Central banks (CBs) around the world – led by the US Fed, European Central Bank and Bank of England – are raising interest rates, ostensibly to check inflation. The ensuing race to the bottom is hastening world economic recession.

Going for broke

New UK Prime Minister Liz Truss has already revived ‘supply side economics’, long thought to have been fatally discredited. Her huge tax cuts are supposed to kick-start Britain’s stagnant economy in time for the next general election.

But studies of past tax cuts have not found any positive link between lower taxes and economic or employment growth. Oft-cited US examples of Reagan, Bush or Trump tax cuts have been shown to be little more than economic sophistry.

Reagan’s Council of Economic Advisers chairman, Harvard professor Martin Feldstein found most Reagan era growth due to expansionary monetary policy. Volcker’s interest rate hikes to fight inflation were reversed. This enabled the US economy to bounce back from its severe 1982 monetary policy inflicted recession.

George W Bush’s 2001 and 2003 tax cuts also failed to spur growth. Instead, deficits and debt ballooned. “The largest benefits from the Bush tax cuts flowed to high-income taxpayers.” Likewise, Trump tax cuts failed to lift the US economy, with billionaires now paying much less than workers.

After Boris Johnson stepped down, UK Conservative Party leadership contenders started by promising more tax cuts. But The Economist was “skeptical that such cuts will lift Britain’s growth rate.” Instead, it worried tax cuts would compound inflationary pressures, triggering ever tighter monetary policy.

The Economist concluded, “It is hard to spot a connection between the overall level of taxation and long-term prosperity.” Unsurprisingly, The Economist sees Truss’ “largest tax cuts in half a century” as “a reckless budget, fiscally and politically.”

While such tax cuts mainly benefit the very rich, the costs of such monetary and fiscal policies are borne by workers and other consumers. Workers are harshly punished by austerity measures, losing both jobs and incomes to interest rate hikes.

Tax cuts usually make things worse. Typically, these require cutting social protection and essential public services, ostensibly to balance the budget. So, already greater wealth and income inequalities will worsen.

Governments have to cut public investments due to ballooning budget deficits. Higher interest rates and public spending cuts will also derail efforts needed to transition to more sustainable, greener futures.

Class war

Policy fights over inflation have many dimensions, including class. Instead of helping people cope with rising living costs, increasing interest rates only makes things worse, hastening economic slowdowns. Thus, workers not only lose jobs and incomes, but also are forced to pay more for mortgages and other debts.

Unemployment, lower incomes, deteriorating health and other pains hurt workers. As workers want higher incomes to cope with rising living expenses, such austere policies are deemed necessary to prevent ‘wage-price spirals’.

As usual, workers are being blamed for the resurgence of inflation. But research by the International Monetary Fund (IMF) and others has found no evidence of such wage-price spirals in recent decades.

Experience and evidence suggest very low likelihood of such dialectics in current circumstances, although some nominal wages have risen. Since the 1980s, labor bargaining power and collective wage determination have declined.

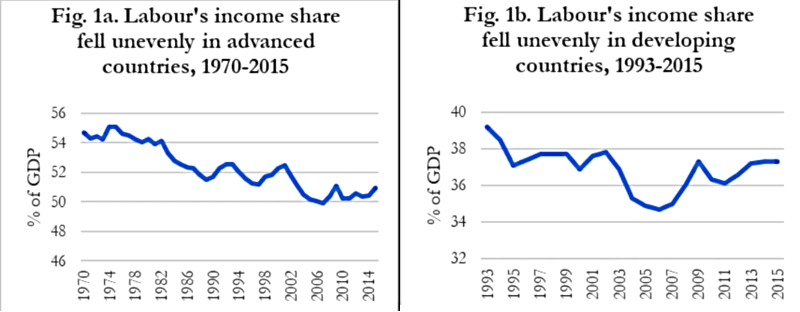

Policymakers should address stagnant, even declining real wages in most economies in recent decades. These have hurt “low-paid workers much more than those at the top.” Even the Organization for Economic Cooperation and Development club of rich countries has “worryingly” noted these trends.

The IMF Deputy Managing Director has explained why wages do not have to be suppressed to avoid inflation. Letting nominal wages rise will mitigate rising inequality, plus declining labor income shares (Figure 1) and real wages.

Profit margins had already risen, even before the Ukraine war and sanctions. US trends prompted the Bloomberg headline, “Fattest Profits Since 1950 Debunk Wage-Inflation Story of CEOs.” Aggregate profits of the largest UK non-financial companies in 2021 rose 34% over pre-pandemic levels.

Policymakers should therefore restrain profits, not wages. Recent price increases have been due to rising profits from mark-ups. Recent trends have made it “easier for firms to put their prices up” notes the Reserve Bank of Australia Governor.

Addressing inequality

The IMF Managing Director (MD) recently warned, “People will be on the streets if we don’t fight inflation.” But people are even more likely to protest if they lose jobs and incomes. Worse, the burden of fighting inflation has been put on them while the elite continues to enrich itself.

Raising interest rates is a blunt means to fight inflation. It worsens living costs and job losses, while tax cuts mainly benefit the rich. Instead, the rich should be taxed more to enhance revenue to increase public provisioning of essential services, such as transport, health and education.

The IMF MD noted raising taxes on the wealthy will help close the yawning gap between rich and poor without harming growth. Public provision of childcare and labor market programs (e.g., retraining) will improve labor supply. Easing worker shortages can thus dampen price pressures.

The current situation requires addressing growing inequality. Redistributive fiscal measures – taxing high earners to fund expanded social protection and public provisioning – are time-tested means to address disparities.

Increasing top tax rates and tax system progressivity are also socially progressive, checking growing inequality. Meanwhile, as consumer prices spiral, rising profits and high executive remuneration have to be checked.

Supply-side policies

The World Bank and Bank of International Settlements heads have urged reducing the current focus on demand management to counter inflation. They both insist on addressing long-term supply bottlenecks, but do not offer much practical guidance.

Poorly coordinated ‘unconventional’ monetary policies since the 2008-09 global financial crisis have created property and stock market bubbles. These damage the real economy, worsen inequality and slow labor productivity growth, with the worst spillover effects in developing counties.

Addressing supply bottlenecks can involve tax incentives and credit policies. But discredited supply-side mantras – e.g., labor market deregulation – must be discarded. Related fiscal and monetary policies – e.g., tax cuts for the rich and inappropriate interest rate hikes – should also be abandoned.

Governments are losing chances to boost productivity, achieve low carbon transformation and cut inequalities. Instead, policymakers should pro-actively push desired economic changes by favoring less carbon-intensive and more dynamic investments.

This may also require checking CBs’ monetary policy independence to more effectively coordinate fiscal with monetary policies. But this should not undermine CBs’ ‘operational independence’ to foster “orderly economic growth with reasonable price stability.”

Governments must rise to the extraordinary challenges of our times with pragmatic, appropriate and progressive policy initiatives. To do this well, they must boldly reject the ideologies and dogmas responsible for our current predicament.

Related IPS articles:

- Inflation Phobia Hastens Recessions, Debt Crises

- Fighting Inflation Excuse for Class Warfare

- Financialization at Heart of Economic Malaise

- Myths, Lobbies Block International Tax Cooperation

- Industrial Policy Still Relevant

- ‘Beggar Thy Neighbor’ Policy Advice

- Tackling Inequality Talk Is Easy

- Wealth Concentration Continues to Increase

This article was originally published on KSJomo.org.

(Anis Chowdhury is Adjunct Professor, Western Sydney University and University of New South Wales, Australia. Jomo Kwame Sundaram was an economics professor and United Nations Assistant Secretary-General for Economic Development.)

ADVERTISEMENT

ADVERTISEMENT