There has recently been a spate of announcements and opinion pieces in the mainstream media supporting the re-introduction of the Goods and Services Tax (GST) that was repealed in June 2018.

This option is touted as the most sensible and responsible thing to do as the federal government deficit has ballooned to about RM100 billion a year, and total federal debt (not including contingent liabilities) now stands at about RM1.2 trillion.

The proponents of the GST argue that in addition to reducing the federal government deficit, the GST will help convince investors that the government is being fiscally prudent and that this will lead to a greater inflow of investments into the Malaysian economy.

The PSM begs to disagree. We campaigned strongly against the GST in 2011–2013 because it is a regressive tax, and nothing has happened in the past ten years to alter that fact.

For the poorer sectors of society who spend almost all their income, a 6% GST tax rate consumes 6% of their income.

For the richest layers of society who save or invest half of their income, a 6% GST rate only consumes 3% of their income.

Consumption taxes like the GST affect the income of the poor proportionately more than the income of the richer layers of society. That’s why it is termed a “regressive” tax.

We would like the policymakers in government to consider the following realities:

1. One of the biggest challenges facing our country is that we are unable to share the growing wealth of the nation equitably.

Our GDP has grown about 23-fold in real terms in the past 50 years, but the median wages of factory workers in real terms are only 1.4 times what it was 50 years ago. (“Real terms” means after taking into account the impact of inflation).

2. Government revenue has decreased from about 27% of the GDP in the 1980s to its current 13% of GDP.

The over-liberalization of the global financial architecture (reinforced by various “Free Trade Agreements”) has forced governments all over the world to reduce their corporate taxes in a desperate attempt to retain investment capital within their countries.

Malaysia, too, has reduced corporate tax from 40% of profits in mid-1980s to its current 24% of profits.

We are in competition with Vietnam and Thailand which are both taxing corporations 19% of profits.

But we must remember that this race-to-the-bottom in corporate tax rates is not ordained from the heavens. It is certainly man-made and by shortsighted men at that! Being man-made it can be, by men, unmade.

3. The lopsided distribution of Malaysia’s national income isn’t some abstract theoretical concept. It has a profound impact on B40 and M40 families, most of whom are drowning in debt, and are forced to work overtime or take on extra work.

It contributes to stress within the family and malnutrition among the children.

Health Department statistics reveal that close to 20% of Malaysian children below the age of 5 are stunted. That means that they are quite far short of the height that children their age should be.

Isn’t 20% quite shocking for a nation that prides itself as standing on the threshold of being a “developed” nation?

Given these facts, any policy that reduces the disposable income of the B40 and M40 must be rejected.

4. There is growing realization all over the world that the failure of richest individuals and corporations to pay their share of taxes is the main reason why the social safety net is fraying in many countries.

It is also the reason why we are unable to commit enough resources to mitigate climate change and switch to renewable energy at a faster rate.

The global minimum 15% tax on large multinational corporations that will be implemented in 2024 is a reflection of that awareness and concern.

We, in Malaysia, should take advantage of this realization to suggest to our ASEAN neighbors that maybe we in ASEAN should stop this ridiculous race-to-the-bottom in corporate taxes.

The rakyat who have chosen this government have a right to expect the government to manage the economy wisely and in a fair manner.

In a situation where the excessive hoarding of national income by the billionaires and the richest corporations is causing budget deficits and ballooning national debt, a responsible government will make plans to address the main cause instead of trying to squeeze an extra RM30 billion from the B40 and M40 who are already hurting economically.

The right thing to do now is to strategize to gradually increase the share of national income going to the B40, the M40 and to the government.

Re-introduction of the GST should not even be considered at this point.

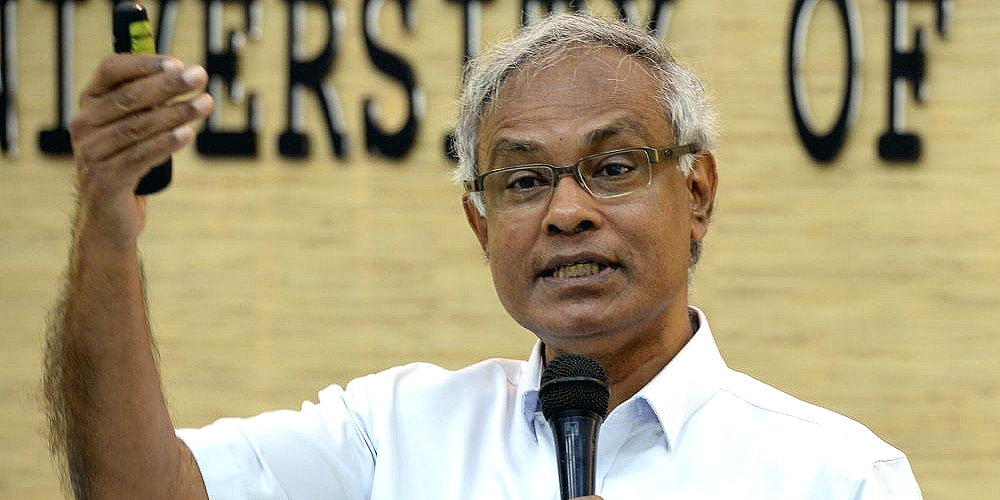

(Dr Jeyakumar Devaraj served as Member of Parliament for Sungai Siput from 2008 to 2018. A respiratory physician who was awarded a gold medal for community service, he is also a secretariat member of the Coalition Against Health Care Privatization and chairperson of the Socialist Party of Malaysia.)

ADVERTISEMENT

ADVERTISEMENT