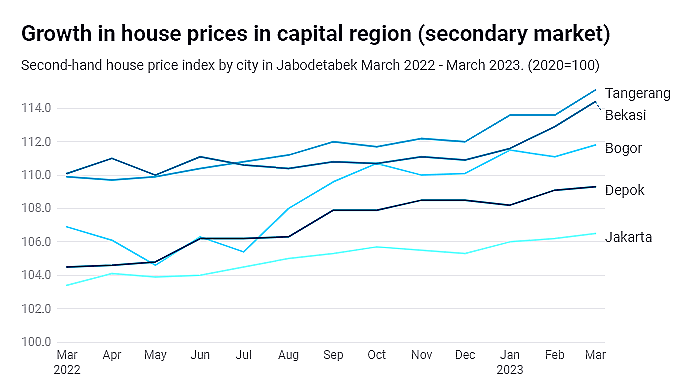

Despite residential property prices having appreciated at a rate much lower than inflation over the past year, a home of their own remains out of reach for most millennials.

State-Owned Enterprises Minister Erick Thohir said last month that 81 million young adults in Indonesia struggled to buy a home.

“According to data from the Public Works and Housing Ministry, there are 81 million millennials of various statuses who have not yet acquired housing facilities,” Erick affirmed when accompanying President Joko “Jokowi” Widodo to the inauguration of a housing estate in Depok, West Java, on April 13, as quoted by Merdeka.

He suggested that a lack of land for residential construction in metropolitan areas was one of the reasons for a generation struggling to buy property.

Millennials have told The Jakarta Post that they also feel burdened by mortgage payments and fear being taken advantage of by real estate agents.

According to Statistics Indonesia (BPS), just 56 percent of Jakarta residents own their homes. That is the lowest rate of any province in Indonesia, followed by Riau Islands (69.39 percent) and East Kalimantan (74.05 percent).

Fahmi Primanda, an account manager for a marketing agency in South Jakarta, is frustrated with his search for a home, explaining that he will face higher transportation costs if he purchases a property outside of the urban area.

“If I lived far from the city, I would spend at least Rp 200,000 [US$13.39] a day traveling to clients’ offices and other places,” said Fahmi, who presently stays in the Kemayoran area.

“A 70-square-meter house in Kemayoran will set you back at least Rp 2 billion [US$134,237] to Rp 3 billion.”

Fahmi and his wife both have full-time jobs, so they value proximity to the city, where his parents live and can help take care of his one-year-old son.

“The long commute would tire me out if the house is far from the city center, for instance in the Cibubur area. If I spent too much time on the road, I’m afraid it would eventually affect my mental health,” he said.

Finance Minister Sri Mulyani Indrawati noted that high prices had kept millennials from buying a home.

“They need [a house], but they cannot afford it. House prices exceed their purchasing power,” she said during the last year’s Securitization Summit.

In 2019, the World Bank found that Jakarta’s house-price-to-income ratio was 10.3, about double that of New York (5.7). The ratio was 12.1 in Bandung and 11.9 in Denpasar.

Mortgages no panacea

Bank Indonesia’s (BI) Residential Property Price Index (IHPR), meanwhile, shows only a mild increase in primary market residential property prices for the first quarter of 2023.

Prices were up 1.79 percent year-on-year (yoy), marking a slowdown from the annual rise of 2 percent in the previous quarter.

BI expects residential property sales in the primary market to decline in 2023 after contracting 8.26 percent yoy in the first quarter, more than reversing the preceding quarter’s 4.54 percent yoy rise.

Non-bank financing remains the primary funding source for residential property development, as 73.31 percent of the capital for housing project development came from internal funds, according to the central bank.

For home buyers, subsidized mortgages under the Home Ownership Credit (KPR) facility remain the go-to financing option, accounting for 74.83 percent of total financing, BI data show.

Having surveyed houses in Serpong, Pamulang and South Jakarta, Fahmi says that, in his current financial state, neither renting nor buying with a mortgage are suitable options.

To be eligible for a KPR mortgage, Fahmi must make a down payment of 10 to 30 percent of the net price of the house, an impossible task at this time, he says.

Meanwhile, renting an apartment would cost him at least Rp 60 million a year; an expense he would find hard to justify: “I don’t think it’s worth spending such an amount of money on something I won’t ever own.”

Also, the narrow corridors and small elevators could trigger his claustrophobia, he added.

Benedo Manuel, a 25-year-old financial planner, explained that home mortgage programs allowed buyers to become homeowners with minimal or no down payment, while the property’s appreciation could balance out administrative fees and other expenses associated with mortgages.

However, there are drawbacks to home loans. In a high-interest market, a borrower with an adjustable rate mortgage could end up paying twice the value of their home, which makes the fixed-rate KPR loans a more attractive option for many.

In any case, Benedo noted, a mortgage was a long-term commitment, and the lender could foreclose should the borrower’s income drop unexpectedly.

“Millennials who do not have permanent jobs, or individuals who are part of the sandwich generation, are vulnerable. Property prices are already out of line with [their] typical salaries,” Benedo said.

He emphasized the need for millennials to get a financial footing early on and recommended cutting back on cafes and the like, the so-called “latte factor,” or on other non-essentials.

“It would be great if they could save 10 percent of their monthly income for a down payment on a house. It would be wonderful if they could save even more than that,” Benedo said.

However, Fahmi concluded: “For me, currently working in sales with a monthly salary of Rp 10 million to Rp 20 million, it’s almost impossible to purchase a house.”

ADVERTISEMENT

ADVERTISEMENT