As rich countries raise interest rates in double-edged efforts to address inflation, developing countries are struggling to cope with slowdowns, inflation, higher interest rates and other costs, plus growing debt distress.

Rich countries’ interest rate hikes have triggered capital outflows, currency depreciations and higher debt servicing costs. Developing country woes have been worsened by commodity price volatility, trade disruptions and less foreign exchange earnings.

Rising debt risks

Almost 60% of the poorest countries were already in, or at high risk of debt distress, even before the Ukraine crisis. Debt service burdens in middle-income countries have reached 30-year highs, as interest rates rise with food, fertilizer and fuel prices.

Developing countries’ external debt has risen since the 2008-09 global financial crisis (GFC) – from $2 trillion (tn) in 2000 to $3.4tn in 2007 and $9.6tn in 2019! External debt’s share of GDP fell from 33.1% in 2000 to 22.8% in 2008. But with sluggish growth since the GFC, it rose to 30% in 2019, before the pandemic.

The pandemic pushed up developing countries’ external debt to $10.6tn, or 33% of GDP in 2020, the highest level on record. The external debt/GDP ratio of developing countries other than China was 44% in 2020.

Borrowing from international capital markets accelerated after the GFC as interest rates fell. But commercial debt is generally of shorter duration, typically less than ten years. Private lenders also rarely offer restructuring or refinancing options.

Lenders in international capital markets charge developing countries much higher interest rates, ostensibly for greater risk. But changes in public-private debt composition and associated costs have made such debt riskier.

Private short-term debt’s share rose from 16% of total external debt in 2000 to 26% in 2020. Meanwhile, international capital markets’ share of public external debt rose from 43% to 62%. Also, much corporate debt, especially of state-owned enterprises, is government-guaranteed.

Meanwhile, unguaranteed private debt now exceeds public debt. Although private debt may not be government-guaranteed, states often have to take them on in case of default. Hence, such debt needs to be seen as potential contingent government liabilities.

Sri Lankan international capital market borrowings grew from 2.5% of foreign debt in 2004 to 56.8% in 2019! Its dollar denominated debt share rose from 36% in 2012 to 65% in 2019, while China accounted for 10% of its external borrowings.

Private borrowings for less than ten years were 60% of Lankan debt in April 2021. The average interest rate on commercial loans in January 2022 was 6.6% – more than double the Chinese rate. In 2021, Sri Lankan interest payments alone came to 95.4% of its declining government revenue!

Commercial debt – mostly Eurobonds – made up 30% of all African external borrowings with debt to China at 17%. Zambian commercial debt rose from 1.6% of foreign borrowings in 2010 to 30% in 2018; 57% of Ghana’s foreign debt payments went to private lenders, with Eurobonds getting 60% of Nigeria’s and over 40% of Kenya’s.

More commercial borrowing

Thus, external debt increasingly involved more speculative risk. Public bond finance, foreign debt’s most volatile component, rose relative to commercial bank loans and other private credit. Meanwhile, more stable and less onerous official credit has declined in significance.

Various factors have made things worse. First, most rich countries have failed to make their promised annual aid disbursements of 0.7% of their gross national income, made more than half a century ago.

Worse, actual disbursements have actually declined from 0.54% in 1961 to 0.33% in recent years. Only five nations have consistently met their 0.7% promise. In the five decades since promising, rich economies have failed to deliver $5.7tn in aid!

Second, the World Bank and donors have promoted private finance, urging ‘public-private partnerships’ and ‘blended finance’ in “From billions to trillions: converting billions of official assistance to trillions in total financing”.

Sustainable development outcomes of such private financing – especially in promoting poverty reduction, equity and health – have been mixed at best. But private finance has nonetheless imposed heavy burdens on government budgets.

Third, since the GFC, developed economies have resorted to unconventional monetary policies – ‘quantitative easing’, with very low or even negative real interest rates. With access to cheap funds, managers seeking higher returns invested lucratively in emerging markets before the recent turnaround.

Large investment funds and their collaborators, e.g., credit rating agencies, have profitably created new means to get developing countries to float more bonds to raise funds in international capital markets.

Making things worse

Policy advice from donors and multilateral development banks (MDBs), rating agencies’ biases and the lack of an orderly and fair sovereign debt restructuring mechanism have shaped commercial lending practices.

Favoring private market solutions, donors, MDBs and the IMF have discouraged pro-active development initiatives for over four decades. Hence, many developing countries remain primary producers with narrow export bases and volatile earnings.

They have urged debilitating reforms, e.g., arguing tax cuts are necessary to attract foreign direct investment (FDI). Meanwhile, corporate tax evasion and avoidance have worsened developing countries’ revenue losses. Thus, net revenue has fallen as such reforms fail to generate enough growth and revenue.

Credit rating agencies often assess developing countries unfavorably, raising their borrowing costs. Quick to downgrade emerging markets, they make it costlier to get financing, even if economic fundamentals are sound.

The absence of orderly and fair debt restructuring mechanisms has not helped. Commercial lenders charge higher interest rates, ostensibly for default risks. But then, they refuse to refinance, restructure or provide relief, regardless of the cause of default.

When will we learn?

Following the 1970s’ oil price hikes, western, especially US banks were swimming in liquidity as oil exporters’ dollar reserves swelled. These banks pushed debt, getting developing country governments to borrow at low real interest rates.

After the US Fed began raising interest rates from 1977 to fight inflation, other major central banks followed, raising countries’ debt service burdens. Ensuing economic slowdowns cut commodity exporters’ earnings.

In the past, the IMF and World Bank imposed ‘one-size-fits-all’ ‘stabilization’ and ‘structural adjustment’ measures, impairing development. Developing countries had to implement severe austerity measures, liberalization and privatization. As real incomes declined, progress was set back.

With the pandemic, developing countries have seen massive capital outflows, more than in 2008. Meanwhile, surging food, fertilizer and fuel prices are draining developing countries’ foreign exchange earnings and reserves.

As the US Fed raises interest rates, capital flight to Wall Street is depreciating other currencies, raising import costs and debt burdens. Thus, many countries need financial help.

Debt-distressed countries once again seek support from the Washington-based lenders of last resort. But without enough debt relief, a temporary liquidity crisis threatens to become a debt sustainability, and hence, a solvency crisis, as in the 1980s.

Related IPS articles:

- Stagflation: From Tragedy to Farce

- Deepening Stagflation: Out of the Frying Pan into the Fire

- Covid-19 Compounds Developing Country Debt Burdens

- Developing Countries Desperately Need COVID-19 Financing

- IMF, World Bank Must Urgently Help Finance Developing Countries

- Neoliberal Finance Undermines Poor Countries’ Recovery

- Can Private Finance Really Serve Humanity?

- Multilateral Bank Intermediation Must Help Developing Countries’ Recovery

- Inflation Targeting Constrains Development

- World Bank’s ‘Mobilizing Finance for Development’ Not Financing Development

This article was originally published on KSJomo.org.

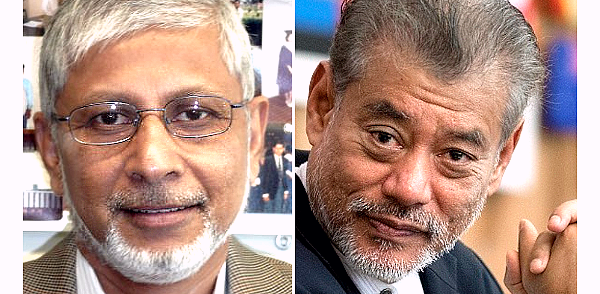

(Anis Chowdhury is Adjunct Professor, Western Sydney University and University of New South Wales, Australia. Jomo Kwame Sundaram was an economics professor and United Nations Assistant Secretary-General for Economic Development.)

ADVERTISEMENT

ADVERTISEMENT