The currently ongoing BRICS Summit, which commenced on 9 September 2024 in Sochi, Russia, must prioritise the development of solid strategies to expedite the transition away from reliance on the United States dollar.

Donald Trump’s 100% tariff threat to protect the dollar’s global status, despite its absurdity, underscores not only the toxicity of this currency but also the critical importance of diversifying and deepening trading relationships with more reliable partners and robust platforms.

Unfortunately, bilateral trade in national currencies may impede the deepening of economic ties among BRICS countries. Hence, establishing an alternative medium of exchange is both essential and urgent.

In its earlier publication, “Navigating the BRICS Storm: Separating Signal from Noise,” EMIR Research detailed how the popular consortium BRICS, now BRICS+, has emerged as an incredibly attractive alternative economic cooperation model for mutually accelerated growth.

The sudden surge in membership requests to the group indicates the high hopes that the Global South-East community places in it.

Viewing BRICS as a “locomotive” or “avant-garde” of the global neo-economic and governance model, hopes run high for various economic solutions, including the crucial task of establishing a “BRICS currency.”

The group members themselves recognise that this solution should not be a mere direct alternative to the dollar but rather a qualitative step forward from an ineffective financial system to a more equitable one.

Aligned with the BRICS philosophy, it must bolster the global position of member states without compromising their sovereignty, in stark contrast to Western platforms.

The discussion around the “BRICS currency” initially sparked at Valdai 2018.

However, recently, rhetoric has shifted, and BRICS policymakers are discussing the creation of a payment mechanism, which is a crucial distinction, as we shall see shortly.

Economic asymmetries between BRICS countries, although natural, can hinder the deepening of economic trade within the bloc when it is conducted in national currencies.

Countries with trade surpluses will accumulate monetary assets in the currencies of deficit countries, which are largely inconvertible and often depreciate.

Consequently, surplus countries will be reluctant to exceed certain limits in such arrangements, thereby constraining trade.

Furthermore, when a national currency becomes significant in international trade, and its volume abroad increases, the issuing country partially loses control over its exchange rate and interest rates.

Stable demand for the currency will increase cash inflows, potentially causing inflation. To combat this, the central bank may raise the key rate, restricting economic growth.

Therefore, creating a universal medium of exchange within BRICS is crucial, although not a trivial task, especially when seen from conventional Western perspectives.

Obviously, creating a “single currency” in the full sense of the word is out of the question.

Transitioning to a single currency, like the euro, for nations across continents with varying economic development, structures, and balance of payments presents more challenges than benefits, particularly in choosing a unified fiscal and monetary policy that is equitable for all.

Allocating one of the BRICS currencies for settlements is also impractical, as it involves a significant political decision—not all BRICS members would agree to, for instance, the Chinese yuan serving this role.

This approach fails to address the core issue of the current system, essentially creating another dominant power like the US.

Moreover, China would not agree to become the new America, constantly running a trade deficit.

The drawback of the above two options is essentially the same: in the former, all countries lose sovereignty over their monetary policy, while in the latter, only one country does.

Meanwhile, preserving the sovereignty of member states is exactly the central attraction of the BRICS platform.

This is why BRICS gravitate towards introducing a supranational composite currency (based on a basket of BRICS currencies, similar to the IMF’s Special Drawing Rights or SDR). But this, too, is easier said than done.

The key stumbling block is viewing the proposed unit of exchange as intrinsically valuable, rather than recognising that money is merely a record of value by which, not for which, the real value is exchanged.

It is baffling how this notion still escapes us in the digital economy age, especially when Distributed Ledger Technology, capable of immutably recording value exchange globally, has been available for decades!

Therefore, another overlooked solution, though not without its challenges, is worth exploring by BRICS: a mutual credit clearance (MCC) system.

The MCC is not a new concept but a well-proven one. The most famous example is the Swiss Economic Circle Cooperative (Wirtschaftsring-Genossenschaft or WIR).

More recent examples include Belgium’s RES Corporate Barter, Italy’s SARDEX and Uruguay’s and Brazil’s Commercial Credit Circuit (C3).

The term “clearance” refers to “the process by which claims among a group of participants are netted-out” (Greco, 2009, 2024)—ultimately, within the MCC system, parties who routinely trade with each other pay for their purchases with their own produce.

However, it is crucial to clarify that this is not a barter system and does not encounter the “multiple coincidence of needs” problem.

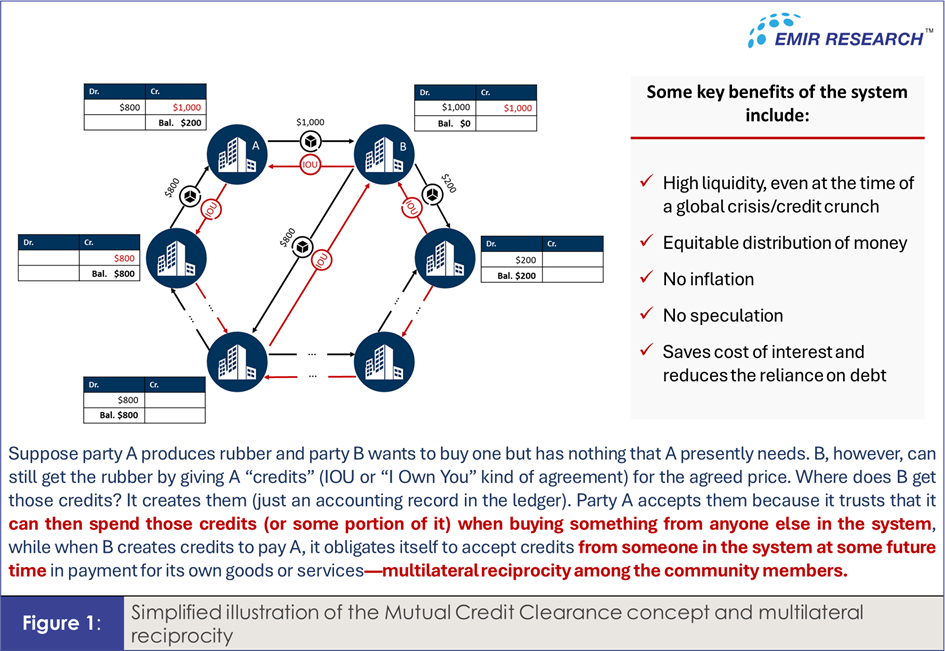

The clearing or netting process occurs not simply between two participants but on a reciprocal basis between each participant and the entire community—multilateral reciprocity (explained in Figure 1), a concept well understood by anyone familiar with Fintech.

Figure 1 provides a simplified example; in reality, the chain of transactions would be significantly longer and more intricate.

The attractiveness of the MCC ring grows exponentially with the number of participants, especially when they produce a diverse range of goods and services covering all segments of the supply chain—a typical network effect.

The numerous benefits of this system (some listed in Figure 1) merit a separate discussion. However, it is beneficial here to contrast MCC with a basket currency mechanism.

Under the basket currency arrangement, a key question remains: who will be responsible for its issuance? An emission bank, operating independently of BRICS national central banks, is clearly necessary.

However, how will it determine the amount of currency to issue? If based on the size of trade operations between countries, the MCC performs this exact function automatically.

Within the MCC circle, any party’s ability to issue credit is conceptually (and can be operationally) limited by its ability to supply something of value demanded by other members.

Under the currency basket, the shares of individual BRICS currencies would reflect the relative weights of their economies.

However, how will this be determined? By Gross Domestic Product (GDP)?

GDP is a problematic indicator, especially for developing countries, as it does not adequately reflect the real economy (resource- and commodity-rich).

However, if it is to be determined by the size of trade operations between countries, then, again, MCC achieves this more organically!

While a currency basket may reduce the volatility risk of individual BRICS currencies by averaging exchange rate fluctuations across different market trends, the issue of trust in this unit remains.

For trust to exist, all countries must recognise the new international currency, which ultimately hinges on its convertibility into something of universal value.

The gold option is unfeasible, especially under a basket currency scenario, as it would require BRICS countries to maintain high gold reserves (unless a netting mechanism is involved, which is possible under MCC).

Additionally, highly volatile gold prices are problematic for convertibility.

Backing the new currency with another commodity or even a basket of commodities would have the same drawbacks.

Making this unit convertible into international liquid currencies, although not impossible, undermines the project’s very purpose—a currency created as an alternative to the dollar is freely convertible into dollars, euros, and yen?

MCC mechanism overcomes these challenges: a universal (within the MCC circle) unit of exchange is essentially backed by its members’ collective ability to produce mutually beneficial goods and services, which can grow in diversity and complexity over time.

What better way to promote mutual growth and development?

After all, the prospective BRICS payment mechanism or unit of exchange is to promote trade within the group!

Therefore, why worry about its “international reserve” status? MCC naturally encapsulates a very fair principle: only those who produce can spend!

The accumulation of individual currencies as reserves can continue outside MCC, with countries not covered by BRICS+ or BRICS outreach, those not independent producers of value (which is rare and unlikely), or both.

Perhaps the BRICS MCC could encourage more countries to cooperate with BRICS+ and discover their true international trade potential.

Importantly, under MCC, all BRICS countries retain monetary sovereignty, and trade surplus countries can deepen trade without additional inflationary pressure.

One approach to valuing a “unit of exchange” in MCC is gold weight, which remains stable over time as a ratio of goods and gold prices, which both grow in the long term.

This can stabilise prices in BRICS trade, stimulating mutual growth and development.

Overall, the MCC concept warrants serious attention from BRICS architects, as it can effectively multilateralise bilateral trade.

Additionally, the success of earlier MCC systems worldwide provides valuable insights for BRICS in developing its own model.

Notably, the MCC is well-suited to supporting local communities of small and medium enterprises, a key focus area for BRICS and a potential good starting point for developing BRICS global MCC.

It is important to note that earlier MCC-based systems were often undermined by those in control of the existing international banking system.

However, this presents little concern for a group that already operates largely outside that framework and seeks to further distance itself from it, promoting more fairness and balance in the world.

(Dr Rais Hussin is the Founder of EMIR Research, a think tank focused on strategic policy recommendations based on rigorous research.)

ADVERTISEMENT

ADVERTISEMENT