KUALA LUMPUR: The Malaysian Institute of Estate Planners (MIEP) is proud to announce its proposal for the 2023 Budget in Malaysia, aimed at supporting families and individual taxpayers in the country.

MIEP is proposing a nominal stamp duty of RM10 for property transfer from a parent to their children or grandchildren, with the purpose of enabling family members to inherit their immovable properties.

In addition, MIEP is proposing a personal tax relief of up to RM500 per individual tax payer for will and estate planning expenses, with the aim of reducing unclaimed monies that are ballooning on a yearly basis.

According to the latest announcement by the Accountant General of Malaysia, there is currently RM11.6 billion in unclaimed monies as of September 2022.

The personal tax relief for will and estate planning expenses is expected to help mitigate this problem by encouraging individuals to take proactive steps in planning for their future and ensuring that their assets are properly managed.

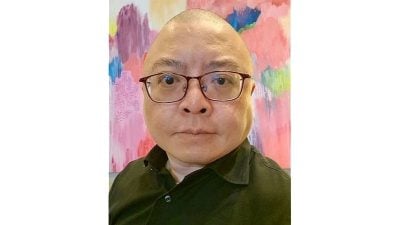

“We believe these proposals will have a positive impact on families and individual taxpayers in Malaysia, while also helping the government reduce the growing problem of unclaimed monies,” said MIEP president See Kok Loong.

“The nominal stamp duty will allow family members to inherit their immovable properties without creating a significant financial burden, and the personal tax relief for will and estate planning expenses will incentivize individuals to take action and plan for their future.”

MIEP is committed to advocating for policies that promote financial stability and security for families and individual taxpayers in Malaysia.

ADVERTISEMENT

ADVERTISEMENT