Over a year ago, Malaysia decided to transition from a Single Wholesale Network (SWN) to a Dual Wholesale Network (DWN) model for 5G, lauded by global industry experts as a step towards a more efficient and competitive 5G landscape.

However, progress has stalled once again.

With 5G technology expected to dominate globally by 2028, now is the time for the government to accelerate the DWN deployment to break the monopoly and align Malaysia with global trends.

The transition to a DWN was to begin once Digital Nasional Berhad (DNB) achieved 80 per cent 5G coverage of populated areas (COPA), reportedly reached on January 10, 2024.

However, with less than a quarter of 2024 remaining, there have been no definitive updates on the transition.

Although the current administration is determined to steer away from the monopoly, intensified campaigns to maintain the 5G SWN status quo persist.

Therefore, it is essential to remind the public why the crucial decision to build a second network was made.

Given its significant implications, EMIR Research (ER) has taken Malaysia’s national 5G rollout seriously since the SWN was first announced.

ER has meticulously collected and presented data, empirical facts, global experience, industry technicalities, relevant policy papers, and economic knowledge to the public and policymakers against the nationwide 5G SWN case.

Therefore, these publications, with detailed analysis and well-documented empirical evidence, are referenced below.

It is well established that nationwide SWNs (except in very small nations like Brunei) univocally lead to higher prices, inferior network quality, a crippled telecommunications industry, and ultimately, a diminished ability to fully leverage connectivity for the benefit of people, industry, and society in ushering innovation economy (refer to ER earlier reports Malaysian 5G rollout ‘unanswerable’ questions, Malaysian 5G rollout: camouflaged costing acrobatics, The impeding failure of good intentions – DNB’s 5G rollout in two parts and the compilation of the SWN case studies Single Wholesale Network: Global experience).

It’s interesting to observe the outcomes of Rwanda’s decision to end the “unsustainable” SWN model, which “makes the broadband market one-sided, yet none of the operators are operating effectively and efficiently” (refer to The National Broadband: Policy and strategy, p3).

Earlier, ER used Rwanda’s 4G SWN journey as a case study in Malaysian 5G rollout: topsy-turvy innovation.

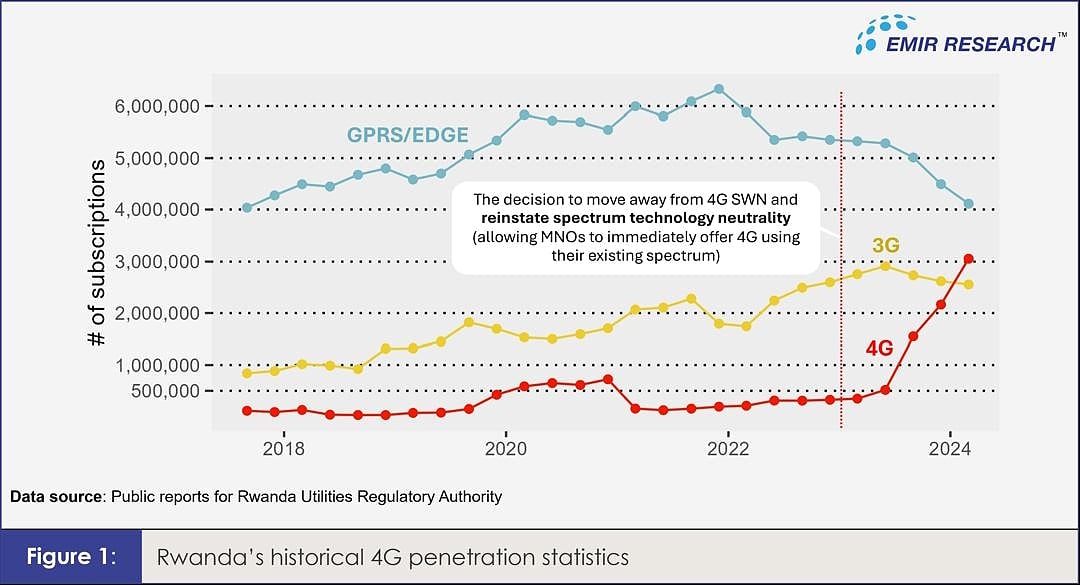

Recently, Rwanda reinstated spectrum technology neutrality, ending KtRN’s 4G monopoly due to high prices and lack of competition, which had stalled 4G adoption. Figure 1 speaks better than any words.

During the 4G monopoly, Rwandan MNOs were blamed for high 4G prices despite promises of lower costs under SWN.

MNOs argued they earned almost nothing from some packages due to wholesale prices paid to KtRN.

The situation did not improve significantly even after KtRN reduced the wholesale price by 30 per cent in 2016.

Malaysian policymakers should consider whether MNOs are to blame for the “DNB tax,” where MNOs charge RM5 to RM20 per month to access the national 5G network, merely packaging it differently.

After all, SWN has delivered on at least one promise—innovative service repackaging.

They say, doing the same thing and expecting different results is the definition of insanity.

Besides dwarf states, SWN could be a geographically focused solution for rural areas, given sufficient nationwide dark fibre coverage, as seen in the UK and New Zealand.

However, this approach contrasts significantly with our model (refer to Malaysian 5G rollout: digital divide whitewash).

Furthermore, government ownership exacerbates SWN’s negative impacts, leading to deadweight loss like other forms of government spectrum monetisation.

In economics, deadweight loss refers to the loss of societal and economic welfare when marginal benefit does not equal marginal cost due to interventions.

Analysis using “order of magnitude” estimates shows that spectrum monetisation (of which, again, Malaysia’s 5G “innovative” “supply-driven” SWN model is an extreme case) creates a more significant deadweight loss to social welfare than general taxation.

For a deeper understanding, readers should refer to Malaysian 5G rollout: Spectrum Economics & deadweight loss.

This analysis also reveals, through careful data unpacking, that claims by SWN proponents blaming Malaysia’s MNOs for “exorbitant prices” and “poor quality” are blatantly false (also refer to Malaysian 5G rollout: bending the truth like no other).

As of 2019, just before the 5G SWN saga, Malaysia was ahead of most regional peers and other middle-income nations globally in mobile internet quality and affordability.

The country could have performed even better if not for a history of excessive spectrum monetisation and deadweight loss by previous administrations, culminating in the grotesque 5G SWN.

It’s even more grotesque how, after the above thick empirical evidence, SWN proponents frame the government’s decision to avoid a national fiasco as a “decision made for geopolitical interests.”

Perhaps they mean themselves? Over-relying on one equipment supplier for critical national infrastructure fits the definition of a “decision made for geopolitical interests”—not ours, but the West’s (refer to Malaysian 5G rollout: FDI promissory trap for perspective).

In sum, the awkwardness of our 5G SWN was apparent from the start.

Over time, it became glaringly evident that the only credible way forward is for the government to fully divest its share in DNB.

Understandably, the government didn’t want to disrupt achieving 80 per cent COPA, though the significance of this milestone remains highly questionable.

Previously, it was widely cited with much fanfare that, according to Speedtest Intelligence data in Q3 2023, Malaysia was ranked 3rd globally for 5G download speed, with a reported speed of 485.25 Mbps, “significantly ahead of its Southeast Asian neighbours”, such as Singapore (338.36 Mbps), Thailand (141.65 Mbps), and the Philippines (124.58 Mbps), making Malaysia’s “unusual” 5G rollout model look like a miracle.

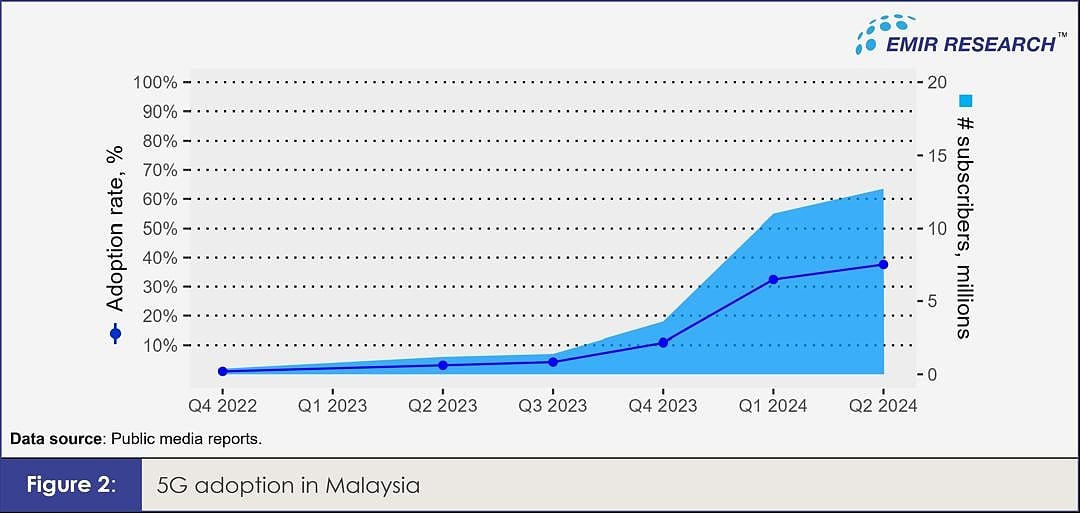

However, it was omitted that this number hinged on a very low customer base (around 4 per cent adoption rate at the end of Q3 2023) and light network load, which grew substantially during Q4 2023 – Q2 2024 (Figure 2).

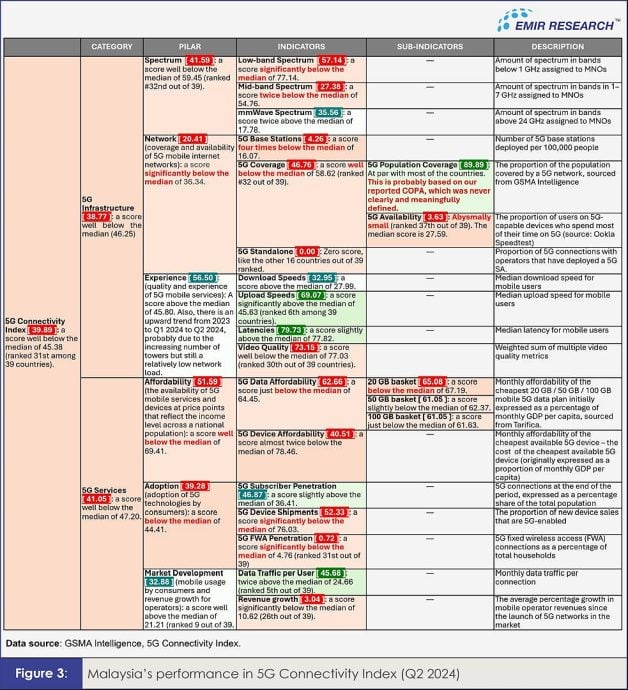

A more recent 5G Connectivity Index (5GI), a multi-dimensional comparison of 5G performance, including spectrum allocation efficiency, network densification, adoption, network experience, and affordability, clarifies the situation.

Updated Q2 2024 data shows Malaysia’s performance as not just mediocre but outright worrisome (31st among 39 countries) (Figure 3).

This 5GI dataset shows that despite substantial public funds spent, our current 80 per cent COPA is essentially meaningless.

Malaysia ranks 33rd out of 39 countries for 5G base stations per 100,000 population, with a score of 4.26 out of 100 (global median is 16).

Additionally, Malaysia ranks 37th in 5G network availability, indicating a severe insufficiency of 5G towers.

We should be concerned. If the SWN monopoly isn’t opened soon, the growing subscription base will reveal the insufficiency of cell sites, resulting in service not much better than 4G.

Importantly, this meaningless COPA (81.9 per cent, as of July 2024) is achieved with about 7,500 towers, many newly built by DNB, compared to around 48,000 jointly owned by major MNOs already largely 5G-enabled.

In fact, reportedly, most Malaysian MNOs began significant investments in making their sites 5G-ready in early 2019, and if global best industry practices were followed, Malaysians could have had 5G access as early as 2020, similar to other leading 5G nations (see Malaysian 5G rollout: Spectrum economics & deadweight loss).

This highlights significant public funds and time wasted over at least four years.

Nevertheless, we must avoid the “sunk-cost trap”—overvaluing past costs irrelevant to future decisions.

Instead of thinking, “We’ve come this far to stop now,” we should ask, “How much more can we afford to lose by not making a credible change?”

Notably, SWN proponents themselves no longer insist that this project does not compromise the rakyat’s money.

As it suits their new narrative better, they now acknowledge that a 35 per cent government stake in DNB directly implicates taxpayers’ money.

However, it is already public knowledge anyway that this project’s entire infrastructure was built using public funds.

Therefore, the most efficient way forward involves, first, the government completely relinquishing its share in DNB, ensuring public funds are no longer involved!

Mobile internet quality is best controlled through healthy, infrastructure-based competition (MNOs’ job) and stringent regulation (government’s job).

Additionally, the exorbitant 200 MHz spectrum block that DNB holds must be re-assigned immediately and efficiently to develop multiple networks. No MNO in the world needs more than 100 MHz for 5G!

Next, if there is a private entity X willing to take over DNB’s assets for wholesale-only business, it should not be an MNO. MNOs should then be allowed to develop their networks with re-assigned 5G spectrum.

However, finding an entity X is highly unlikely, given the high liabilities inherited.

On the contrary, MNOs have already demonstrated their readiness to take over DNB’s assets and liabilities.

Allowing them to restructure DNB’s assets and develop DWN as well as immediately embark on meaningful 5G network densification (as many of their base stations are already 5G-ready) is more efficient.

This pathway also optimises the use of valuable spectrum.

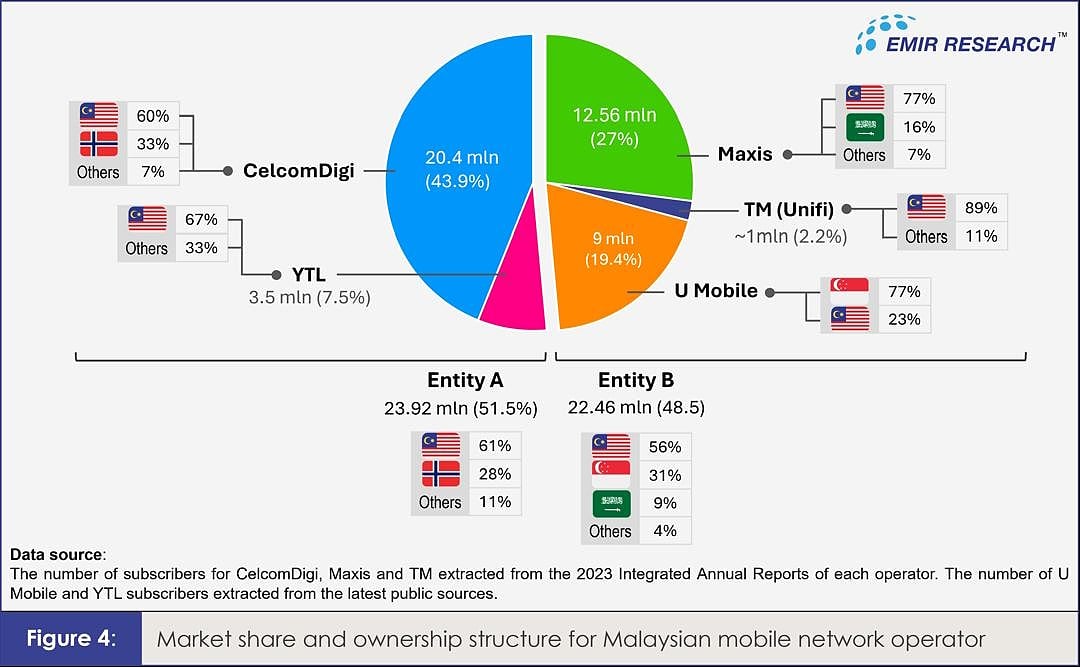

However, MNOs must be divided between entities A and B to ensure healthier competition and governance.

There should be a balanced market share and a mix of foreign and local ownership in each entity. Figure 4 illustrates this optimal combination.

Finally, for the most efficient spectrum and other industry resources use benefiting many Malaysians, spectrum technology neutrality must be reinstated immediately.

This alone would end SWN overnight, providing an immediate pathway to improve 5G connectivity despite resistance from parties clinging to the SWN status quo and compromising national interests!

(Dr Rais Hussin is the Founder of EMIR Research, a think tank focused on strategic policy recommendations based on rigorous research.)

ADVERTISEMENT

ADVERTISEMENT