All we need now is a sustained weight loss program for our civil service.

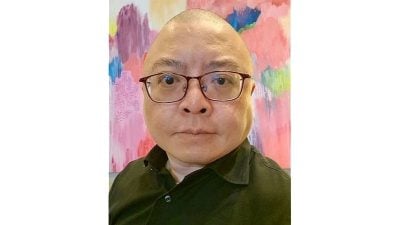

Finance minister Tengku Zafrul Tengku Abdul Aziz has started traveling around the country since August 1 to collect feedback from the public for his 2023 Budget initially slated for October 28, with the hope next year’s Budget will cater to the needs of all Malaysians.

However, given the dramatic changes taking place in the country’s politics of late, the tabling of the Budget is now brought forward to October 7. And former prime minister Muhyiddin Yassin said the 2023 Budget would be personally tabled by prime minister Ismail Sabri Yaakob himself, followed very likely by an announcement on the dissolution of the parliament the following day.

It is an extremely unusual phenomenon in the democratic world to have the parliament dissolved right after the Budget is tabled. We are worried the upcoming Budget will be excessively sweetened by promises to keep the voters happy rather than one that is catering to the needs of Malaysians.

Sure enough with a sugar-coated election budget in place, the election campaign will become much more easily manipulated and publicized. From the dissolution of parliament to the actual election, the ruling party will have nearly 60 days to sell the “beef” in its Budget to manipulatively steer itself into triumph.

Already there have been early signs of an election budget specifically tailored to please the voters, and the country’s massive army of civil servants will be the first to savor the sweetness of the windfall.

The prime minister revealed earlier this month that the 2023 Budget will continue to prioritize the well-being of the rakyat, and that good news are awaiting civil servants come August 30, probably in the forms of higher remunerations and increased allowances.

The question is: how is our badly drained Treasury going to come up with the spare cash to satisfy our more than 1.7 million civil servants, not to mention another 15 million plus lower- to middle-income Malaysians who need a lift from the government? The drastic rise in budgetary deficit could be alarming!

Total allocations for the 2022 Budget stood at RM332.1 billion equivalent to 20.3% of the country’s GDP at a budgetary deficit of 6%.

We have to admit that the government has done pretty well, at least in the numbers, in battling the pandemic, growing the economy and containing the inflation. Our second quarter y-o-y growth of 8.9% and July inflation of 4.4% do put us well ahead of the pack globally.

The country’s GDP is anticipated to expand by at least 6% to RM1.73 trillion this year.

But we must also admit that the government has so far forked out nearly RM80 billion extra this year for assistance, allowances and subsidies in order to keep prices steady (which unfortunately most Malaysians don’t feel) in preventing an above-global-average 11% surge in CPI. Time will tell whether the government has adopted the right strategy.

Looking back, the 2022 Budget could be lumped into four major categories: the bulk of which or RM223.5 billion for operating expenditure, RM75.6 billion for development, RM23 billion for Covid-19 fund and RM2 billion for emergency reserves.

Of this total, a whopping 67.3% has been set aside for servicing government debt interests, salaries and pensions of civil servants, while only a pathetic 22.8% is for development expenditure.

The excessively high proportion of operating expenditure is very anomalous. Unless the shortfall can be filled by expanded tax revenue, budgetary deficit will keep widening!

We predict the total allocations under Budget 2023 will likely top 20.5% of the GDP at around RM355 billion with a budgetary deficit of 6%. Not more than RM81 billion of this total is for development expenditure. We will not have sufficient funds to finance public infrastructure projects, unless we can control or cut back on operating expenditure.

To solve this problem, we may have to impose new taxes, raise the maximum income tax rate from 30% to 40%, reintroduce GST…

If we are unable to cut expenses, then we must look into ways to expand tax revenue!

We have a severely bloated civil service ratio of one civil servant to only 19.3 people (1:91.4 for Singapore). It’s a matter of time the national coffers will eventually be dried up by our ballooning civil service.

All we need now is a sustained weight loss program for our civil service.

ADVERTISEMENT

ADVERTISEMENT