By Beiyi Seow with Lan Lianchao in Shanghai

BEIJING, Oct 15 (AFP) — China’s economic growth is expected to have slowed further in the third quarter, according to an AFP poll of analysts, with a mounting energy crisis and property market tremors casting a pall as the country’s post-Covid recovery lost steam.

While the world’s number-two economy bounced back quickly from the coronavirus outbreak last year, with gross domestic product growth returning to pre-pandemic levels, economists say further slowdown is “inevitable”.

Growth is forecast to come in at 5.0 percent on-year for July-September by the 12 analysts polled by AFP, representing a sharp slowdown from the 7.9 percent clocked in the previous three months.

They also downgraded their full-year growth expectations to 8.1 percent, from the 8.5 percent predicted in a July poll. Official figures will be released on Monday.

Analysts said China’s growth slowdown mainly stems from policy tightening this year in key areas including the property sector and a drive to cut emissions.

Residential real estate activity has slowed with tightened regulations and credit policies for developers, along with guidance to banks to slow mortgage lending, according to Oxford Economics.

The travails of property giant Evergrande — which is struggling under a mountain of debt worth more than $300 billion — is dragging down sentiment among prospective buyers, it added.

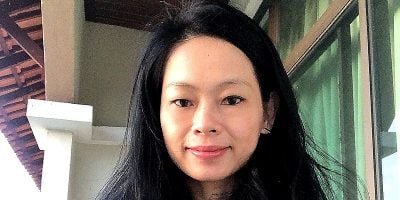

Christina Zhu, of Moody’s Analytics, said a slowdown in property investment and house prices could hit growth as real estate investment accounts for a large share of fixed asset investment, which she said accounts for more than 40 percent of total GDP.

“The two major risks for the remainder of the year are the property market debt problem and power shortages,” Zhu added.

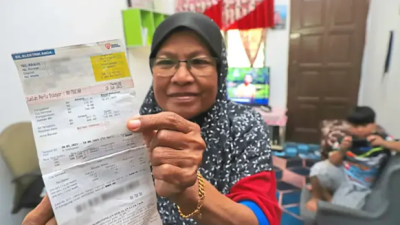

Power rationing in recent weeks, along with surging raw material costs and the government’s climate push, have led to reduced mining activities and manufacturing production.

Such disruptions “will not only put pressure on (the) domestic labor market and consumption, but also have ripple effects on global trade and prices”, Zhu warned.

But UBS economists believe Beijing will further fine-tune policies to avoid a sharp power crunch, having already introduced guidelines to raise coal production and imports.

The actual hit to GDP will depend on how this is managed, they added.

Meanwhile, the government is trying to recalibrate the economy to one driven by consumers and away from investment and exports.

But officials presently have to walk a fine line between supporting growth and keeping a lid on inflation with factory gate prices rising at their fastest rate in a quarter of a century.

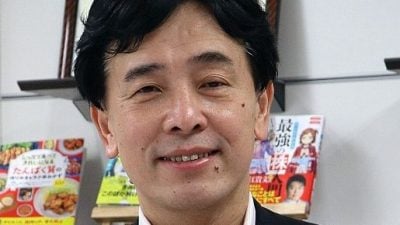

Despite still-strong foreign demand, factors like extreme weather and fresh virus outbreaks, on top of energy shortages and the cooling housing market have all weighed on China’s economy, said Gene Ma, head of China research at the Institute of International Finance.

Flooding shuttered coal mines earlier this month, while extreme weather has destroyed crops and a series of regional lockdowns have brought large cities to a standstill with just a handful of Covid-19 cases.

“China’s remarkable post-Covid-19 recovery ran out of steam by the summer of this year,” he added.

Consumption remains a drag with passenger car sales likely plunging in September, said Hao Zhou, senior emerging markets economist at Commerzbank.

Regional lockdowns and a “zero Covid” strategy would also have weighed on the services sector, as well as disposable income, Zhou added.

“Hence, further economic slowdown looks inevitable,” he said.

Some have called for more targeted policy support.

The key, said DBS bank senior economist Nathan Chow, is to “alleviate cash flow pressure for the affected sectors and companies”.

ADVERTISEMENT

ADVERTISEMENT