EMIR Research welcomes the continuous public engagement with DNB and their hired consultants, for the aim of a debate is never a shallow victory but credible progress and, in this case, credible progress for the nation-based on data, science and economics.

Though DNB has not been forthcoming, as DNB still does not answer the most pressing questions (“Malaysian 5G Rollout ‘Unanswerable’ Questions”) but raises even more eyebrows instead by involuntarily (or voluntarily) giving out more details.

Nevertheless, this on-going public engagement helps to keep track of what is coming out of DNB and spot potential red flags.

DETRIMENTAL IMPACT ON MALAYSIAN TELECOM INDUSTRY

DNB’s UK-based consultancy, Plum Consultancy, claims that EMIR Research misunderstood how DNB’s 5G Single Wholesale Network (SWN) works.

DNB-Plum explains at length how the “DNB approach is different and is not network sharing”, which is pure semantics and conveniently ignores the key issue that EMIR Research continuously emphasized based on hard evidence of science, data and economics.

When individual MNOs have no freedom to fully deploy their active network equipment (and DNB, with the help of Plum, admits this fact themselves: “there will be one set of electronics… to carry data between base stations and end-user devices” which is widely understood to be active RAN sharing), we have a big problem — MNOs can no longer compete on the quality of network which is the key differentiating feature and all other features, including differentiation “on retail end” or “in terms of the services offered” which DNB keeps emphasizing are only secondary to and totally dependent on the network quality.

If DNB-Plum has not grasped it from the first time, EMIR Research would like to reiterate that it is fully aware of and also acknowledged in its writings on numerous occasions that under DNB, the core networks will be by individual MNOs (at least until the implementation of 5G stand-alone solution).

However, this does not help the DNB’s argument because no matter how superior equipment you have at the core network level, it can do very little if the active network access equipment, which in the case of DNB is provided by one vendor and is entirely out of MNO’s control, provides substandard quality.

Globally and in the Malaysian market until this point, most differentiation between MNOs (other than pricing) has been based on critical innovation and differentiation in the RAN.

In contrast, innovation in the core is minimal and, in turn, requires RAN-side support.

In short, MNOs need to control both the core and access to compete effectively!

Note that GSM Association (GSMA), in its response to DNB, argumentatively echoes EMIR Research’s concern about this delinking of network ownership from service delivery and its various negative impacts on the industry and end consumers.

And if Plum does not see this adverse effect on the telecom industry in Malaysia coming or does not want to see it (which is surprising, given their supposedly “over 15 years working on hundreds of such projects including extensive work on the deployment of 4G and 5G”) then maybe Plum could explain why SWN model turned out problematic for a handful of nations who attempted it for 4G and why the rest of the world so avoids it for 5G, including the UK where British mobile operators received 5G spectrum through auction. Apparently, Plum, a UK-based consultancy, has failed to convince their policymakers of the benefits of a nationwide SWN.

LOWER MOBILE DATA SERVICE PRICES UNDER SWN?

According to Plum, “in contrast, rational economic analysis indicates that EMIR’s proposal will lead to wholesale 5G costs [that are] four to five times higher than those of the SWN,” further explaining that “rolling out six 5G networks — one for each mobile operator — would require six times as many 5G base stations”.

This is a far-fetched assumption by Plum that telcos would not share base stations and other infrastructure! Given Plum’s claimed experience in the industry, they should be well aware that this has been one significant trend globally (Malaysia included) in the telecom industry for years now, even for 4G (what more for 5G where this is the only survival strategy), which makes the estimate by Plum that “the overall ten-year cost of 5G network ownership under this option [to] be four to five times greater than under an SWN”, a massively monumental overstatement.

Furthermore, MNOs can significantly reuse their existing infrastructure (in contrast to DNB’s current rollout) to lower total deployment costs — they would not “roll out a 5G network” but upgrade an existing 4G network to also support 5G. This is a very different scenario, and it is at far lower cost, especially with regard to ongoing or OPEX costs for the network.

However, Plum chooses to ignore the benefit of sharing fixed costs between the existing 4G network and the new 5G layer versus a much higher cost of adding a new 4G + 5G network as is required under the DNB’s current rollout.

Note that retail pricing of service to retail customers will consider the costs of both 4G and the 5G layers, at least until the 4G networks are withdrawn and switched off and it becomes stand-alone 5G.

So, sharing, rather than duplicating the fixed costs between 4G and 5G, as in the case of the 5G rollout by individual MNOs, has clear benefits for retail customers.

Also, while being so focused on the towers, DNB-Plum are silent about how much costs could be reduced by each respective MNO on the access equipment if the network is rolled out gradually in pace with demand and, importantly, in pace with the innovation in the industry and progressively reducing the cost of equipment!

As Plum acknowledges themselves the competition in the RAN infrastructure, which, as explained above, under DNB’s current proposition will be out of MNOs control, “is determined largely by the relevant standards bodies and then implemented by the global network vendors” but that is precisely where the big problem lies.

Under the DNB’s current rollout model, MNOs will not be able to tap into this global pool of innovation by vendors!

Under DNB’s proposed model, each MNO would be locked for ten years, without access to vendor competition, with a fixed cost of equipment provided by one single supplier — as technology changes (becomes more advanced and cheaper), MNOs would not be able to continue to evaluate new options in terms of features and lower prices which will also hugely weight on the consumer prices.

Therefore, it is highly uncertain how “the end-user prices under the SWN are expected to be around 60% lower”, but it is highly certain, again, that this removal of innovation from the supply of 5G RAN will massively reduce competitive differentiation in the retail market and slow down the ongoing adoption of leading-edge RAN technologies for Malaysia while also compromising Malaysia’s ability to attract 4IR’s, 5IR’s and subsequent IR’s ecosystem players — massive opportunity cost for the nation the scale of which we probably would not be able even to grasp in its entirety.

SUFFICIENCY/INSUFFICIENCY OF 10,000 CELL SITES

Plum consultancy also defends the sufficiency of 10,000 cell sites to provide 90% populated area coverage with a dismissive “there is no evidence to suggest that these estimates (by DNB are faulty)”.

Only they forget to attach solid evidence to substantiate the claim that they are correct.

Where is the detailed technical report to substantiate that 10,000 cell sites will be sufficient to provide 90% populated area coverage, importantly, with the claimed 5G speed? How the populated area in terms of its density is defined has also never transpired in the discussion.

However, even more interesting is the following statement: “EMIR’s conclusion may have validity if, as it assumes, 5G spectrum is not available at 700 MHz”.

As it transpires now, DNB has 700MHz, 3.5GHz and 28GHz spectrum. Number of towers required to cover populated areas would be different depending on the frequency spectrum — 10,000 sites may be sufficient for 700 MHz, but more towers (and therefore substantially higher costs) would be associated with higher frequency spectrum. Until now DNB has not come crystal clear on this.

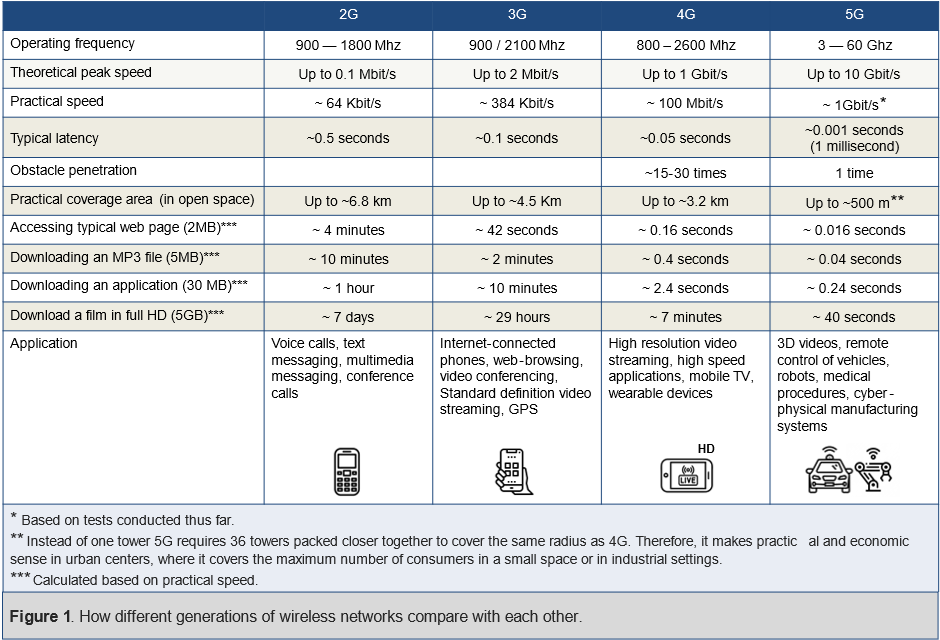

However, with 700 MHz, at best, we would be able to get 4G speed and the promise of 1Gbps speed will be gone. So 5G infrastructure, at 5G costs for 4G speed?

Apparently, then, due to substantially increased coverage per cell site, 700 MHz band would be used to cover rural areas.

If DNB is trying to change their goal-posts now and is telling us that we need 4G in the rural areas to “bridge the digital divide” (one of the key premises to their existence and so-called “supply-driven” approach) then this is exactly what EMIR Research and other experts have been telling all this while—that we do not need questionable and failed elsewhere SWN model to bridge the digital divide. Keep in mind 5G full functionality versus needs of the rural dwellers (Figure 1).

Therefore, for bridging digital divide there is a better and cheaper solution with older but well-established technologies (see for example “Cheaper solution for rural broadband” or “Finding a cure for Malaysia’s broadband illness”).

In short, Malaysia, and particularly rural areas are suffering due to the scarcity or even complete absence of passive network infrastructure, mainly fiber backhaul.

Therefore, EMIR Research, echoing the telecom experts’ opinion, has suggested that the primary focus of DNB should be to own and expand the existing passive network infrastructure only, while utilizing for this purpose Universal Service Providers funds and prioritizing rural areas, so that the large sums of tax-payers money could be saved and redirected elsewhere.

Malaysia has many more pressing problems and impact per every dollar spent must be the priority now!

Furthermore, the proposed restructuring model for DNB will also resolve many other governance problems when the retail players are also DNB’s shareholders.

There must be complete separation between retailers and wholesalers which is not what current DNB rollout model offers.

Given the seriousness of the issue, more details will be discussed in the Part 2 of this article as EMIR Research is trying, once again, to re-centre DNB-Plum on all the key issues.

Hopefully we will have more direct answers from DNB-Plum, instead of rehashing of the archaic narratives that has been rebutted comprehensively by many including GSMA, EMIR and other telecom experts.

We don’t want as what Shakespeare once said: “Tale told by an idiot, full of sound and fury, signifying nothing”, to continue unabated.

Read:

The impeding failure of good intentions: DNB’s 5G rollout – Part 2

(Dr. Rais Hussin is the President and Chief Executive Officer of EMIR Research, a think tank focused on strategic policy recommendations based on rigorous research.)

ADVERTISEMENT

ADVERTISEMENT