Given the fact there has been a flood of personal loan facilities available in the market, the government should not allow such easy-to-get loans.

PETALING JAYA: Easy personal loans could sink Malaysians deep into financial dilemma due to poor financial prudence and discipline.

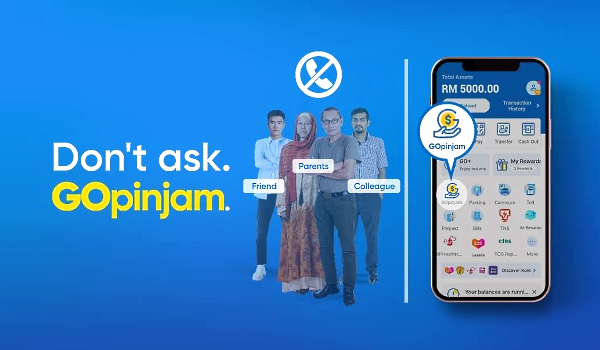

Touch ‘n Go e-wallet has recently introduced a new personal loan facility “GOpinjam” for users aged 21 and above with a monthly salary from as low as RM800. Users can apply for loans from RM100 up to RM10,000.

A user shared his experience after trying out the new feature that he only needed to key in his monthly salary of RM1,200 to secure a RM3,600 loan in under one minute, questioning whether it was a debt trap as the loan had come unbelievably easy and fast.

GOpinjam offers flexible repayment periods from one week to 12 months with interest rates between 8% to 36% per annum, depending on the loan amount and repayment period.

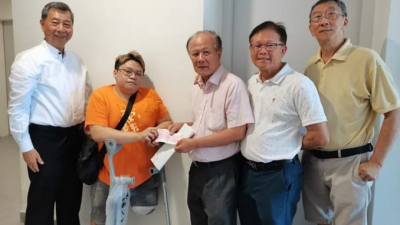

Local financial expert Datuk Chua Tia Guan reminded Malaysians to be very clear about their purposes of taking loans.

“You need to know very well whether the loan is just for consumption purposes or to be used to boost your productivity in order to increase your income.

“Sure enough you can borrow, but you must know what you need the money for. If you borrow to start a business, it will be better just to get a low-interest loan from the government.”

Chua pointed out that given the fact there has been a flood of personal loan facilities available in the market, the government should not allow such easy-to-get loans.

He urged Bank Negara to tighten its control over such loans.

He told Sin Chew Daily in an interview that easy loans would plunge a borrower into deep financial difficulty especially if he or she lacks financial prudence.

Quoting a parliamentary report, he said half the people declared bankrupt in the country between 2019 and February this year were due to defaults on their personal loans.

“This is a very serious condition. Besides, household debts have also been rising.”

Chua said Malaysia’s household debts stood at RM1.27 trillion in June 2020, climbing to RM1.34 trillion, or about 89.6% of the country’s GDP, in June the following year.

He urged local financial institutions to release the loans responsibly to borrowers who have the ability to pay back their dues.

“Poor financial discipline, financial planning and low income are causes of rapid rise in debts.

“The government must find out why so many people need to take loans.”

ADVERTISEMENT

ADVERTISEMENT