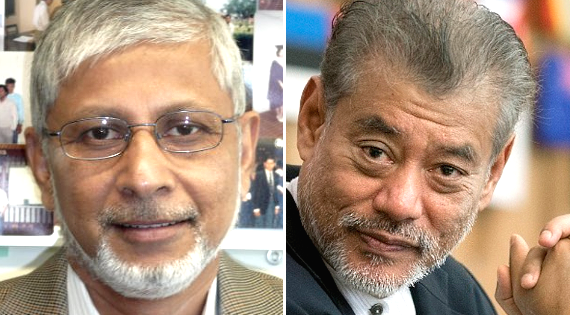

By Anis Chowdhury / Jomo Kwame Sundaram

COVID-19 has become a "developing country pandemic", retreating from the North's mass vaccination.

With developing countries heavily handicapped, the International Monetary Fund (IMF) warns of a "dangerous [new] divergence".

Renewed North-South divide

The Economist believes death rates in developing countries are much higher than officially reported – 12 times more in low- and middle-income countries (LMICs), and 35 times greater in low-income countries (LICs)!

Rich countries' 'vaccine nationalism' and protection of patent monopolies have only made things worse. After "passing round the begging bowl", recent G7 promises by the world's largest rich countries – including a billion vaccine doses – are "too little, too late", as emerging details confirm.

Rich countries' aid cuts during the pandemic have only rubbed salt into an open wound. Without meaningful debt relief by lenders, developing countries are falling further behind once again.

Borrow domestically

Now, developing countries must mobilize funds domestically for relief and recovery as foreign exchange is only needed to finance imports. Central bank governors have long agreed that "the scope for relying more on domestic markets, and less on international markets, is considerable".

Government bonds issued for domestic borrowing are widely considered safe savings instruments. They thus also support and develop domestic capital markets, although limited incomes and savings ensured thin markets in most developing countries.

Hence, governments have to borrow from central banks to meet their financing needs. As government debt is denominated in the domestic currency, repayment is manageable. With borrowing from central banks contributing to a country's money supply, governments can borrow as needed.

Central banks lend

Central bank financing of government borrowing for development expenditure is nothing new. It was widespread until restrained in recent decades by pressure from donors, financial markets and institutions, including the IMF and World Bank.

Instead, the new policy advice has promoted 'central bank independence', 'inflation targeting', 'debt limits', 'balanced budgets' and prohibiting direct borrowing from central banks.

After the 2008-2009 global financial crisis, rich countries pursued 'unconventional' monetary policies, with central banks buying government and corporate bonds. But few developing country governments have resorted to borrowing from central banks.

Even talk of such policies evokes fears of 'runaway inflation', unsustainable 'debt build-up', balance of payments crises and 'crowding out' the private sector. These concerns have limited such borrowing, unnecessarily constraining government spending.

Inflation bogeyman

Undoubtedly, 'hyper-inflation' – exceeding 35% to 40%, usually due to rare events such as war or state collapse – has adversely affected growth historically. But Indonesia and South Korea both grew at 7-8% annually for over two decades with double-digit inflation rates exceeding 10%.

Government spending is not the only alleged cause of inflation. Inflation may also be attributed to shortages, e.g., the pandemic has disrupted much production and supply.

Inflation is typically unavoidable in fast-growing economies experiencing rapid structural change as some sectors expand faster than others, with some even contracting.

Such inflation is likely to decline as economic imbalances, frictions and disruptions ease. Inflation, it should be remembered, is double-edged, also reducing debt burdens while encouraging spending, rather than saving.

Crowding-out or in?

Government spending is needed to keep economies ticking, especially as contemporary recessions are partly due to government policies to contain the pandemic. State inaction would only worsen mass unemployment, bankruptcies, etc.

When a government spends, the central bank credits the commercial bank accounts of recipients. Thus, expansionary fiscal policy augments private banks' cash reserves.

This, in turn, increases market liquidity unless the authorities offset or 'sterilize' such effects, e.g. by selling government or central bank or short-term securities, or associated derivatives such as 're-purchase' agreements.

Then, instead of pushing up interest rates, the central bank discount rate declines, exerting downward pressure on retail interest rates. Hence, claims that government spending 'crowds out' private investments tend to exaggerate.

And if a government borrows for infrastructure investment or skill development, overall productivity increases, and business costs decline. Hence, debt-financed infrastructure and public social investment would crowd-in, rather than crowd-out private investment.

Public expenditure can thus break the vicious circle of reduced spending and greater uncertainty. Also, government spending on healthcare, education, housing, infrastructure and the environment enhances sustainable development.

Balance of payments fears

Expansionary fiscal measures, thus financed by domestic borrowing, are said to worsen balance of payments problems in several ways.

First, higher interest rates attract more capital inflows, causing the exchange rate to appreciate, making the country less export competitive.

Second, higher domestic demand implies more imports for both consumption and production. Third, rising inflationary pressures make domestic products more expensive and imports more attractive.

But such arguments against domestic debt-financed fiscal expansion contradict crowding-out claims. If such government expenditure reduces private spending, then excess demand will shrink, reducing inflation and balance of payments problems.

Governments can also use countervailing measures, such as restricting luxury imports and managing capital flows, to maintain a competitive exchange rate and promote exports.

Fighting windmills of the mind

Debt-GDP thresholds recommended by 'international finance' are not based on optimality or financial stability criteria. An IMF study emphasized that the so-called 'debt limit' "is not an absolute and immutable barrier … Nor should the limit be interpreted as being the optimal level of public debt".

The 60% limit for developed countries was arbitrarily set. Presented as the upper bound for European Community countries, it was actually only the average debt-ratio for some powerful members, but not Italy and others!

The IMF's 40% debt-GDP ratio limit for developing and emerging market economies is only for external, not domestic debt, and certainly not for total government debt, as often implied.

The Fund has acknowledged, "it bears emphasizing that a debt ratio above 40 percent of GDP by no means necessarily implies a crisis – indeed … there is an 80 percent probability of not having a crisis (even when the debt ratio exceeds 40 percent of GDP)".

In fact, debt is deemed sustainable as long as national economic growth is greater than the interest rate. For international finance, debt sustainability concerns focus on external debt, typically denominated in foreign currencies.

Governments can more easily 'roll over' domestic currency debt, although interest costs may be higher. But borrowing in domestic currency should not enable fiscal irresponsibility.

Hence, the key challenge is to ensure the most effective and productive use of such borrowed funds. Pragmatism requires considering capacities, capabilities and checks against abuse and wastage.

Build forward better

Instead of 'building back' the unsustainable and unfair status quo ante before the pandemic, developing country governments should now selectively target government expenditure to 'build forward better', emphasizing measures to achieve sustainable development.

Borrowing to finance recovery and reform should incorporate desirable changes, e.g. working in new ways, creating new activities, accelerating digitization, revitalizing neglected sectors and enhancing sustainability.

Developing country governments must use appropriate measures to finance recovery programs to fully realize the transformative potential of pandemic-induced recessions to build more resilient and inclusive economies.

All this requires policy and fiscal space. To progress, governments must reject the received policy wisdom that has kept them enthralled for decades.

This article was originally published on KSJomo.org.

Related IPS commentaries:

1. Neoliberal Finance Undermines Poor Countries' Recovery. 2 Mar 2021

2. Urgently Needed Deficit Financing No Excuse for More Fiscal Abuse. 8 Dec 2020

3. Fight Pandemic, Not Windmills of the Mind. 28 July 2020

4. Use Stimulus Packages for Longer Term Progress. 18 Mar 2020

(Anis Chowdhury is Adjunct Professor, Western Sydney University and University of New South Wales, Australia. Jomo Kwame Sundaram was an economics professor and United Nations Assistant Secretary-General for Economic Development.)

ADVERTISEMENT

ADVERTISEMENT