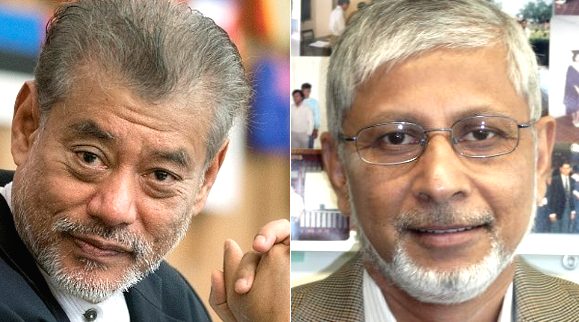

By Jomo Kwame Sundaram / Anis Chowdhury

After being undermined by decades of financial liberalization, developing countries now are not only victims of vaccine imperialism, but also cannot count on much financial support as their COVID-19 recessions drag on due to global vaccine apartheid.

Financialization undermined South

Developing countries have long been pressured to liberalize finance by the International Monetary Fund (IMF) and the World Bank. The international financial institutions claimed this would bring net capital inflows. This was supposed to reduce foreign exchange constraints to accelerating growth, creating "a rosy scenario, indeed".

Globalization's claim naively expects "more birds to fly into, rather than out of an open birdcage". Instead, financial globalization meant net capital flows from capital-poor developing countries to capital-rich developed countries, i.e., dubbed the "Lucas paradox". A decade later, flows "uphill" had "intensified over time".

The past decade saw the largest, fastest and most broad-based foreign debt increase in these economies in half a century. Total foreign debt of emerging market economies rose from around 110% of GDP in 2010 to more than 170% in 2019, while that of low-income countries (LICs) increased from 48% to 67%.

Pandemic woes

Developing countries saw private finance drop by US$700 billion in 2020, while foreign direct investment flows to developing countries declined by 30-45% in 2020. Remittances fell by 7% in 2020, and are expected to fall by another 7.5% in 2021.

Meanwhile, developing countries' indebtedness increased as total aid flows had long fallen short of even half the long promised 0.7% of donor countries' incomes. In 2020, when developing countries needed it most, donor governments cut bilateral aid commitments by almost 30%.

With limited access to other finance, developing countries, especially LICs, face much higher borrowing costs, even in normal times. With the pandemic, developing countries have been downgraded by rating agencies, further raising borrowing costs.

Facing falling foreign exchange earnings needed to import essential drugs, vaccines and other vital supplies, including food, most countries have to borrow. In 2020, official foreign debt probably rose by 12% of GDP in emerging market economies, and by 8% in LICs. The pandemic thus greatly worsened developing countries' debt distress.

Before the pandemic, more than a quarter of official revenue went to servicing debt. With the worst recession since the Great Depression in 2020, as well as declining revenue and foreign exchange inflows, debt is now blocking finance for more adequate relief and recovery in many countries.

Debt relief?

Many – even World Bank Chief Economist Carmen Reinhart, once a 'debt hawk' – have called for debt relief, but little has happened. IMF debt service relief of about US$213.5 million for 25 eligible LICs ended six months later in mid-October 2020, as scheduled.

The G20's 'Debt Service Suspension Initiative for Poorest Countries' for 73 mainly LICs for May-December 2020 covered around US$20 billion of bilateral public debt owed to official creditors by International Development Association and least developed countries (LDCs).

The G20 initiative did not provide lasting relief, not even reducing foreign debt burdens and barely addressing immediate needs. It merely kicked the can down the road. Debt still had to be repaid in full during 2022–2024 as interest continues to accumulate. It also offered middle income countries (MICs) nothing.

Also, private creditors refused to join in or help out. UNCTAD estimates that in 2020 and 2021, lower MICs and LICs will pay between US$0.7 trillion and US$1.1tn to service debt, as upper MICs pay US$2.0-2.3tn. Meanwhile, some countries have used US$11.3bn of IMF funds meant "for health budgets and food imports" to service private sector debt.

SDRs to the rescue?

Undoubtedly, distressed developing countries desperately need foreign exchange to cope. But IMF Managing Director Kristalina Georgieva's call to boost global liquidity with "a sizeable SDR" (Special Drawing Right) allocation was blocked by the Trump administration, who objected that it would give China, Iran, Russia, Syria and Venezuela access to new funds.

The Financial Times (FT) argues that the proposed new SDR1tn (US$1.37tn) issuance – almost five times the US$283bn issued in 2009 – is justified by the scale of the crisis. For the FT, it would be "the simplest and most effective way to get additional purchasing power into the hands of the countries that need it".

It is now widely agreed that "new issuance of SDRs is vital to help poorer countries". It would augment the IMF's US$1tn lending capacity, already inadequate to address the ongoing pandemic and economic crises.

SDRs can only be used to pay other central banks, the IMF and 16 "prescribed holders", including the World Bank and major regional development banks. Thus, SDRs can help foreign exchange constrained countries, especially if rich countries transfer their unused SDRs to the IMF or for development finance.

The IMF could thus expand two existing special funds for LICs: the Poverty Reduction and Growth Trust provides interest-free loans, while the Catastrophe Containment and Relief Trust pays interest and principal due on their IMF obligations.

But SDRs are not an equitable magic bullet as apportionment reflects the size of a country's economy. In other words, rich countries would get much more, regardless of need, as during the 2008-2009 global financial crisis.

US role vital

With 85% of IMF votes required to issue new SDRs, and the US holding veto power with 16.5%, Biden administration support is vital. For SDR issuance under US$650 billion, the White House only needs to consult, rather than get approval from the US Congress.

Treasury Secretary Janet Yellen has urged the IMF and World Bank to do everything "they can to ensure that developing countries have the resources for public health and economic recovery". She has supported new SDRs despite conservative opposition, e.g., from Rupert Murdoch's Wall Street Journal.

But Fund and Bank resources still pale in comparison with the challenge. With preferred creditor status, they can borrow at the much lower interest rates available to them. By so intermediating, they can help developing countries, especially LICs and LDCs, to more cheaply access desperately needed funds.

This article was originally published on KSJomo.org.

(Jomo Kwame Sundaram was an economics professor and United Nations Assistant Secretary-General for Economic Development; Anis Chowdhury is Adjunct Professor, Western Sydney University and University of New South Wales, Australia.)

ADVERTISEMENT

ADVERTISEMENT