PETALING JAYA: Capital protection is more important than a higher return for investments by Employees’ Provident Fund (EPF), say local economic experts.

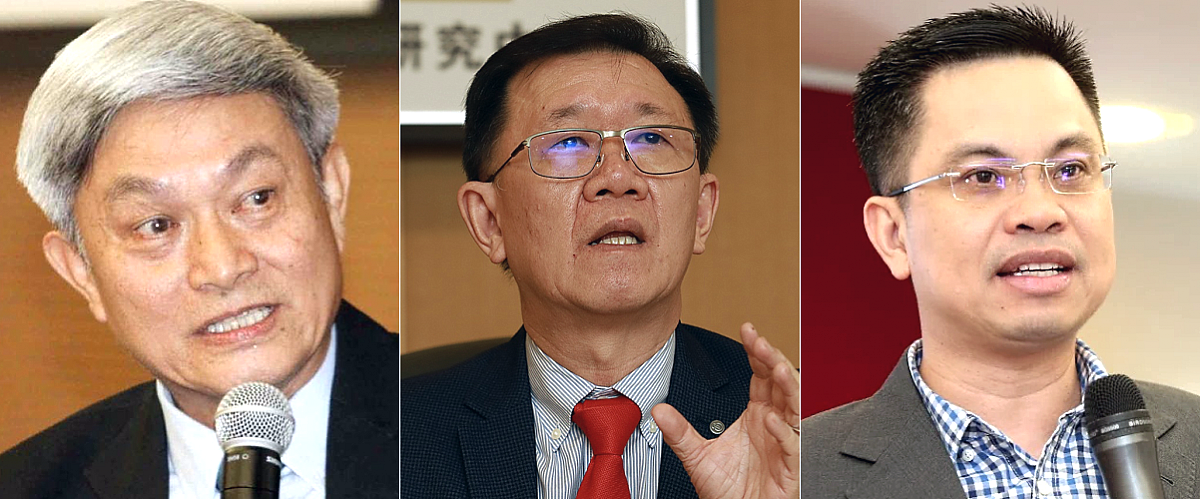

Both Dr. Yeah Kim Leng, Professor of Economics at Sunway University Business School, and Datuk Chua Tia Guan, Head of Tax & Financial Consulting of Asia Business Center, concurred that capital protection is more important for EPF as a retirement fund.

Taking into consideration the country’s economic growth and EPF’s performance last year, Dr. Yeah said the 5.5 percent dividend rate declared for 2023 by EPF was acceptable, as it was still higher than 5.35 percent for 2022.

Both agreed members of the public ought to understand that EPF’s dividend declaration was made based on its returns in cash and not paper profit.

Lee Heng Guie, Executive Director of Socio-Economic Research Center (SERC) under the Associated Chinese Chamber of Commerce and Industry Malaysia (ACCCIM), said the declaration of dividend by EPF in the range of 5 to 6 percent would be determined by the performance of its investment.

“Overall, apart from the share market, EPF made good returns in its investment overseas, especially in the US and other markets,” Lee said.

“Returns from the bond market were good too. Coupled with the depreciation of ringgit, members of the public have expected the dividend rate to be much higher than that for the previous year,” he said.

Chua, meanwhile, pointed out that the local stock market index shrank 2.7 percent last year, and the 5.5 percent dividend rate declared by EPF for 2023 was therefore reasonable.

He urged members of the public to view the returns in a rationale manner.

A statement by EPF saying its investment returns for the first nine months of 2023 grew 33 percent could have painted a wrong impression among the public.

EPF would not be too aggressive in its investment strategy by allocating all its funds for high risk investments, he said, adding that EPF has a combination portfolio comprising low and high risk investments to balance the risks, he said.

“Even when the share market is doing well, EPF members should not expect a similar returns rate as the share market.

“For now, the share market performance is only moderate,” he said.

Under Section 27 of the EPF Act 1991, guaranteed minimum dividend rate is 2.5 percent per year on members’ savings, and members are guaranteed to receive the minimum dividend rate in any situation.

ADVERTISEMENT

ADVERTISEMENT