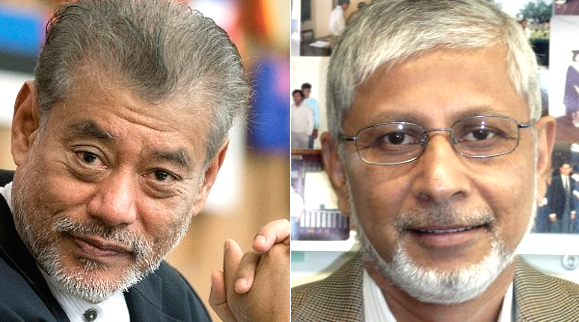

By Jomo Kwame Sundaram / Anis Chowdhury

Developing country governments are being wrongly advised to use their modest fiscal resources to pay down accumulated debt instead of strengthening pandemic relief and recovery. Thus, debt phobia risks deepening and extending COVID-19 recessions by prioritizing buybacks.

Pandemic debt mounting

Nearly half (44%) of low-income countries were already debt-distressed or at high risk even before the COVID-19 pandemic was declared in March 2020. Limited fiscal space has constrained developing countries' relief and recovery measures, making them far more modest than those of developed countries.

Nevertheless, their government debt ratios rose faster in 2020. Many developing countries have taken on more debt, typically on non-concessional terms—from private lenders and non-Paris Club members. Public debt in emerging markets has thus surged to levels not seen in over half a century.

In January-October 2020, the average debt burden of developing countries increased by 26% as tax revenues declined sharply. The IMF projects their average debt ratios will rise by 7-10% of GDP in 2021, with some terming this a "debt pandemic".

Debt burdens limit fiscal resources and the policy space needed to better address the pandemic health and economic crises in developing countries. Debt is particularly debilitating in the least developed countries, where healthcare services were modest even before the pandemic.

Last October, the United Nations warned G20 senior officials of "protracted fiscal paralysis" and the "worst global crisis since WWII" if developing countries did not get significant debt relief. For the World Bank President, the "disappointing" G20 Debt Services Suspension Initiative (DSSI) only "defers debt payments" as interest mounts, without reducing debt.

Debt buybacks?

Ostensibly to avert the "looming debt crisis", some are calling for debt buybacks while private creditors refuse to offer any debt relief. They claim "bond buy-backs present a highly attractive solution, offering substantial debt relief at a relatively low cost".

Hence, they urge using the International Monetary Fund's (IMF) New Arrangements to Borrow plus funds from donors and multilateral institutions to buy debt at a discount. Such calls have grown with the prospect of new Special Drawing Rights (SDRs) of at least US$500 billion, as the Biden administration has dropped US opposition.

Proponents do not explain why debt buybacks should now take precedence over urgently deploying fiscal resources for relief and recovery. As more countries compete for funds, driving up interest rates, buybacks should ease the credit market for others.

Successful debt buybacks?

Buyback advocates misleadingly imply that the 1989 Brady bond plan and the 2012 Greek bond buybacks were both "successful". The plan wrote down some sovereign debt to commercial banks for several mainly Latin American countries, following the early 1980s' spike in US interest rates.

The US debt buyback initiative was launched by George HW Bush's Treasury Secretary, Nicholas Brady and backed with US Treasury bills after his predecessor failed to resolve the debt crises of several heavily indebted US allies.

In return for IMF support, these countries were subjected to IMF-World Bank program conditions. These supposedly "growth promoting" policies actually resulted in many "lost years" of stagnation.

Benefits for most debtors were unclear as buybacks failed to improve market confidence in debtor countries, or their development performance. The Brady scheme was portrayed as "voluntary", although in fact, "officials used various techniques to pressure banks into Brady deals".

Even with fewer debt-distressed countries and more similar creditors then, "country negotiations with bank creditors often dragged on for months", even a year. In fact, only the banks gained from the Brady deals which enabled them to close the chapter with minimal losses and move on.

The 2012 Greek debt buyback program is said to be a "success" in "the sense of being orderly, reasonably quick". However, it only affected private debt as governments and central banks held over two-thirds of Greece's sovereign debt.

While treating "holdout creditors" generously, the program did not restore Greek debt sustainability. Unsurprisingly, the "bigger winners were hedge funds, which pocketed higher profits than many had expected".

Dubious models for emulation

Debt buyback advocates seem to ignore how debtor-creditor relations have changed since the 1980s. There are now many more types of private creditors, debtors and credit or borrowing arrangements compared to the 1980s, when government debt from US and UK commercial banks was far more significant.

The US government then had much more leverage on US commercial banks as it was seen as trying to avoid bank failures and to ensure financial sector stability. With powerful lobbyists, such as the Institute of International Finance (IIF), private finance has much more bargaining power now.

Today, no single government or multilateral institution has considerable influence on the far more varied private creditors. Such lenders have already rejected the G20 DSSI and ignored IMF and World Bank calls for debt relief. Meanwhile, rating agencies threaten to downgrade the credit ratings of countries considering participation.

Many more countries face debt problems, each with its own history and mix of debt contracts. Hence, a 'one-size-fits-all' buyback program will simply not work. Each country program will require protracted negotiations, with no guarantee of reaching a settlement.

Who really benefits?

According to World Bank Chief Economist Carmen Reinhart and her co-authors, in most cases, debt buybacks have benefited recalcitrant private creditors without providing much relief to debtors "willing to exchange higher future debt for lower payments now".

"Private creditors are increasingly claiming outsize shares of repayment in debt restructurings even when the official sector is senior creditor to the private sector…Official creditors may be left holding the bag for the bulk of the losses, even when they start with little of the outstanding debt, as in Greece".

Hence, they caution: "make sure new funding ends up benefiting the citizens of debtor countries affected by the pandemic rather than lining the pockets of creditors…The more official aid and soft loans can go toward helping needy citizens around the globe—and the less such assistance ends up as debt repayments to uncompromising creditors—the better".

Get priorities right

With 'collective action' complications affecting negotiations, and the greater number and variety of heavily indebted countries and creditors, equitable debt buybacks are impossible to negotiate. Worse, prioritizing buybacks means rejecting former debt hawk Reinhart's current pragmatic advice to "First fight the war, then figure out how to pay for it".

The urgent priority is for fiscal resources to strengthen relief, recovery and reform measures. Prioritizing debt buybacks, instead of urgently augmenting fiscal resources, may thus contribute to another "lost decade" or worse.

This article was originally published on KSJomo.org.

(Jomo Kwame Sundaram was an economics professor and United Nations Assistant Secretary-General for Economic Development; Anis Chowdhury is Adjunct Professor, Western Sydney University and University of New South Wales, Australia.)

ADVERTISEMENT

ADVERTISEMENT