Two years ago in October, the Pandora Papers leak prompted then Opposition Leader Anwar Ibrahim to request a parliamentary debate to shed light on the exposé.

The shocking story of prominent Malaysians stashing hundreds of billions of ringgits abroad was an important matter, but then Speaker of Dewan Rakyat Azhar Azizan Harun turned down Anwar’s request.

With a new Speaker installed now, the Pandora Papers debate should still be allowed to happen so that Malaysians will realize how serious the matter is.

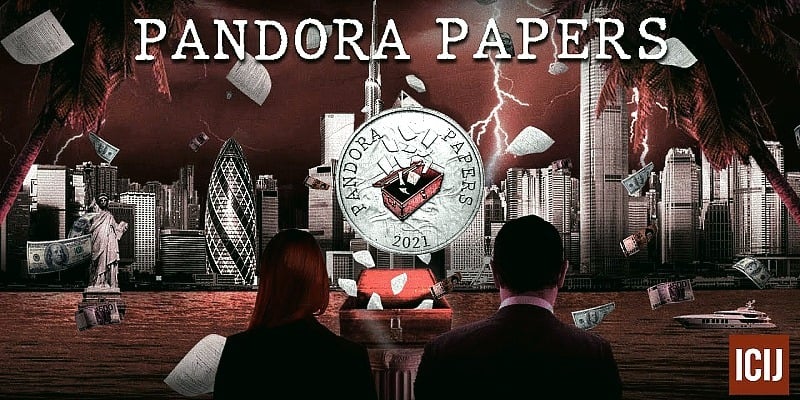

The Pandora Papers is a massive collection of 12 million documents leaked to the International Consortium of Investigative Journalists (ICIJ).

The information came from a number of companies that help customers set up or manage offshore companies in tax havens such as the Cayman Islands, Panama, Dubai and Switzerland. The leak was revealed on October 3, 2021.

Malaysians named in the disclosure include former finance minister Tengku Zafrul Tengku Abdul Aziz, former deputy finance minister Yamani Hafez Musa, Umno president Ahmad Zahid Hamidi, Selayang MP William Leong and former finance minister Daim Zainuddin.

This leak is not just about hidden wealth as it shows how rich people, powerful people, royalty and even corrupt politicians avoid paying taxes.

The leak illustrates how rich people deceive the government because they want to avoid paying taxes.

They have the means and the opportunity to engage middlemen to set up a company so that they can avoid paying taxes.

Poorer people are subjected to the country’s laws, and they have no choice but to cough up the tax demanded by the taxman.

Strictly speaking, the rich are not breaking the law, and there is a fine line between tax avoidance, and tax evasion which is illegal.

Malaysians may not understand why or how the super-rich are able to park their money in offshore tax havens, but they should realize how the government’s treasury is denied the much needed revenue.

They should also question why previous governments have failed to stem the tide of the illegal outflows of money.

When the Pandora Papers were revealed, governments around the world conducted internal investigations, but in Malaysia, the government under Ismail Sabri showed little interest.

This despite the knowledge of a study by Washington-based Global Financial Integrity (GFI) which ranked Malaysia third in illegal outflows in 2015.

The study involved 148 countries, and GFI said the People’s Republic of China was top of the list, followed by Mexico. Malaysia was in third place, followed by Russia.

Unlike the leakage of the Panama Papers in 2016, Malaysia was specifically highlighted in the Pandora Paper due to the involvement of convicted felon Najib Abdul Razak’s close friend Jho Low, in the 1MDB scandal.

A 2020 study by the Economic Cooperation and Development Organization (OECD) reported that at least US$11.3 trillion was held offshore.

Today, Anwar’s Unity Government confirmed that the MACC is investigating prominent individuals on the Pandora Papers list.

A debate will help educate Malaysians on money, taxes and fiscal responsibility.

They may think that the Pandora Papers has little to do with them, but they may be outraged to find that the illegal outflow of money has a huge impact on their lives.

Although tax avoidance is not a crime and those using shell companies to store their money overseas have not broken any law, Malaysians would want the MACC to investigate if the money owned by former ministers and politicians came from government tenders and projects.

There are other reasons too. The Pandora Papers have highlighted the immense wealth gap between the rich and the poor.

Most of us have seen our savings dwindle with runaway inflation making things worse, and we struggle just to keep our heads above water.

However, those people mentioned in the Pandora Papers have lots of choices that include transferring and investing their money overseas. How fair is that?

As a combined twin effect of the coronavirus pandemic and the terrible state of our economy, a sizable portion of the population is living in poverty and struggling to find food, with many shops closed, many items either not available or not for sale.

Malaysians want the government to put an end to tax evasion!

The reason many Malaysians on the list were named in the Pandora Papers is that they do not want to be identified. Many used the security and privacy protection offered by shell companies to keep their ownership of valuable real estate, the acquisition of private jets, yachts and gems, secret.

Back home, they want to cultivate an impression that they are not super wealthy, especially as half the population are starving and struggling.

Essentially, these people who claim to be of humble origins, are hypocrites. The rakyat would be angry when they find out about their wealth.

The Pandora Papers leak have also shown that the tax system is two-tiered. We cannot escape the taxman who may act like bullies. They will hound us for late payment of our personal income tax even if we owe the internal revenue department only RM10 or RM100.

However, the super-rich can whisk their money overseas and avoid paying tax altogether.

Malaysians should also try to think of what our government can do with this money. We can reduce the country’s ever increasing trillion-ringgit national debt and improve our public services.

Sources:

- Malaysiakini: GFI: Malaysia di tempat ke-3 aliran keluar wang haram pada 2015

- Malaysiakini: The art of avoiding taxes

- Malaysiakini: Hidden riches of world leaders, billionaires exposed in unprecedented leak

- Malaysiakini: Guan Eng: Why no MACC, Bank Negara probe into Pandora Papers?

- Malaysiakini: Pandora Papers: PM duty-bound to end offshore financial abuses – Kit Siang

- The Edge Markets: Jho Low, parents enter appearance in US$3.78b 1MDB suit

(Mariam Mokhtar is a Freelance Writer.)

ADVERTISEMENT

ADVERTISEMENT