Malaysian politicians have long reminded us that we will soon achieve high-income country status. But the vulnerable, often silent majority has largely felt left out and various vulnerabilities are more acutely felt by this growing “precariat”.

Many of them yearn for lasting, comprehensive social protection. Malaysians struggling to cope with recent catastrophic events — such as the pandemic and recent floods — are increasingly demanding reliable relief. But this yearning goes well beyond aspiring for short-term relief programs addressing temporary threats.

Social protection floor

A recent Khazanah Research Institute (KRI) report recommends comprehensive social protection over the life cycle — from childhood to working adulthood and then, retirement with aging. It seeks to enhance social security in Malaysia, calling for an inclusive “social protection floor”, leaving no one behind.

Led by Hawati Abdul Hamid, “Building Resilience: Towards Inclusive Social Protection in Malaysia” is co-authored by Adam Manaf Mohamed Firouz, Jarud Romadan Khalidi, Nur Thuraya Sazali, Puteri Marjan Megat Muzafar and Siti Aiysyah Tumin.

The report makes recommendations for desirable government investments towards a fairer society. Invoking multilateral conventions, it promotes social security for all, based on a life cycle approach, and universal provisioning of key social services and income security.

Rather than reactive, the report is forward-looking. As the government considers relief and recovery measures for the near term, it should reform “forward” for the future — instead of the Davos slogan of “building back better”. After all, one must “never let a good crisis go to waste”.

Protecting all

The proposed social protection floor includes a universal child benefit (UCB) to ensure every child’s cognitive and physical development is not compromised.

Improving life prospects not only equalizes opportunities for all children, but also brings long-term economic and other benefits to the nation. At the outset, the proposed UCB would cover children until 12. It would then extend coverage annually to all teenagers under 18.

Extending mandatory social security to all working-age Malaysians is the report’s second major thrust. In terms of sequencing, it proposes extending minimal coverage to all first before improving protection over the longer term.

Existing social insurance schemes were never designed for the new working majority — in non-standard employment, contract labor, the self-employed and others in informal employment — who are largely excluded from existing programs.

Old age vulnerability

The Employees Provident Fund (EPF) was set up in 1951 to win Malayan hearts and minds during the colonial counter-insurgency campaign. The Emergency from mid-1948 had made little military headway in its first three years before the British changed strategy.

The EPF has been funded by employer and employee contributions, without government financing. Contributing is legally mandatory for all (including part-time) private sector employees. But the EPF does not cover most working people who are not formally employed.

Hence, most do not participate, especially those with contracts for labor — popularly known as contract workers. With only a small fraction of the labor force eligible for government and other pensions, less than half can rely on pensions or EPF savings.

Before the pandemic, over five-sixths of EPF members could not expect retirement incomes above the official poverty line from their savings! Now, only 3% have enough to stay above the EPF’s more realistic Belanjawanku poverty line.

Such widespread shortfalls mean no income security for most elderly Malaysians to live out their lives in dignity after retirement. Instead, the report proposes a social insurance pension (SIP) to provide basic income security for the elderly.

Funding social security

Urging comprehensive social protection to cope with various risks over the life cycle, the report’s recommendations incorporate social solidarity principles of risk pooling and collective funding. But changes in technology and labor processes as well as fiscal constraints pose new challenges for sustainably financing social protection.

Meanwhile, payments to the self-employed or contract employees have often risen as livelihoods become more precarious. Apart from averting poverty, social security also seeks to limit precarity by mitigating socioeconomic shocks, other vulnerabilities and related risks.

Comprehensive social protection should induce a virtuous cycle, strengthen the social contract, foster trust in government and enhance government revenue. To be sure, more targeted social assistance will still be needed — for example, for those coping with disabilities.

In this effort, the report envisages voluntary and other such civil society organizations contributing much. Yet, comprehensive social protection requires establishing and providing a basic floor — without relying on charity, changing fads or policy whims.

Feasibility?

To implement its recommendations, the report urges keeping feasibility, cost-effectiveness and efficacy in mind. Recognizing pandemic fiscal demands, it urges allowing time to ensure adequate financing to build needed institutional capacities and capabilities.

The report proposes having a single national social security institution with a unified registry providing comprehensive social security, with no one left out. Government spending for UCBs and working-age protection schemes are estimated at around RM16.4 billion in the first year.

The authors recommend beginning SIP after all those who are under 18 have child benefits. They also expect savings from consolidating existing programs, lowering needed additional government expenditure to RM2.4 billion annually.

To be fiscally, economically and socially sustainable, the report proposes government funds supplement employer and employee contributions. Thus, the government will have to subsidize the precariat, namely the unemployed, unpaid (for example, homemakers) and workers in informal and non-standard employment.

Razak’s legacy

The report acknowledges Malaysia has already achieved much. It notes both the EPF and the Social Security Organization (Socso) quickly provided some relief to members after the COVID-19 pandemic disrupted livelihoods.

While noting coverage gaps, it appreciates how contributory social insurance helped formal sector employees cope with life cycle risks. But going forward, much more remains to be done to address obstacles, problems and criticisms.

As Tun Abdul Razak Hussein sought to reunite Malaysia following May 1969, he proposed the Rukunegara and the New Economic Policy (NEP) in 1971. These sought to achieve “national unity” by ending poverty and reducing inter-ethnic socioeconomic disparities.

Razak envisaged a Bangsa Malaysia and “nationalist socialism” with state intervention in the national interest. He set up Socso in 1972 to eventually provide comprehensive social protection in nine areas. But his vision died with him, with no other leader, including his son, pursuing it since.

Thus, the KRI report takes up the challenge laid down half a century ago by Razak. It suggests what can and should be done for equitable development. After all, a nation is judged not only by the ostentatious lifestyles of its elite, but more so by how it treats its worst-off.

This article was originally published on The Edge Malaysia.

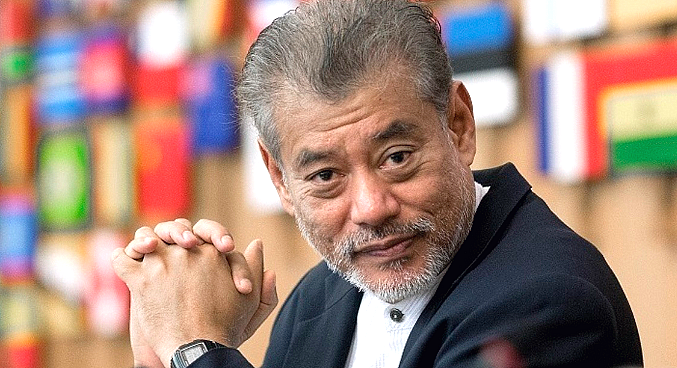

(Jomo Kwame Sundaram, a former economics professor, was UN assistant secretary-general for economic development. He is the recipient of the Wassily Leontief Prize for Advancing the Frontiers of Economic Thought.)

ADVERTISEMENT

ADVERTISEMENT