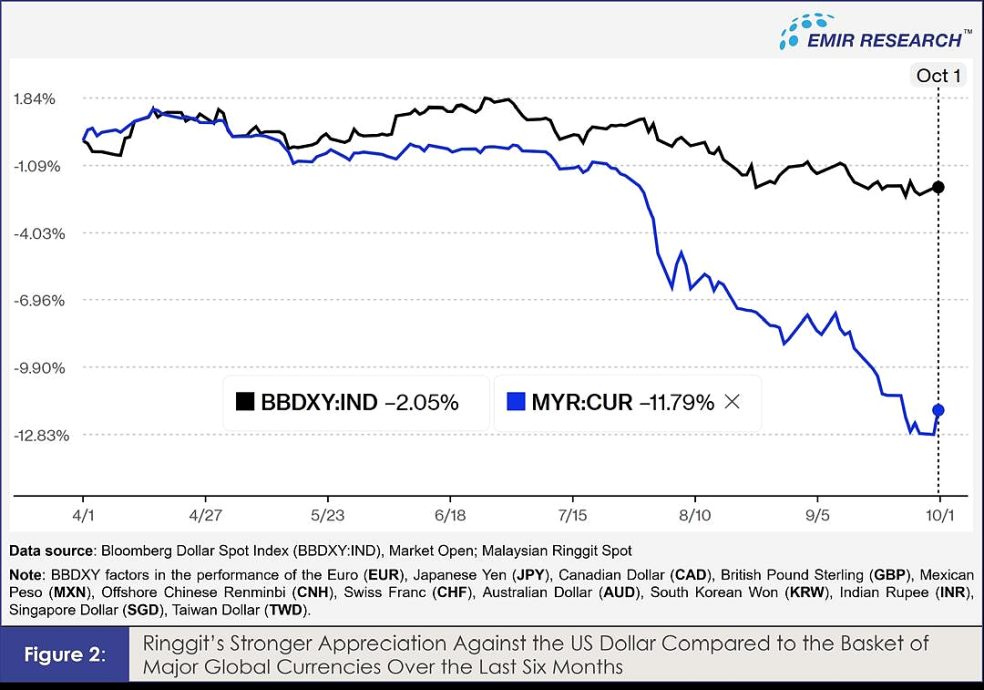

Notably, over the past six months, the ringgit has appreciated against the USD more significantly than other regional and leading global currencies.

This trend is evident when comparing the ringgit’s performance to the Bloomberg Dollar Spot Index (BBDXY), which tracks a large basket of major global currencies, including those from Asia, against the USD (Figure 2).

Additionally, the ringgit has strengthened against most regional currencies.

Such a stellar performance must be underpinned by more than mere repatriation of earnings by Government-Linked Companies (GLCs) and Government-Linked Investment Companies (GLICs), as has been resonating in recent local reports, because while this strategy can help mitigate further depreciation, it is insufficient on its own without strong economic fundamentals and other comprehensive efforts.

Undeniably, Malaysia’s economy experienced robust growth in H1 2024, as evidenced by the Gross Domestic Product (GDP) figures.

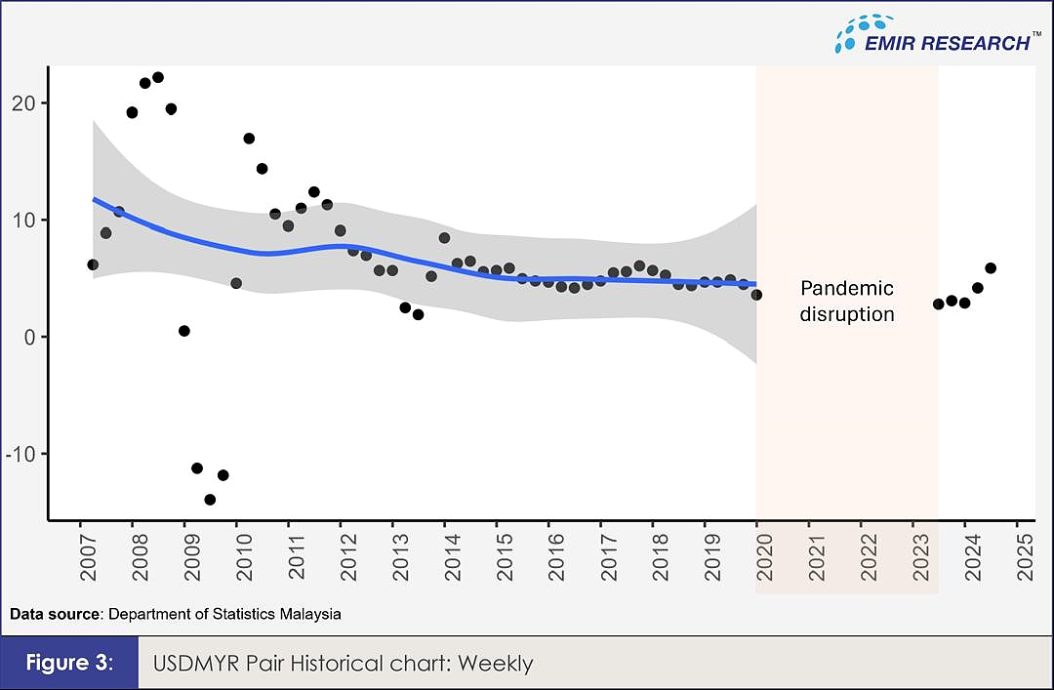

Remarkably, excluding the COVID-19 pandemic plus one year period, which presents incomparable data due to extreme year-on-year variations, Figure 3 reveals that recent economic growth has not only been notable but, for the first time, has surpassed the pre-pandemic trend of long-term steady economic decline!

Additionally, the 2.4% quarter-on-quarter real GDP growth in Q2 2024 significantly exceeded the historical average of 1.1% for Malaysia since 2013 (excluding pandemic data).

These observations suggest potential underlying structural changes in the economy, further supported by solid inflows of Foreign Direct Investment (FDI).

According to the Malaysian Investment Development Authority (MIDA) report, approved foreign investments amounted to RM 74.6 million in the first half of 2024, representing a 16.7% increase over the same period in 2023.

The services, manufacturing, and, notably, agriculture sectors were the primary drivers behind Malaysia’s stronger-than-expected economic growth in the first half of 2024.

In particular, the retail service sector experienced substantial growth during this period.

The marked influx of tourists to Malaysia, totalling 11.8 million in the first half of 2024 and nearing pre-pandemic levels based on month-on-month comparisons in June, as per Malaysia Tourism Statistics, has significantly contributed to the country’s economic dynamics.

This surge has not only bolstered the ringgit and generated substantial revenue but has also potentially created numerous jobs in hospitality and related industries, including retail trade, accommodation, restaurants, and communications.

The decision to grant temporary visa-free entry to citizens of China and India at the end of 2023, along with other comprehensive measures to attract high-value tourists, as emphasised by EMIR Research in “Seizing opportunities to support sliding ringgit,” has proven to be a prudent and timely move.

Malaysia’s trade performance has also been steady into the H1 2024.

This trend will likely continue, bolstered by robust global demand and a potential increase in commodity prices driven by the weakening USD, especially in the context of the still complex global geopolitical situation.

Important levels to watch in the near term

The USD Index (DXY) might have found its intermediate bottom.

While further significant weakening remains possible, particularly due to the mounting global trust deficit towards the USD—driven by rising US national debt and sanctions policy—the index might begin consolidating in the fourth quarter of 2024.

This period could witness more uncertain and sideways movements, influenced by headlines related to the US election.

Currently, the DXY bounced again from the significant psychological level at 100.00 and the 200-day Simple Moving Average (SMA) line.

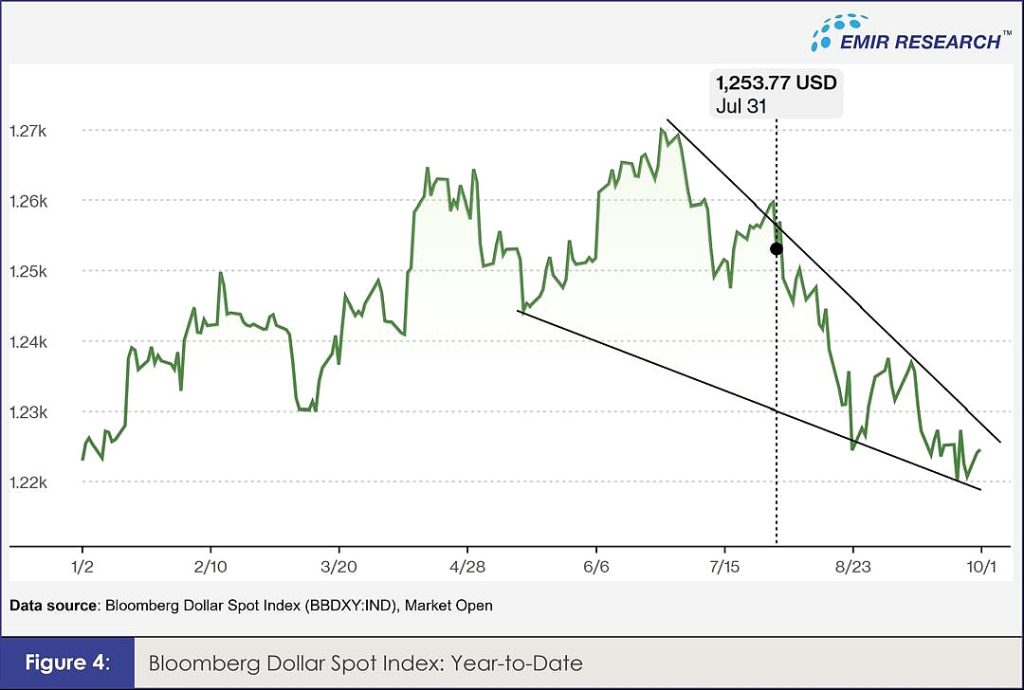

Furthermore, the BBDXY index, which provides a significantly broader perspective than the DXY by encompassing a substantially larger basket of major global currencies, exhibits a falling wedge formation pattern on its year-to-date chart (Figure 4).

This pattern suggests that further USD weakening might be limited over the medium term, and a potential correction could occur, which may exert some pressure on the ringgit.

Among the external factors supporting Malaysia, aside from USD weakness, is the growing investor confidence in the region, driven by China’s central bank introducing broad monetary support and measures for the property market.

This has led to a rally in both Chinese stocks and the yuan.

Consequently, other Asian currencies closely linked to China, such as the ringgit, have also benefited from these developments.

This effect may be further amplified by the perceived current/relative political stability in Malaysia, especially in contrast to the challenges to democracy and political stability faced by other countries in the region and globally.

Combining the above economic and political factors with technical analysis, the USD/MYR exchange rate is expected to remain within the 4.10 – 4.40 range during Q4 2024.

The 4.10 level represents the bottom of a long-term channel established since 2016 (Figure 5).

Meanwhile, the 4.40 level corresponds to the confluence of the 50% Fibonacci retracement of the pair’s sharp rally since late July 2024 and the 200-day Simple Moving Average (SMA).

If the ringgit continues to strengthen due to favourable fundamental factors and further sound local structural changes, it may retest the bottom of the channel (seen in Figure 5).

Should this level be breached, it could pave the way for the ringgit to reach the next significant psychological and Fibonacci extension level at 3.8, perhaps even in the 1H 2025.

Nevertheless, it is crucial to monitor economic indicators and policy decisions from both the US Federal Reserve and Bank Negara Malaysia, as these can cause sudden shifts in the exchange rate, potentially disrupting long-established patterns.

However, what remains clear is the importance of leveraging this opportune moment to maintain investor confidence in Malaysia.

This can be achieved through stable monetary policy, at least through Q4 2024 and Q1 2025, and more importantly, through continuous and deepening structural reforms!

The GDP growth might be there. However, it will take time for structural changes to start being felt by the average Malaysian, rather than merely top corporates, in line with Madani’s vision, in the form of more sustainable living costs, higher-paying jobs and greater quality of life.

(Dr Rais Hussin is the Founder of EMIR Research, a think tank focused on strategic policy recommendations based on rigorous research.)

ADVERTISEMENT

ADVERTISEMENT