The government should cut down unnecessary expenses and make good use of every ringgit collected.

In an interview with Nikkei Asia, prime minister Datuk Seri Ismail Sabri Yaakob said this is not a good time to dissolve the parliament to pay way for fresh elections due to spiraling inflation.

Indeed, the 15th general election can be held anytime before next September!

Now that this is not the best time to hold another election, then the government must do something to address the economic problems encountered by Malaysians before the next election.

After the war broke out between Russia and Ukraine, goods prices around the world have surged dramatically due to material shortage.

Malaysians are very much more concerned about their day-to-day lives now than political conflicts in the country, general election, or even the menace of the coronavirus.

1. Goods prices have soared across the board, but how is the government going to tackle this problem?

2. The shortage of food and other materials is looming. The worst of times has already arrived. How should the government deal with it?

3. The continued devaluation of the ringgit has sent prices of imported goods steeply rising. For the past two years, we have almost zero surplus in our external trade, meaning half of the goods at supermarket shelves may be more expensive now as a result of the lower ringgit exchange rate.

Former finance minister Tengku Razaleigh Hamzah has predicted that the ringgit exchange rate will dip to 5.50 against the dollar next year. If his forecast becomes real, then it will be an economic calamity for the country. How to sort out this problem?

4. With crude oil prices rising steadily, the government is expected to fork out at least RM30 billion this year for petrol subsidies (about RM71 billion for other subsidies). This amounts to 21.4% of the 2022 Budget. Where to get the money for this fiscal shortfall?

5. The minimum monthly wage has just been raised to RM1,500 effective May 1, but the increment has been more than offset by skyrocketing goods prices, while employers have to bear the additional salary cost. How is the government going to settle this issue?

6. Many economic sectors in the country are facing acute labor shortage after the pandemic. The deficit in the F&B sector alone is more than 200,000 workers. How to fix the problem?

There are simply too many problems that the Malaysian government needs to solve urgently.

And just as the entire country is weighed down by the lack of financial resources, it is very untimely for the government to come up with the proposal to reinstate GST (goods and services tax) to expand the government’s revenue base in a bid to relieve the pressure from additional public subsidies.

So, it is the fiscal dilemma that has prompted the government to want to reinstate GST? This is going to be a huge bet on the part of the ruling coalition simply because this GST will involve anyone who spends in shops with over RM500,000 in annual turnover.

In other words, everything that you buy will be 6% dearer (based on the last GST rate).

Where tax fairness is concerned, indeed GST is a very excellent system, but not everyone will be happy with it. Not everyone will benefit from the government’s GST collection, and not everyone thinks the government will spend the money where it is most needed.

Our excessively bloated public services sector, pathetic efficiency at government institutions, widespread bureaucracy, rampant corruption, and enviable perks handed out generously to ministers and MPs… all these yet-to-be-solved problems form a powerful resistance to the government’s GST reinstatement plan.

If these problems are not resolved, we will never collect enough taxes for the government to squander!

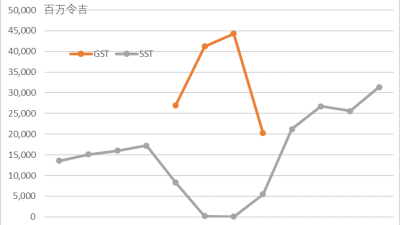

GST was first introduced on April 1, 2015. After the Pakatan Harapan government abolished the GST, the government’s potential tax revenue has been shrunk to the tune of RM20-30 billion a year. This financial shortfall is very difficult to be filled for a government that is excessively generous with subsidies.

Anyway, over 140 countries worldwide have adopted some kind of GST or VAT (value-added tax), and this speaks volumes of the taxation system’s fairness and effectiveness.

The PM says the government will try to re-educate the public to accept GST. However, the planned GST rate will not be set too high lest it exacerbates the people’s already heavy financial burden. Nor will it be set too low, as this will defeat the purpose of expanding the government’s tax revenue.

Sure enough the government can reinstate GST, but it has to use the additional tax income wisely.

It is hoped that the government will cut down unnecessary expenses and make good use of every ringgit collected.

Meanwhile, also make sure that unscrupulous merchants will not exploit this opportunity to drastically increase their selling prices and transfer the additional costs to the consumers.

ADVERTISEMENT

ADVERTISEMENT