Half a century after the 1970s’ stagflation, economies are slowing, even contracting, as prices rise again. Thus, the World Bank warns, “Surging energy and food prices heighten the risk of a prolonged period of global stagflation reminiscent of the 1970s.”

In March, Reuters reported, “With surging oil prices, concerns about the hawkishness of the Federal Reserve and fears of Russian aggression in Eastern Europe, the mood on Wall Street feels like a return to the 1970s”.

Stagflation in the 1970s

Worse, it seems few lessons have been learned from the last stagflation episode. There is no agreed formal definition of stagflation, which refers to a combination of economic stagnation with high inflation, e.g., when unemployment and prices both rise.

When growth is weak and many are jobless, prices rarely rise, keeping inflation low. The converse is true when growth is strong. This inverse relationship between economic activity and inflation broke down with supply shocks, particularly oil and other primary commodity price surges during 1972-75.

Non-oil primary commodity prices on The Economist index more than doubled between mid-1972 and mid-1974. Prices of some commodities, e.g., sugar and urea fertilizer, rose more than five-fold!

As costlier energy pushed up production expenses, businesses raised prices and cut jobs. With higher food, fuel and other prices, rising costs, coupled with income losses, reduced aggregate demand, further slowing the economy.

Fed chokes economy to cut inflation

Years before becoming US Fed chair in 2006, a Ben Bernanke co-authored paper noted, “Looking more specifically at individual recessionary episodes associated with oil price shocks, we find that … oil shocks, per se, were not a major cause of these downturns”.

They concluded, “an important part of the effect of oil price shocks on the economy results not from the change in oil prices, per se, but from the resulting tightening of monetary policy”. Their findings corroborated others, e.g., by James Tobin.

Following Milton Friedman and Anna Schwartz, other economists also found “in the postwar era there have been a series of episodes in which the Federal Reserve has in effect deliberately attempted to induce a recession to decrease inflation”.

The US Fed began raising interest rates from 1977, inducing an American economic recession in 1980. The economy briefly turned around when the Fed stopped raising interest rates. But this nascent recovery soon ended as Fed chair Paul Volcker raised interest rates even more sharply.

The federal funds target rate rose from around 10% to nearly 20%, triggering an “extraordinarily painful recession”. Unemployment rose to nearly 11% nationwide – the highest in the post-war era – and as high as 17% in some states, e.g., Michigan, leaving long-term scars.

Interest rate hikes reduced needed investments. Outside the US economy, these sharp and rapid interest rate hikes triggered debt crises in Poland, Latin America, sub-Saharan Africa, South Korea and elsewhere.

Earlier open economic policies meant “the increase in world interest rates, the increased debt burden of developing countries, the growth slowdown in the industrial world…contributed to the developing countries’ stagnation”.

Countries seeking International Monetary Fund (IMF) financial support had to agree to severe fiscal austerity, liberalization, deregulation and privatization policy conditionalities. With per capita incomes falling and poverty rising, Latin America and Africa “lost two decades”.

Stagflation reprise

The IMF chief economist recently reiterated, “Inflation is a major concern”. The Bank of International Settlements has warned, “We may be reaching a tipping point, beyond which an inflationary psychology spreads and becomes entrenched.”

Central bankers’ anti-inflationary efforts mainly involve raising interest rates. This approach slows economies, accelerating recessions, often triggering debt crises without quelling rising prices due to supply shocks.

Economic recoveries from the 2008-09 global financial crisis (GFC) remained tepid for a decade after initially bold fiscal responses were quickly abandoned. Meanwhile, ‘quantitative easing’, other unconventional monetary policies and the Covid-19 pandemic raised debt to unprecedented levels.

GFC trade protectionist responses, US and Japanese ‘reshoring’ of foreign investment in China, the pandemic, the Ukraine war and sanctions against Russia and its allies have reversed earlier trade liberalization.

Higher interest rates in the rich North have triggered capital flight, causing developing country currencies to depreciate, especially against the US dollar. The slowing world economy has reduced demand for many developing country exports, while most migrant worker remittances decline.

Interest rate hikes have worsened debt crises, particularly in the global South. The poorest countries have seen an $11bn surge in debt payments due while grappling with looming food crises. Thus, developing country vulnerabilities have been worsened by international trends over which they have little control.

Lessons not learned

Supply-side cost-push inflation is very different from the demand-pull variety. Without evidence, inflation ‘hawks’ insist that not acting urgently will be costlier later.

This may happen if surging demand is the main cause of inflation, especially if higher costs are easily passed on to consumers. However, episodes of dangerously accelerating inflation are very rare.

Acting too quickly against supply-shock inflation can be unwise. The 1970s’ energy crises sparked greater interest in energy efficiency. But higher interest rates in the 1980s deterred needed investments, even to reverse declining or stagnating productivity growth.

Raising interest rates also accelerated recessions. But similar commodity price rises before the 1970s’ and imminent stagflation episodes – involving energy and food respectively – obscure major differences.

For instance, ‘wage indexing’ – linking wage increases to price rises – enhanced the 1970s’ inflation spiral. But labor market deregulation since the 1980s has largely ended such indexation.

The IMF acknowledges globalization, ‘offshoring’ and labor-saving technical change have weakened unionization and workers’ bargaining power. With both elements of the 1970s’ wage-price spirals now insignificant, inflation is more likely to decline once supply bottlenecks ease.

But the wage-price spiral has also been replaced by a profit-price swirl. Reforms since the 1980s have also enhanced large corporations’ market power. Greater corporate discretion and reduced employees’ strength have thus increased profit shares, even during the pandemic.

In November 2021, Bloomberg observed the “fattest profits since 1950 debunks wage-inflation story of CEOs”. Meanwhile, the Guardian found “Companies’ profit growth has far outpaced workers’ wages”.

Corporations are taking advantage of the situation, passing on costs to customers. The net profits of the top 100 US corporations were “up by a median of 49%, and in one case by as much as 111,000%”!

Meanwhile, many more consumers struggle to meet their basic needs. Interest rate hikes have also hurt wage-earners, as falling labor shares of national income have been exacerbated by real wage stagnation, even contraction.

Hence, policymakers should ease supply bottlenecks and address imbalances to accelerate progress, not raise interest rates causing the converse. Thus, they should rein in corporate power, improve competition and protect the vulnerable.

Allowing international price rises to pass through, while protecting the vulnerable, can accelerate the transition to more sustainable consumption and production, including cleaner renewable energy.

Related IPS articles:

- April Fool’s Inflation Medicine Threatens Progress

- When Saviors Are the Problem

- Deepening Stagflation: Out of the Frying Pan into the Fire

- Stagflation Threat: Be Pragmatic, Not Dogmatic

- Fighting Inflation Excuse for Class Warfare

- Finance Drives World to Stagflation

This article was originally published on KSJomo.org.

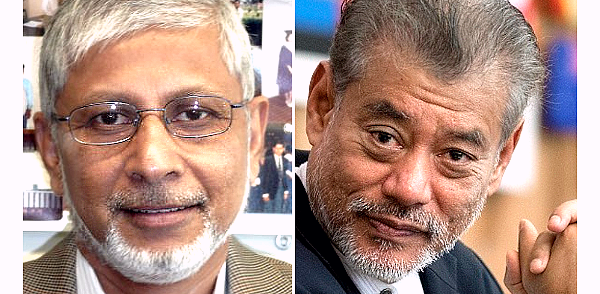

(Anis Chowdhury is Adjunct Professor, Western Sydney University and University of New South Wales, Australia. Jomo Kwame Sundaram was an economics professor and United Nations Assistant Secretary-General for Economic Development.)

ADVERTISEMENT

ADVERTISEMENT