After decades of rejecting international tax cooperation under multilateral auspices, rich countries have finally agreed. But, by insisting on their own terms, progressive corporate income tax remains distant.

Tax avoidance and evasion by transnational corporations (TNCs) are facilitated by ‘tax havens’ – jurisdictions with very low ‘effective’ taxation rates. Intense competition among developing countries to attract foreign direct investment (FDI) makes things worse.

Developing countries need tax revenue most, but they will lose more, as a share of GDP, than wealthy countries. But a global minimum corporate (income) tax rate (GMCTR) can become a “game changer” undermining tax havens.

Minimal minimum rate

TNCs exploit legal loopholes to avoid or minimize tax liabilities. Such practices are referred to as ‘base erosion and profit shifting’ (BEPS).

Tax havens collectively cost governments US$500–600bn yearly in lost revenue. Low-income countries (LICs) will lose some US$200bn, more than the foreign aid, of around US$150bn, they receive annually.

Corporate income tax represents 15% of total tax revenue in Africa and Latin America, compared to 9% in OECD countries. Developing countries’ greater reliance on this tax means they suffer disproportionately more from BEPS.

A GMCTR requires TNCs to pay tax on their worldwide income. This discourages hiding profits in tax havens. The Independent Commission for the Reform of International Corporate Taxation (ICRICT) recommended a 25% GMCTR.

This 25% rate was around the current GDP-weighted average statutory corporate tax rate for 180 countries. Slightly below the OECD countries’ average, it is much less than the developing countries’ average. So, a GMCTR below 25% implies major revenue losses for most developing countries.

To reverse President Trump’s 2017 tax cut, the Biden administration proposed, in April 2021, to tax foreign corporate income at 21%. In June, the G7 agreed to a 15% GMCTR, endorsed by G20 finance ministers in July. This poor G7 rate is now sold as a “ground-breaking” tax deal.

Unsurprisingly, the World Bank President also rejected 21% as too high. The Bank has long promoted ‘race-to-the-bottom’ host country tax competition. Embarrassingly, its Doing Business Report was ‘suspended’ indefinitely in 2021 after its politically motivated data manipulation was exposed.

The OECD also wants to distribute taxing rights and revenue by sales, and not where their goods and services are produced. Critics, including The Economist, have pointed out that large rich economies would gain most. Small and poor developing economies, particularly those hosting TNC production, will lose out.

The OECD proposals could reduce small developing economies’ (SDEs) tax bases by 3%, while four-fifths of the revenue would likely go to high income countries (HICs). Hence, developing countries prefer revenue distribution by contribution to production, e.g., employees, rather than sales.

Undemocratic inclusion

Developing countries have never had a meaningful say in international tax matters. G20 members should have asked multilateral organizations, such as the UN and the IMF, which the G7 dominated OECD has long blocked.

Instead, the G20 BEPS initiative asked the OECD to work out its rules. After decades of keeping developing countries out of tax governance, its compromise Inclusive Framework on BEPS (IF) promotes lop-sided international tax cooperation.

Developing countries were only involved “after the agenda had been set, the action points were agreed on, the content of the initiatives had been decided and the final reports were delivered”.

Developing countries have been allowed to engage with OECD and G20 members, supposedly “on an equal footing”, to develop some BEPS standards. To become an IF member, a country or jurisdiction must first commit to the BEPS outcome.

Thus, the non-OECD, non-G20 countries must enforce a policy framework they had little role in designing. Unsurprisingly, with little real choice or voice, the 15% GMCTR was agreed to, in October 2021, by 136 of the 141 IF members.

FDI vs taxes

The proposed OECD tax reforms are supposed to be implemented from 2023 or 2024. The United Nations Conference on Trade and Development (UNCTAD) Investment Division recognizes it will have major implications for international investment and investment policies affecting developing countries.

UNCTAD’s World Investment Report 2022, on International tax reforms and sustainable investment, offers guidance for developing country policymakers to navigate the complex new rules and to adjust their investment and fiscal strategies.

Committed to promoting investments in the real economy, especially by FDI, UNCTAD recognizes most developing countries lack the technical capacity to address the complex tax proposal. Implementing BEPS reports and related documents via legislation will be difficult, especially for LICs.

Existing investment treaty commitments also constrain fiscal policy reform. “The tax revenue implications for developing countries of constraints posed by international investment agreements (IIA) are a major cause for concern”, the Report notes.

Although tax regimes influence investment decisions, tax incentives are far from being the most important factor. Other factors – such as political stability, legal and regulatory environments, skills and infrastructure quality – are more significant.

Nonetheless, tax incentives have been important for FDI promotion. Such incentives inter alia include tax holidays, accelerated depreciation and ‘loss carry-forward’ provisions – reducing tax liability by allowing past losses to offset current profits.

With the GMCTR, many tax incentives will be less attractive to much FDI. Tax incentives will be affected to varying degrees, depending on their features. UNCTAD estimates productive cross-border investments could decline by 2%.

Hence, policymakers will need to review their incentives for both existing and new investors. The GMCTR may prevent developing countries from offering fiscal inducements to promote desired investments, including locational, sectoral, industry or even employment-creating incentives.

Investors rule

With generally lower rates, ‘top-up taxes’ could significantly augment SDEs’ revenue. Top-up taxes would apply to profits in any jurisdiction where the effective tax rate falls below the minimum 15% rate. This ensures large TNCs pay a minimum income tax in every jurisdiction where they operate.

However, host countries may be prevented by IIAs – especially Investor State Dispute Settlement (ISDS) provisions – from imposing ‘top-up taxes’. If so, they will be imposed by TNCs’ mainly rich ‘home countries’.

Thus, FDI-hosting countries would lose tax revenue without benefiting by attracting more FDI. Existing IIAs – of the type found in most developing countries – are likely to be problematic.

Hence, the GMCTR’s implications are very important for FDI promotion policies. Reduced competition from low-tax locations could benefit developing economies, but other implications may be more relevant.

As FDI competition relies less on tax incentives, developing countries will need to focus on other determinants, such as supplies of skilled labor, reliable energy and good infrastructure. However, many cannot afford the significant upfront financial commitments required to do so.

Many important details of reforms required still need to be clarified. Thus, developing countries must strengthen their cooperation and technical capabilities to more effectively negotiate GMCTR reform details. This is crucial to ‘cut losses’, to minimize the regressive consequences of this supposedly progressive tax reform.

Related IPS articles:

- Myths, Lobbies Block International Tax Cooperation

- Powerful States Push Tax Race to the Bottom

- Only Multilateral Cooperation Can Stop Harmful Tax Competition

- UN Leadership Necessary for Fairer Tax Cooperation

- OECD Tax Reform Proposal Could Be Better

- Ensuring Fairer International Corporate Taxation

- South Must Also Set International Tax Rules

- ‘Beggar Thy Neighbor’ Policy Advice

- World Bank Must Stop Encouraging Harmful Tax Competition

This article was originally published on KSJomo.org.

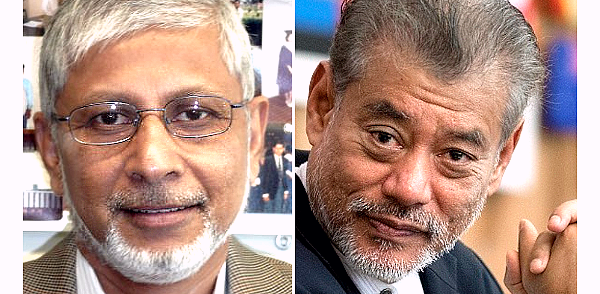

(Anis Chowdhury is Adjunct Professor, Western Sydney University and University of New South Wales, Australia. Jomo Kwame Sundaram was an economics professor and United Nations Assistant Secretary-General for Economic Development.)

ADVERTISEMENT

ADVERTISEMENT