In parliament on Monday 11 September, Prime Minister Datuk Seri Anwar Ibrahim tabled the mid-term review of the 12th Malaysian Plan originally launched by the Ismail Sabri administration back in September 2021.

Anwar’s announcement highlighted that another RM15 billion will be added to implementing 12MP, thus ensuring high budget deficits over the next two years.

What hasn’t been reported widely, perhaps because all the details haven’t been thoroughly digested yet, is that there will be a major broadening of the tax base.

The first new tax that will be introduced in the next budget will be a capital gains tax.

In principle, the capital gains tax will be a good tool to assist in redistributing wealth from T20 to B40 in society.

How effective this will be depends on what types of capital gains tax that will be applied upon, the actual tax rates, as well as what will and what will not attract exemptions.

The other major issue with any capital gains tax is how it will be assessed by the Inland Revenue Department (LHDN).

One can expect that local bank disclosure regulations will be strengthened to give the Inland Revenue Department the ability to detect transactions that capital gains tax should be applied.

A capital gains tax is very much needed in Malaysia as there is a growing discrepancy between the incomes of T10 and B40.

It’s yet unknown whether this tax will be applied at the individual or corporate level.

The second tax, the Goods and Services Tax (GST) is now under formal reconsideration once again.

Broadening the tax base is necessary for the government, but this does not mean the extra revenue must be spent on development.

The GST was introduced in Malaysia by the Najib Razak government on 1 April 2015 to make the sales tax system much more uniform, and collect a much higher revenue off consumption.

To keep its election promise, the new Pakatan Harapan government abandoned the GST and reinstated the old sales tax system when it came to power in 2018.

Although abolishing the GST was politically popular, many economists saw the abolishment of the GST as a retrograde move, as the sales tax system could be more easily evaded.

The GST generally captured more transactions, making tax avoidance much more difficult.

Although the GST is better for the government to collect tax at the transaction stage of domestic trade, it is a regressive tax, i.e., the incidence of tax falls more heavily on lower-income groups than higher-incomes groups.

Many feel this is an unfair burden on the poor, relative to the middle- and high-income earning groups in the country.

What will be crucial here is the rate that GST would be reintroduced.

One would suspect the GST rate may be higher than the original 6.0% applied back in 2015. Most likely, any new GST would be re-applied somewhere between 7.5-10.0%.

If the GST is to be re-introduced — and this is highly probable because of fiscal need — then a large basket of goods that low-income groups consume relative to middle- and high-income groups should be exempted from the GST to bring better equity in society.

This was one of the weaknesses when the GST was introduced back in 2015.

As was the case back in 2015, the economy will witness a one-off jump in inflation as the GST is re-introduced.

Broadening the tax base is a necessary move for the government. However, this shouldn’t mean that the extra revenue should be spent on development.

This could even be inflationary at a time, when inflation may become a crucial economic management issue.

Any extra revenue should go into reforming pensions and EPF issues as Malaysia’s population is ageing.

Broadening the tax base shouldn’t be a license to spend more.

The devil is in the detail. One can be rest assured that these details will only emerge bit by bit.

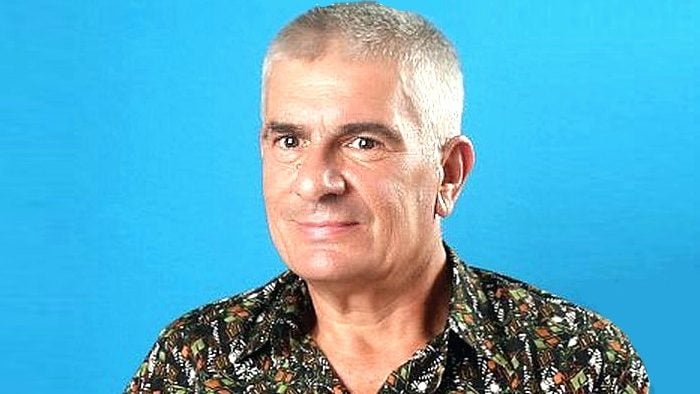

(Murray Hunter has been involved in Asia-Pacific business for the last 40 years as an entrepreneur, consultant, academic and researcher. He was an associate professor at Universiti Malaysia Perlis.)

ADVERTISEMENT

ADVERTISEMENT