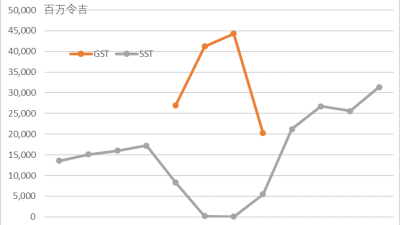

Prime Minister Ismail Sabri Yaacob’s announcement on potential reinstatement of GST came at the back of an economic situation that is yet to recover following a pandemic, having been in a number of prolonged lockdowns throughout the past two years.

The reinstatement of GST is purportedly to boost federal coffers to tackle inflation and cushion the financial burden of subsidies for the people.

A noble cause indeed.

To expand the revenue base, it is reported that the government would aim for a GST rate that is lower than before, yet not so low that it defeats the purpose of expanding tax revenue for the government.

Proponents of GST argue that GST is very efficient, transparent and fair. It is a business-friendly taxation system that can improve the country’s economy and provide stronger competitiveness for the country’s exports.

However, since the first introduction of GST in 2015, concern has been raised as to the regressive nature of GST.

As a consumption tax, GST taxes a flat rate where the poor and low- and middle-income groups pay a higher proportion of their income on GST compared to the higher income groups.

This is particularly concerning following a pandemic that has disproportionately impacted poor and vulnerable Malaysian households, as well as increases in food prices due to the ongoing food security issue.

For small businesses that are yet to fully recover, GST may disadvantage them due to the time taken to receive GST refund, leading to cash flow burden.

Instead of focusing on reinstating the GST, which is just a mere change of mechanism in the taxation system, the government should focus on reforms that would help to address the fundamental issues plaguing our country.

This is in view of Malaysia’s predicament of being in a middle-income trap which should be addressed seriously by the government by improving governance, boosting productivity, weeding out corruption and promoting value-add in the economy through adoption of technology as well as focusing on human capital and the education system.

Without concrete and lasting changes that would alleviate the country’s problems, Malaysia would not become a progressive and well-being nation.

As a matter of urgency, corruption and leakages of public funds must be addressed more seriously.

Malaysia’s position is 62nd in the latest world Corruption Perception Index (CPI) ranking, a drop compared with 57th in 2020.

Corruption eradication is thus essential in reducing the government’s financial burden and improve Malaysia’s standing among investors.

To complement the government’s efforts to combat corruption, anti-corruption movements by the people through civil society organizations such as the Rasuah Busters should be lauded and supported by all.

The ultimate aim is to create a society with zero tolerance for corruption and abuse of power.

This endeavor goes hand in hand with promoting leaders of high moral-ethical integrity within a democratic ecosystem which upholds justice, equity and shared prosperity.

(Badlishah Sham Baharin is Chairman of Gabungan Bertindak Malaysia (GBM); Mohammad Abdul Hamid is Central Executive Committee Member of Pertubuhan IKRAM Malaysia and Public Policy Consultant.)

ADVERTISEMENT

ADVERTISEMENT