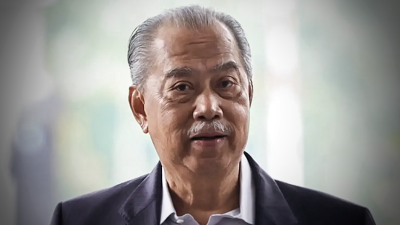

KUALA LUMPUR, Feb 1 (Sin Chew Daily) — A good sign for Moody's Investors Service to retain the Malaysian government's local and foreign currency long-term issuer and local currency senior unsecured debt ratings at A3 with a stable outlook, says Tan Sri William Cheng, president of the Malaysia Retailers Association.

This is a good sign for the local business sector, he said.

Cheng, who is also the executive chairman of Parkson Holdings Bhd and group executive chairman of Lion Group, said the government and people should work together to maintain the ratings and it would be better if the ratings could be improved.

Moody's said the rating affirmation was based on its expectation that Malaysia's medium-term growth prospects will remain strong, underpinned by its diversified and competitive economy and supportive demographics, while its macroeconomic policy-making institutions will continue to be credible and effective, providing resilience to the sovereign credit profile.

This means that the five economic stimulus packages and Budget 2021 have created some impact.

Cheng said good ratings mean that the companies and government can secure loans with lower interest rates.

"One pays higher interest rate if the rating is poor. We should work towards maintaining existing ratings and upgrade the ratings if possible. Then the interest rate will be even lower," he said.

Cheng said despite launching a series of economic stimulus packages, the key to revive the economy of Malaysia would depend on proper implementation and increase both domestic and foreign investments.

"It is good that the government has a target. But it is important to revive the confidence of people and work on how to attract foreign funds. We need both local and foreign investments," he said.

Cheng suggested that the government improve on the investment environment to restore investors' confidence in the country.

"Foreign investment is plunging in Malaysia, with less than 5 per cent. We used to rank third among Asean countries in terms of foreign investment. Now Singapore, Vietnam, Indonesia and Thailand have all overtaken us," he said.

Cheng said the COVID-19 pandemic is the main reason dampening economic recovery.

To assist business sector, the government should ensure that the pandemic is under control.

Cheng also suggested the government to conduct mass screenings and not only confined to foreign workers.

"The government should screen all, especially the eight million people in Kuala Lumpur and Selangor classified as red zones with high number of COVID-19 cases," he said.

Cheng proposed the government to set up a one-stop center to shorten the investment approval period from one year to one month to be effective in assisting the business sector.

ADVERTISEMENT

ADVERTISEMENT