All over the world, people expect policies by central bankers trained in economics to have a sound scientific base. But in fact, inflation targeting is an article of faith with neither theoretical nor empirical basis.

Policy inspiration

The two per cent (2%) inflation target is now virtually an “economic religion”. US Federal Reserve chairman Jerome Powell noted it had become a “global norm”.

In 1989, New Zealand became the first country to adopt a 2% inflation target. “The figure was plucked out of the air”, acknowledged Don Brash, then Governor of the Reserve Bank of New Zealand (RBNZ), its central bank.

It was prompted by a “chance remark” of NZ Finance Minister Roger Douglas during “a television interview on April 1, 1988, that he was thinking of genuine price stability, ‘around 0, or 0 to 1 percent’.” Meanwhile, Brash seemed to think his role was to keep inflation positive, but under 2%.

In the RBNZ’s annual report to March 1989, Brash was “confident that inflation could be reduced below 2 percent by the year to March 1993”. The finance minister welcomed this, asking “whether it might be feasible to achieve that by the end of calendar year 1992 – he liked the sound of ‘0 to 2 by ’92’”!

Thus, “‘0 to 2 by ’92’ became the mantra, repeated endlessly”. Brash and his colleagues “devoted a huge amount of effort” preaching this new mantra “to everybody who would listen – and some who were reluctant to listen”.

This involved “many hundreds of informal speeches to Rotary Clubs, Chambers of Commerce, farmers’ groups, church groups, women’s groups, and schools”. A new cult – inspired by RBNZ’s inflation targeting – was thus born.

Parliamentary mandate

When the bill setting the RBNZ inflation target between zero and 2% reached the legislature, parliamentarians were about to adjourn for Christmas. Also, “one of the bill’s strongest opponents was laid up in the hospital”.

Nevertheless, the debate over the legislation was robust. Labor unions were worried that an inflexibly narrow target would raise unemployment. The New Zealand Manufacturers’ Federation warned, “This is wrong in principle, undemocratic and inflexible”.

A real estate developer asked Brash to announce his body weight, for him to work out what rope would be needed to hang the RBNZ Governor from a lamppost in NZ’s capital, Wellington. But the bill passed as leaders of the ruling Labour Party brushed aside concerns.

Weak evidence, strong conclusion

Since the RBNZ’s adoption of 2% inflation, “plucked out of the air” as a target, leading economists – some of whom have served as senior officials at the major international financial institutions and central banks – studied long time series for many countries.

However, none could find any strong evidence to justify a single digit inflation threshold beyond which inflation may negatively impact economic growth. Yet, they concurred with a single digit inflation target!

For example, Stanley Fischer concluded, “however weak the evidence, one strong conclusion can be drawn: inflation is not good for longer-term growth”. And Robert Barro asserted, “the magnitude of [negative] effects are not that large, but are more than enough to justify a keen interest in price stability”.

A Reserve Bank of Australia study found “Average inflation is…a fragile explanation of economic growth”. Yet, it concluded, “While the results are not as robust as one would like, the most obvious interpretation of the evidence … is that the negative correlation between inflation and growth arises from a causal relationship”.

Pierre Fortin – past President of the Canadian Economics Association – emphasized, “Strong claims that there are large macroeconomic benefits to be reaped … are not presently founded on robust quantitative evidence. They are premature”.

Cheerleaders claim inflation-targeting has delivered low inflation. But others have alternative explanations for the Great Moderation. The “one-size-fits-all” mantra has also effectively shut the door to alternative strategies for robust, sustainable and inclusive growth.

Harm’s way

Inflation targeting can be harmful, especially as monetary authorities have little control over external sources of inflation. Current inflationary pressures are largely due to rising international food and fuel prices.

Targeting also harms the economy when inflation is caused by supply shocks, such as production and distribution disruptions, e.g., due to pandemic related lockdowns or other restrictions.

Raising interest rates or monetary tightening to achieve targets when inflation is largely due to external or supply shocks will exacerbate the debt burdens of households, businesses and governments, thus reducing economic growth and employment prospects.

Central bankers trying to “cool” labour markets in their anti-inflation crusade hurt labour by raising unemployment and worsening working conditions. It is likely to be socially less costly to ‘accommodate’, i.e., accept supply or external shock inflation than mechanically achieving an arbitrary inflation target.

Inflation targeting has also privileged price stabilization at the expense of other central bank responsibilities, including maximizing employment, growth and progress.

Of course, central bankers should be monitoring prices of key goods and services (e.g., food, fuel, housing, healthcare) which weigh heavily on consumer spending. Policymakers must design alternative policy tools to address such essential price rises rather than relying solely on raising interest rates.

Targeting a specific inflation rate is against the International Monetary Fund (IMF)’s Articles of Agreement. Article IV states, “each member shall: (i) endeavour to direct its economic and financial policies toward the objective of fostering orderly economic growth with reasonable price stability, with due regard to its circumstances”.

Thus, IMF members are obliged to foster economic growth, and maintain “reasonable” price stability – not chasing a fixed inflation target, presuming that growth would follow. There is no ‘one-size-fits-all’ policy or universal target. And policy design depends on country specific circumstances.

Counter revolution

Inflation targeting should never have become monetary policy. It should have been rejected long ago if policymaking was informed by theory and experience. But central banks have been targeting inflation, supposedly to enhance growth and employment!

Some assert money is “neutral”, insisting central bankers cannot affect real economy variables, e.g., output, employment, investment. Thus, they have “discounted the role of money in … monetary policy more than is justified”.

But money is far from neutral, impacting the real economy quite significantly. This was evident after the 2008-2009 global financial crisis and during the COVID-19 pandemic. Policymakers should instead be primarily concerned about the real economy – output, employment, sustainable development.

Unsurprisingly, inflation targeting has not accelerated growth, especially in developing countries. Even in developed countries, it seems to have exacerbated “secular stagnation”, i.e., anaemic growth.

Thus, instead of increasing growth, employment and structural transformation, the inflation obsession has slowed economic growth. Universal rejection of the inflation targeting hoax will thus advance human progress.

Related IPS articles:

- Resist Inflation Phobia Coup

- Inflation Paranoia Threatens Recovery

- Inflation Bogey Blocking Recovery

- Central Banks Must Address Pandemic Challenges

- Fight Pandemic, Not Windmills of the Mind

This article was originally published on KSJomo.org.

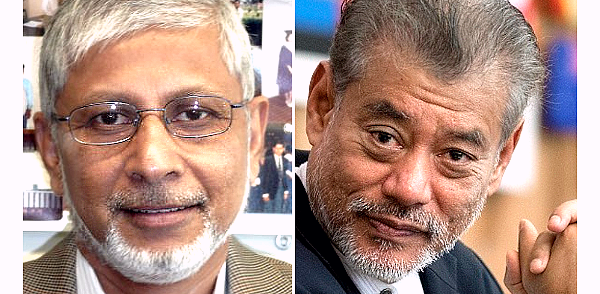

(Anis Chowdhury is Adjunct Professor, Western Sydney University and University of New South Wales, Australia. Jomo Kwame Sundaram was an economics professor and United Nations Assistant Secretary-General for Economic Development.)

ADVERTISEMENT

ADVERTISEMENT