No matter how much some may try to bend the truth, the data, science, and economics beneath it stand where they stand — there are no examples worldwide where the high expectations placed on nation-scale Single Wholesale Networks (SWN) would have come to fruition!

Perhaps, instead of finger-counting, DNB should transparently have presented a more solid quantitative cost-benefit evaluation such as, for example, the one in “Single Wholesale Network for 5G: Quantitative Assessment of Market Impact.”

The authors used well-established business and economic theories, consolidated international experience in the form of empirical research and telecom industry estimates for various economic parameters, and own industry figures as inputs for quantitative modelling.

Their results revealed that SWN, as opposed to competitive rollout by individual MNOs, will lead to a lower rollout speed and higher consumer prices.

Also, for the highly acclaimed “network ownership costs duplication reduction” through SWN, the authors arrived only at about 30% savings, as the most optimistic figure, which was only marginally higher than what can be achieved by MNOs through voluntary infrastructure sharing.

And we already know that voluntary infrastructure sharing is a major trend in the global telecom industry, including Malaysia, that profoundly intensified with the worldwide 5G rollout.

Furthermore, this marginal cost win by SWN is easily offset by adjustments for other relevant SWN-associated costs and risks, such as, for example:

■ additional costs of a regulatory framework to prevent the abuse of market power (as SWN, by definition, is a monopoly);

■ in SWN, equipment must be more powerful to provide reliability, robustness resilience to multiple MNOs, which not always can be provided by the vendors at a reasonable price;

■ additional costs for software equipment etc.

For additional “camouflaged costs” analysis in the context of Malaysian SWN by DNB, refer to an earlier publication by EMIR Research, “Malaysian 5G Rollout: Camouflaged Costing Acrobatics.”

The above findings are congruent with other consolidated global international empirical experiences.

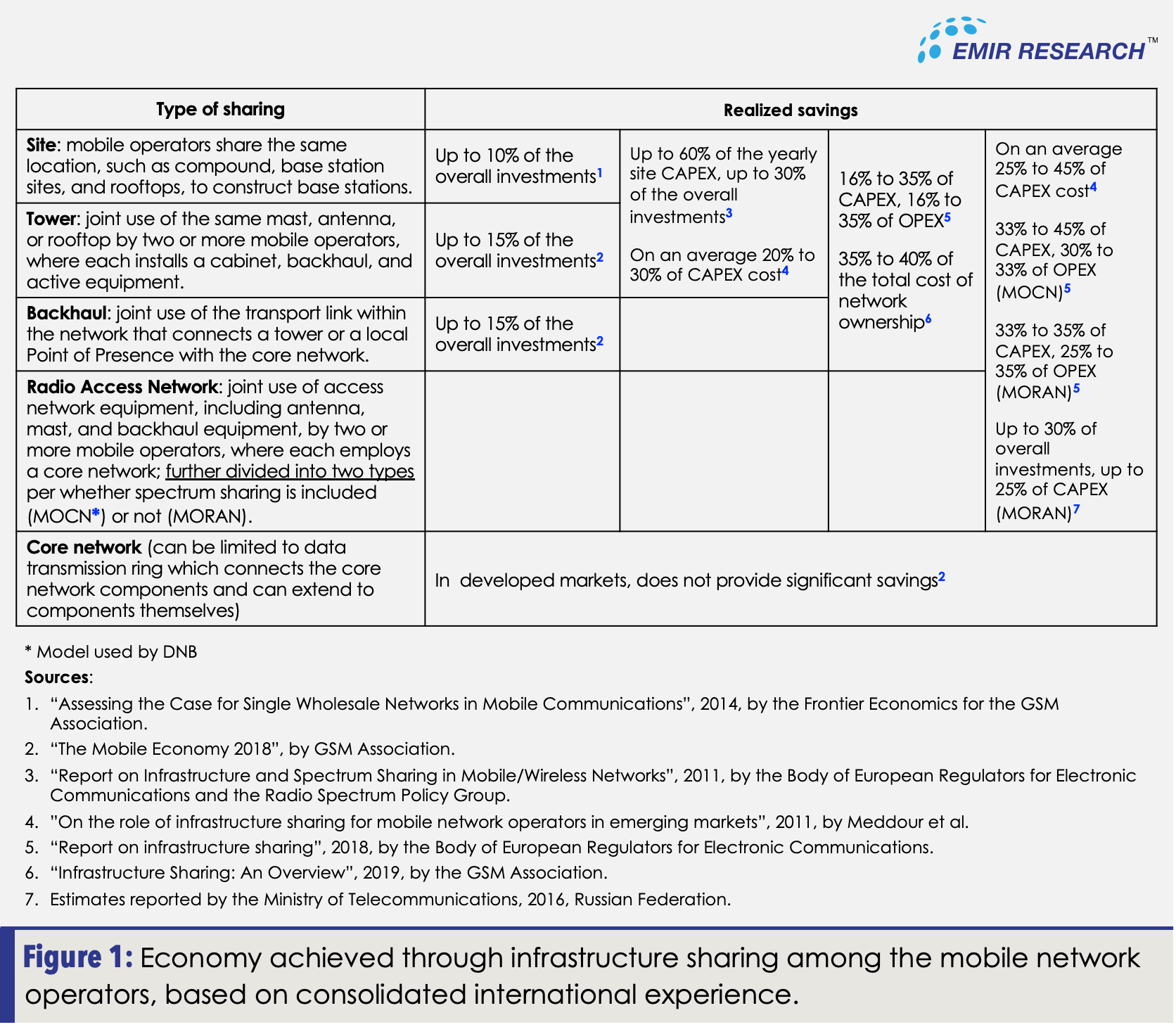

According to various empirical estimates over the years (Figure 1), sharing of passive (non-value adding to MONs) infrastructure can deliver a 35% to 40% reduction in the total cost of ownership.

Perhaps, GSM Association (GSMA) summarizes this data the best: “SWN is unlikely to lead to significant cost savings from removing duplication, beyond what can be achieved through network sharing agreements between existing operators” (“Assessing the case for Single Wholesale Networks in mobile communications” by GSMA, p. 112).

So why does Malaysia need DNB’s SWN when cost-wise this rollout model not only does not achieve anything that MNOs cannot achieve on their own but also highly likely understates its costs increasing financial burden directly to the rakyat (refer to “Malaysian 5G Rollout: Camouflaged Costing Acrobatics”)?

On top of it, as become crystal-clear evident over time, solving the digital-divide problem slogan is merely a whitewash (refer to “Malaysian 5G Rollout: Digital Divide Whitewash”).

Moreover, SWN cases worldwide are extremely rare for a good reason — the known SWNs fall miserably short of their objectives, resulting in slower rollouts, higher consumer prices and poorer network performance.

A comprehensive, up-to-date, case-by-case compilation of SWN experience by EMIR Research based on publicly available sources such as official websites of the respective SWN operators, media, scientific journal articles, global indices, and data points can be perused in “Single Wholesale Network: Global Experience.”

Even among the countries that dared the SWN model, there was never a notion of a “supply-driven” approach on top of the already problematic SWN model.

For example, the CEO of Brunei’s Unified National Networks (UNN)— the case so often cited by DNB out of context—specifically emphasized their demand-driven focus on well-established older generation technology (4G and below) to recover investments while organically preparing the platform for the future (5G)!

After all, Brunei, a country of less than 500,000 where infrastructure-based competition is probably impractical, makes it unique.

The United Kingdom (UK) and New Zealand (NZ), countries championing 5G through competitive rollout by MNOs, limited their SWN ventures to rural areas (which DNB is not doing) and well-established technology needed here and now, especially in the context of rural dwellers’ needs — the 4G (which DNB is not doing either).

However, as critics fairly put it, UK SWN has limited progress, mainly due to the lack of neutral hosting (which involves sharing base station equipment) and not working with local communities to reduce backhaul costs through direct-buried fiber.

Meanwhile, the NZ pathway was more comprehensive and integrated — filling in the UK’s voids — thus resulting in a readily observable narrowing of the digital divide.

Among all the known SWNs, Rwanda’s case is probably worth highlighting as the closest to the Malaysian experience. Its SWN for 4G LTE started in 2014 as a joint public-private venture between Rwanda’s government and South Korean operator Korea Telecom (KT) with no concurrent 4G spectrum allocation or granting spectrum neutrality to MNOs by law.

Over the years, KT has managed to achieve good coverage. However, the operator failed to monetize it mainly due to prohibitive prices to end consumers driven by high spectrum prices.

Eventually, KT was forced to rely on business ventures outside of Rwanda to compensate for its losses. And as the most recent and positive development for Rwanda, to end this deadlock, the Rwanda Utilities Regulatory Authority (RURA) has decided to modify KT’s licence to allow other companies to deploy 4G networks as part of the country’s National Broadband Policy and Strategy, adopted by the government in October 2022 (effectively ending SWN monopoly for 4G and future generations of network) by granting spectrum neutrality to MNOs.

As it is insanity to do the same thing over and over again and expect different results, GSM Association (GSMA) consistently urges policymakers to support MNOs’ voluntary infrastructure sharing agreements, cost-effective access to spectrum, support for spectrum refarming, non-discriminatory access to public infrastructure (dark fibre included) as a more effective regulatory approach to greatly expand mobile coverages and services to regions where services are insufficient as opposed to high risks-ridden SWN (refer, for example, to “Assessing the case for Single Wholesale Networks in mobile communications” for detailed reasoning with empirical evidence).

And if GSMA might be criticized as an industry group representing the interests of mobile operators worldwide, the Body of European Regulators for Electronic Communications (BEREC) as an organization representing the consumers’ interests maintains a unanimously negative view of MOCN (DNB’s exact model) due to its potency to substantially reduce the differentiation capacity of the sharing parties in terms of service quality (refer to “BEREC Common Position on Mobile Infrastructure Sharing” — common position and framework for national regulatory authorities).

Among the active forms of sharing, BEREC urges national regulatory authorities to very carefully assess spectrum pooling (MOCN) and national roaming on a case-by-case basis restricting its application to areas with very low population density where infrastructure-based competition is infeasible (which DNB is not doing).

Among the above recommendations by regulators and industry analysts, cost-effective access to spectrum begs a special reemphasize.

A government should not use spectrum for government revenue-maximization purposes (DNB’s model) as it is linked to a negative impact on consumers and the broader economy, including the higher amount of national debt, especially in developing countries (refer to empirical evidence in “Spectrum Pricing in Developing Countries)” — acting as tolls on the bridge over the digital divide.

Instead, the government should auction it as soon as needed at a reasonable price (just to cover spectrum management costs). This way, the government will generate some revenue and ignite the powerful engine of multiplier effect in the economy through affordable internet prices.

This effect is incredibly profound as the telecom sector is highly correlated with other vital industries such as manufacturing, public services, healthcare and education.

And while DNB, in its denial, can continue playing with semantics or calling Malaysia’s sole nationwide pursuit of SWN for 5G rollout a “trend,” the policymakers, being guided by the resounding evidence of SWN risks and expected failure elsewhere, must do the right thing — swiftly move forward and away from its 5G SWN by extending common-sense regulation policies.

The best thing that can be done to rescue Malaysia swiftly from any further damage inflicted by DNB’s SWN experiment is to allow the major MNOs (most of whom are publicly listed companies) to 100% take over DNB with an equal stake in it. This will immediately relieve the government of the substantial financial burden of salvaging DNB.

MNOs would know how to better navigate it efficiently without burdening consumers. Moreover, low take up of 5G by consumers worldwide puts the natural limit of end-consumer prices.

As many of the DNB dealings have been shrouded with mystery, prior to this exercise of MNOs taking over, there should be comprehensive due diligence done on DNB to ensure “wholesome clarity” on the exact situation of DNB.

Concurrently with the takeover, the technology-neutrality of MNOs’ spectrum licenses should be reinstated, allowing them to immediately start offering 5G services competitively using their legacy spectrum.

Unlike older-generation networks, 5G would require mere software tweaking by MNOs at their base stations.

Given the vast presence of MNO’s base stations, that are also 5G ready, at least in urban and semi-urban areas, 5G internet can spring immediately where it is the most needed!

This will effectively and immediately move Malaysia away from SWN, gear its industry 4.0 and expedite the 80% coverage of populated areas by the end-2023 in line with the original government’s targets but most optimally — through leveraging existing MNO infrastructure.

The tech-neutrality for network deployment must also be guaranteed to MNOs to support further efficiency, innovation, and competition in our telecom industry.

Given the tasks of rolling out 5G will be taken over by the major MNOs, the government should consider some tax breaks mechanism for a period of time as this will cushion the burden these MNOs will inherit from DNB and free any commitment of the government with signed contract and/or agreements.

The above mentioned 5G implementation plan proposal will ensure network redundancy, robustness and resiliency (including cybersecurity), increase competition and innovation, and minimize implementation complexity and risks while also meeting the government’s five key objectives as was announced by Prime Minister Anwar Ibrahim during his Budget 2023 speech, for a successful 5G rollout:

1. expediated rollout to meet 80% coverage by Dec 2023 with no delays;

2. radical transparency and good governance;

3. inclusiveness (government, regulators, industry and consumer);

4. full participation by the industry; and

5. at the fair price to the rakyat!

(Dr. Rais Hussin is the president and chief executive officer of EMIR Research, a think tank focused on strategic policy recommendations based on rigorous research.)

ADVERTISEMENT

ADVERTISEMENT